Commencement Bancorp, Inc. (CBWA) Announces Second Quarter 2025 Results

Commencement Bancorp (OTCQX:CBWA) reported strong financial results for Q2 2025, with net income of $1.5 million ($0.40 per share), up from $1.3 million in Q1 2025 and $776,000 in Q2 2024. The bank demonstrated robust growth with loans receivable increasing by $37.9 million (32.4% annualized) and deposits growing by $20.5 million (14.4% annualized).

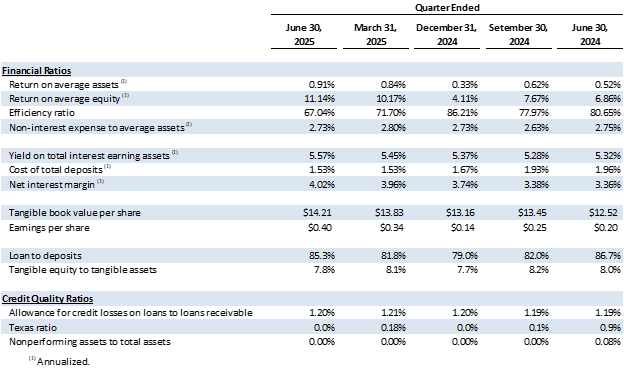

Key performance metrics showed improvement with net interest margin expanding to 4.02% from 3.96% in Q1 2025. The bank maintained strong credit quality with zero nonperforming assets and an allowance for credit losses at 1.20%. Total assets reached $681.7 million, supported by ample liquidity of $133.5 million and strong capital ratios above regulatory requirements.

Commencement Bancorp (OTCQX:CBWA) ha riportato risultati finanziari solidi per il secondo trimestre del 2025, con un utile netto di 1,5 milioni di dollari (0,40 dollari per azione), in aumento rispetto a 1,3 milioni nel primo trimestre 2025 e 776.000 dollari nel secondo trimestre 2024. La banca ha mostrato una crescita robusta con un incremento dei prestiti a ricevere di 37,9 milioni di dollari (32,4% su base annua) e una crescita dei depositi di 20,5 milioni di dollari (14,4% su base annua).

I principali indicatori di performance hanno evidenziato un miglioramento con un margine di interesse netto che si è ampliato al 4,02% rispetto al 3,96% del primo trimestre 2025. La banca ha mantenuto una solida qualità del credito con zero attività deteriorate e un accantonamento per perdite su crediti pari all'1,20%. Gli attivi totali hanno raggiunto 681,7 milioni di dollari, supportati da un'ampia liquidità di 133,5 milioni di dollari e da solidi coefficienti patrimoniali superiori ai requisiti normativi.

Commencement Bancorp (OTCQX:CBWA) reportó sólidos resultados financieros para el segundo trimestre de 2025, con un ingreso neto de 1.5 millones de dólares (0.40 dólares por acción), aumentando desde 1.3 millones en el primer trimestre de 2025 y 776,000 en el segundo trimestre de 2024. El banco mostró un crecimiento robusto con un aumento en préstamos por cobrar de 37.9 millones de dólares (32.4% anualizado) y un crecimiento en depósitos de 20.5 millones de dólares (14.4% anualizado).

Los principales indicadores de desempeño mostraron mejoras con un margen de interés neto que se expandió a 4.02% desde 3.96% en el primer trimestre de 2025. El banco mantuvo una fuerte calidad crediticia con cero activos improductivos y una provisión para pérdidas crediticias del 1.20%. Los activos totales alcanzaron 681.7 millones de dólares, respaldados por una amplia liquidez de 133.5 millones y sólidos índices de capital por encima de los requerimientos regulatorios.

Commencement Bancorp (OTCQX:CBWA)�� 2025�� 2분기�� 강력�� 재무 실적�� 보고했으��, 순이�� 150�� 달러(주당 0.40달러)�� 기록했습니다. 이는 2025�� 1분기�� 130�� 달러와 2024�� 2분기�� 77�� 6�� 달러에서 증가�� 수치입니��. 은행은 대출채권이 3,790�� 달러(연율 32.4%) 증가��고, 예금�� 2,050�� 달러(연율 14.4%) 증가하는 �� 견고�� 성장�� 보였습니��.

주요 성과 지표도 개선되어 순이자마진이 4.02%�� 2025�� 1분기�� 3.96%에서 확대되었습니��. 은행은 부�� 자산�� 전혀 없으��, 신용 손실 충당금은 1.20%�� 유지하여 강한 신용 품질�� 유지했습니다. �� 자산은 6�� 8,170�� 달러�� 달하��, 1�� 3,350�� 달러�� 충분�� 유동성과 규제 요건�� 상회하는 강력�� 자본 비율�� 뒷받침되�� 있습니다.

Commencement Bancorp (OTCQX:CBWA) a annoncé de solides résultats financiers pour le deuxième trimestre 2025, avec un revenu net de 1,5 million de dollars (0,40 dollar par action), en hausse par rapport à 1,3 million au premier trimestre 2025 et 776 000 au deuxième trimestre 2024. La banque a démontré une croissance robuste avec une augmentation des prêts à recevoir de 37,9 millions de dollars (32,4 % annualisé) et une croissance des dépôts de 20,5 millions de dollars (14,4 % annualisé).

Les principaux indicateurs de performance ont montré une amélioration avec une marge nette d'intérêt passant à 4,02 % contre 3,96 % au premier trimestre 2025. La banque a maintenu une solide qualité de crédit avec zéro actif non performant et une provision pour pertes sur prêts de 1,20 %. Le total des actifs a atteint 681,7 millions de dollars, soutenu par une liquidité abondante de 133,5 millions et des ratios de capital solides au-dessus des exigences réglementaires.

Commencement Bancorp (OTCQX:CBWA) meldete starke Finanzergebnisse für das zweite Quartal 2025 mit einem Nettoeinkommen von 1,5 Millionen US-Dollar (0,40 US-Dollar pro Aktie), was einen Anstieg gegenüber 1,3 Millionen im ersten Quartal 2025 und 776.000 im zweiten Quartal 2024 darstellt. Die Bank zeigte robustes Wachstum mit einem Anstieg der ausstehenden Kredite um 37,9 Millionen US-Dollar (annualisiert 32,4 %) und einem Wachstum der Einlagen um 20,5 Millionen US-Dollar (annualisiert 14,4 %).

Wichtige Leistungskennzahlen verbesserten sich, wobei die Nettozinsmarge auf 4,02 % von 3,96 % im ersten Quartal 2025 anstieg. Die Bank behielt eine starke Kreditqualität bei mit keinen notleidenden Vermögenswerten und einer Rückstellung für Kreditverluste von 1,20 %. Die Gesamtaktiva erreichten 681,7 Millionen US-Dollar, unterstützt durch eine ausreichende Liquidität von 133,5 Millionen und starke Kapitalquoten über den regulatorischen Anforderungen.

- Net income increased 93.3% year-over-year to $1.5 million

- Strong loan growth of 32.4% annualized with $62.3M in new loan commitments

- Net interest margin improved to 4.02%, up 66 basis points year-over-year

- Zero nonperforming assets and improved classified loans ratio to 1.69%

- Robust liquidity position at 19.6% of total assets

- Required $15 million FHLB borrowing at 4.50% to fund loan growth

- Non-interest expenses increased 2.3% quarter-over-quarter

- Unrealized losses in investment securities increased by $88,000

2025 Second Quarter Financial Highlights:

Net income was

$1.5 million compared to$1.3 million for the first quarter of 2025 and$776,000 for the second quarter of 2024.Loans receivable increased

$37.9 million , or32.4% annualized growth rate.Deposits increased

$20.5 million , or14.4% annualized growth rate.Net interest margin increased to

4.02% from3.96% during the first quarter of 2025.Total cost of deposits remained steady at

1.53% .The Bank had no nonperforming assets as of June 30, 2025.

Capital ratios remained well above regulatory requirements.

TACOMA, WA / / July 29, 2025 / Commencement Bancorp, Inc. (OTCQX:CBWA) (the "Company", "we," or "us"), the parent company of Commencement Bank (the "Bank") reported net income of

"We are pleased with our continued net interest margin expansion in 2025, resulting in an improvement of 58 basis points over the same period in 2024. Due to the hard work of our bankers, we are reaping the rewards of higher loan volumes and increased yields, which when combined with our focus on managing our overall cost of funds, has resulted in improved profitability. Our capital and liquidity remain strong, and our reputation as the trusted local bank is allowing us to exceed our loan growth goals for the year," said John E. Manolides, Chief Executive Officer.

"Our bankers' calling activity and business development throughout the past several months has started to materialize, which was evidenced in the second quarter. I'm proud of their resilience while competing, building trust, and earning new lending, deposit, and treasury relationships. Our heightened brand and style of banking continues to resonate in the markets we serve, and it's rewarding to see our strong performance during the quarter," said Nigel L. English, President & Chief Operating Officer.

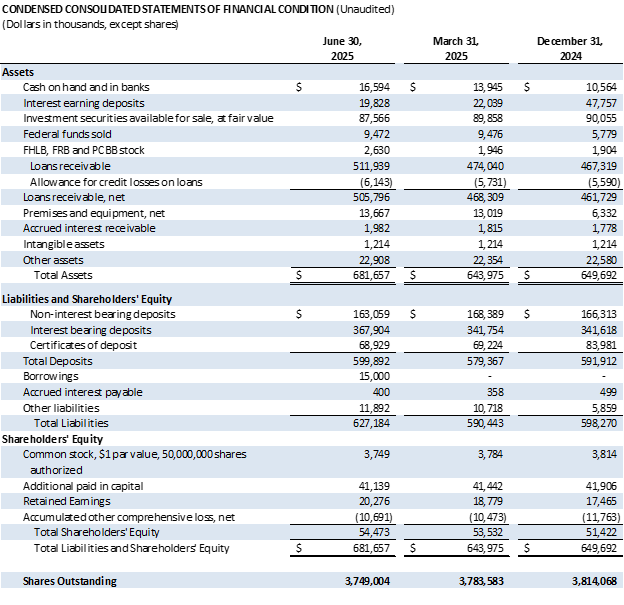

Balance Sheet

Total assets increased to

Investment securities available for sale decreased

Loans receivable increased

Total deposits increased

Total borrowings were

Credit Quality

The Bank had no nonperforming assets at June 30, 2025 or March 31, 2025. The allowance for credit losses to loan receivable remains strong at

The percentage of classified loans (loans rated Substandard or worse) to loans receivable improved to

Liquidity

The Bank has ample liquidity with both on- and off-balance sheet sources. Total on-balance sheet liquidity of

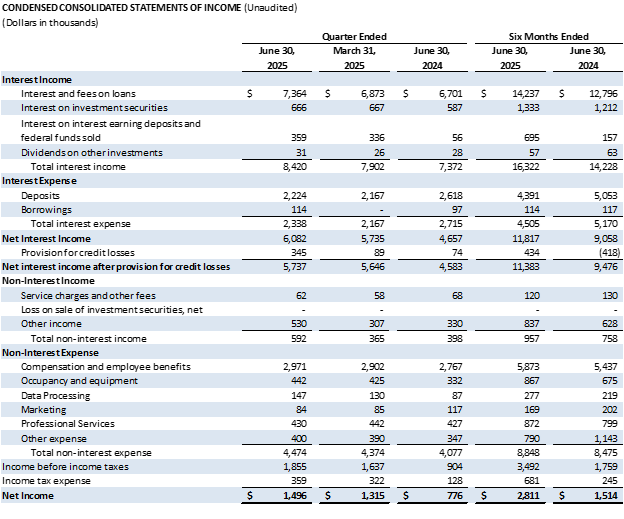

Income Statement

Net interest income increased

Interest income on loans increased

Interest expense on deposits increased

Interest expense on borrowings increased to

Total non-interest income increased

Total non-interest expense increased

###

About Commencement Bancorp, Inc.

Commencement Bancorp, Inc. is the holding company for Commencement Bank, headquartered in Tacoma, Washington. Commencement Bank was formed in 2006 to provide traditional, reliable, and sustainable banking in Pierce, King, and Thurston counties and the surrounding areas. Their team of experienced banking experts focuses on personal attention, flexible service, and building strong relationships with customers through state-of-the-art technology as well as traditional delivery systems. As a local bank, Commencement Bank is deeply committed to the community. For more information, please visit . For information related to the trading of CBWA, please visit .

For further discussion, please contact the following:

John E. Manolides,Chief Executive Officer | 253-284-1802

Nigel L. English, President & Chief Operating Officer | 253-284-1801

Brandi Parker, Executive Vice President & Chief Financial Officer | 253-284-1803

Forward-Looking Statement Safe Harbor: This news release contains comments or information that constitutes forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations that involve a number of risks and uncertainties. Forward-looking statements describe Commencement Bancorp, Inc.'s projections, estimates, plans and expectations of future results and can be identified by words such as "believe," "intend," "estimate," "likely," "anticipate," "expect," "looking forward," and other similar expressions. They are not guarantees of future performance. Actual results may differ materially from the results expressed in these forward-looking statements, which because of their forward-looking nature, are difficult to predict. Investors should not place undue reliance on any forward-looking statement, and should consider factors that might cause differences including but not limited to the degree of competition by traditional and nontraditional competitors, declines in real estate markets, an increase in unemployment or sustained high levels of unemployment; changes in interest rates; greater than expected costs to integrate acquisitions, adverse changes in local, national and international economies; changes in the Federal Reserve's actions that affect monetary and fiscal policies; changes in legislative or regulatory actions or reform, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act; demand for products and services; changes to the quality of the loan portfolio and our ability to succeed in our problem-asset resolution efforts; the impact of technological advances; changes in tax laws; and other risk factors. Commencement Bancorp, Inc.undertakes no obligation to publicly update or clarify any forward-looking statement to reflect the impact of events or circumstances that may arise after the date of this release.

SOURCE: Commencement Bank

View the original on ACCESS Newswire