Wudinna Gold Project Acquisition - Update

Barton Gold Holdings (OTCQB:BGDFF) has provided an update on its binding agreement to acquire the Wudinna Gold Project from Cobra Resources PLC. The project contains 279,000oz of gold resources in South Australia. Cobra has scheduled a shareholder vote for July 24, 2025, with 39.38% of shareholders already committed to voting in favor.

The total transaction value is A$5.5 million, comprising A$500,000 in cash payments and A$5 million in Barton shares. Upon completion, Barton will issue approximately 6.41 million shares to Cobra across two tranches. The acquisition aligns with Barton's strategy to leverage its existing gold mill infrastructure in the central Gawler Craton region for future production growth.

Barton Gold Holdings (OTCQB:BGDFF) ha fornito un aggiornamento sul suo accordo vincolante per acquisire il Progetto Oro Wudinna da Cobra Resources PLC. Il progetto contiene risorse di 279.000 once d'oro nel Sud Australia. Cobra ha programmato una votazione degli azionisti per il 24 luglio 2025, con il 39,38% degli azionisti già impegnati a votare a favore.

Il valore totale della transazione è di 5,5 milioni di dollari australiani, comprensivi di 500.000 dollari australiani in pagamenti in contanti e 5 milioni di dollari australiani in azioni Barton. Al completamento, Barton emetterà circa 6,41 milioni di azioni a favore di Cobra in due tranche. L'acquisizione è in linea con la strategia di Barton di sfruttare la propria infrastruttura esistente di impianti auriferi nella regione centrale del Gawler Craton per una futura crescita produttiva.

Barton Gold Holdings (OTCQB:BGDFF) ha proporcionado una actualización sobre su acuerdo vinculante para adquirir el Proyecto de Oro Wudinna de Cobra Resources PLC. El proyecto contiene recursos de 279,000 onzas de oro en Australia del Sur. Cobra ha programado una votación de accionistas para el 24 de julio de 2025, con el 39,38% de los accionistas ya comprometidos a votar a favor.

El valor total de la transacción es de 5,5 millones de dólares australianos, que incluye 500,000 dólares australianos en pagos en efectivo y 5 millones de dólares australianos en acciones de Barton. Al completarse, Barton emitirá aproximadamente 6,41 millones de acciones a Cobra en dos tramos. La adquisición se alinea con la estrategia de Barton de aprovechar su infraestructura existente de plantas de oro en la región central del Gawler Craton para el crecimiento futuro de la producción.

Barton Gold Holdings (OTCQB:BGDFF)�� Cobra Resources PLC로부�� Wudinna �� 프로젝트�� 인수하기 위한 구속�� 있는 계약�� 대�� 최신 정보�� 제공했습니다. �� 프로젝트�� 남호주에 279,000 온스�� �� 자원�� 보유하고 있습니다. Cobra�� 2025�� 7�� 24���� 주주 투표�� 예정하고 있으��, 이미 39.38%�� 주주가 찬성 투표�� 동의�� 상태입니��.

�� 거래 가치는 550�� 호주 달러��, 현금 지급액 50�� 호주 달러와 Barton 주식 500�� 호주 달러�� 구성되어 있습니다. 거래 완료 �� Barton은 �� 차례�� 걸쳐 �� 641�� ���� Cobra�� 발행�� 예정입니��. 이번 인수�� Barton�� 중앙 Gawler Craton 지역에 보유�� 기존 금광 인프라를 활용하여 미래 생산 성장�� 기여하려�� 전략�� 일치합니��.

Barton Gold Holdings (OTCQB:BGDFF) a fourni une mise à jour concernant son accord contraignant pour acquérir le projet aurifère de Wudinna auprès de Cobra Resources PLC. Le projet contient 279 000 onces d'or en ressources en Australie-Méridionale. Cobra a prévu un vote des actionnaires le 24 juillet 2025, avec 39,38% des actionnaires déjà engagés à voter en faveur.

La valeur totale de la transaction s'élève à 5,5 millions de dollars australiens, comprenant 500 000 dollars australiens en paiements en espèces et 5 millions de dollars australiens en actions Barton. À l'issue de la transaction, Barton émettra environ 6,41 millions d'actions à Cobra en deux tranches. Cette acquisition s'inscrit dans la stratégie de Barton visant à exploiter son infrastructure existante de moulin à or dans la région centrale du Gawler Craton pour soutenir la croissance future de la production.

Barton Gold Holdings (OTCQB:BGDFF) hat ein Update zu seiner verbindlichen Vereinbarung zur Übernahme des Wudinna Gold Projekts von Cobra Resources PLC gegeben. Das Projekt enthält 279.000 Unzen Gold Ressourcen in Südaustralien. Cobra hat eine Aktionärsabstimmung für den 24. Juli 2025 angesetzt, wobei bereits 39,38% der Aktionäre ihre Zustimmung signalisiert haben.

Der Gesamtwert der Transaktion beträgt 5,5 Millionen Australische Dollar, bestehend aus 500.000 Australischen Dollar in Barzahlungen und 5 Millionen Australischen Dollar in Barton-Aktien. Nach Abschluss wird Barton etwa 6,41 Millionen Aktien in zwei Tranchen an Cobra ausgeben. Die Übernahme entspricht Bartons Strategie, die bestehende Goldmühleninfrastruktur in der zentralen Gawler Craton Region für zukünftiges Produktionswachstum zu nutzen.

- None.

- Additional share issuance of 6.41M shares will cause dilution

- Multiple completion conditions and documentation requirements still pending

Cobra Notice of Meeting issued;

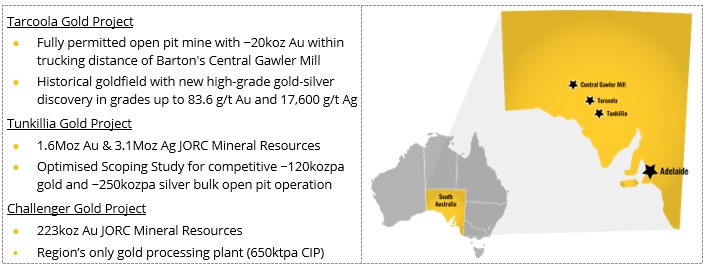

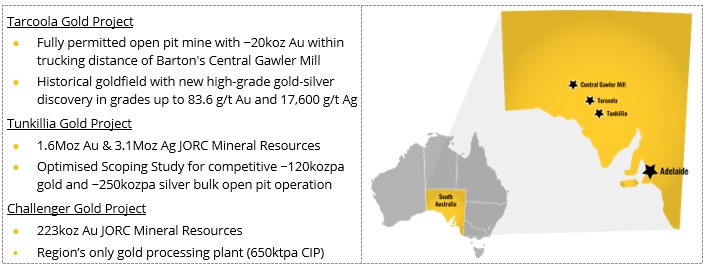

HIGHLIGHTS

Binding terms agreed with Cobra Resources PLC for acquisition of its 279,000oz Au South Australian Wudinna Gold Project, subject only to Cobra shareholder approval (Transaction) [1]

Cobra notice of meeting issued for 24 July 2025 shareholder vote on Transaction, with existing irrevocable undertakings to vote in favour totalling

39% received as of Friday, 4 July 2025

ADELAIDE, AUSTRALIA / / July 7, 2025 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to provide an update relating to its recently announced agreement to acquire the Wudinna Gold Project (Wudinna) from Cobra Resources PLC (Cobra). Cobra has issued a Notice of General Meeting (Notice) for 24 July 2025, for Cobra shareholders to vote upon the proposed Transaction.[2] As outlined in the Notice, as of Friday, 4 July 2025 all Cobra Directors, along with certain shareholders, have provided irrevocable undertakings to vote in favour of the Transaction totalling

Pursuant to the terms of the Transaction agreement, Barton has paid to Cobra a Non-Refundable Deposit of A

Completion will be achieved and Barton will have a binding ownership interest in Wudinna;

Barton and Cobra will sign Escrow and Orderly Market Agreements, and prepare other Transaction documentation including various mineral rights, access and operating agreements; and

Barton will make further payments, and issue Barton shares, to Cobra as follows, with the number of Barton shares to be issued totalling 1,025,619 (for the

$800,000) and 5,384,501 (for the$4,200,000) :[3]

Agreement signing | Grant of New Tenements | Final Settlement | Total | |

Cash | ||||

Barton shares | ||||

Total |

Commenting on the acquisition update, Barton Managing Director Alexander Scanlon said:

"We are honoured to receive such a strong early commitment of support from Cobra's largest shareholders, and note the overwhelmingly positive feedback from Barton's shareholders, for this mutually beneficial transaction.

"During the past five years Barton has carefully and diligently assembled a strategic long-term South Australian gold development platform focused on the central Gawler Craton, including the region's only gold mill. As we move to leverage this key infrastructure for a lower-risk, -cost and -dilution transition to 'producer', we also remain focused on future production growth plans. Wudinna offers significant optionality to our regional strategies, and we will be pleased to welcome Cobra to our register as steadily build value across our platform."

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 1.9Moz Au & 3.1Moz Ag JORC Mineral Resources (73.0Mt @ 0.79 g/t Au), brownfield mines, and

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG ) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 ( JORC ).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at or on the ASX website . The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

[1] Refer to ASX announcements dated 30 June 2025

[2] Refer to Cobra announcement dated 7 July 2025, which can be found here:

[3] The above Barton shares will be issued based upon the 30 trading day volume weighted average price (VWAP) for Barton shares as of market close on 27 June 2025, being A

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 30 June 2025. Total Barton JORC (2012) Mineral Resources include 1,031koz Au (39.3Mt @ 0.82 g/t Au) in Indicated category and 834koz Au (33.8Mt @ 0.77 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original on ACCESS Newswire