Mako Mining Reports First Quarter 2025 Financial Results, Including Record Mine Operating Cash Flow of US$19.9 million, Adjusted EBITDA of US$16.1 million and EPS of US$0.12/share from 10,817 oz Gold Sold at US$2,915/oz

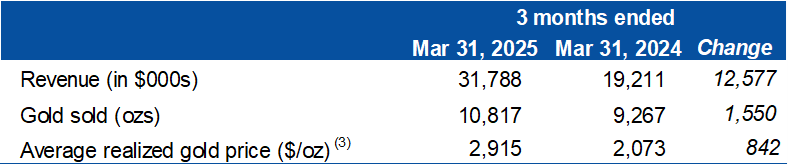

- Record revenue of $31.8 million, up 65.6% from Q1 2024 ($19.2 million)

- Strong net income of $9.4 million ($0.12 per share)

- Impressive ROE of 47.5% and ROA of 30.9%

- Healthy cash position with $22.0 million in Cash and Receivables

- Strategic acquisition of Moss gold mine completed

- High average gold selling price of $2,915/oz

- Increased Cash Cost ($1,239/oz) and AISC ($1,411/oz) due to Moss acquisition

- $4.0 million payment for previously accrued Income Tax Payable

- Significant exploration and evaluation expenses of $1.5 million

VANCOUVER, BC / / June 2, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three months ended March 31st, 2025 ("Q1 2025"). All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

The Company's financial results for Q1 2025 reflect record gold sales from its San Albino and Moss Mine of

On March 27th, 2025, Mako completed the acquisition of EGA (the "Moss Acquisition"), which owned the Moss gold mine in Arizona, and these financial results reflect the consolidation of the Moss Acquisition into Mako's Q1 2025 Financial Statements and MD&A. Finished products in the amount of 936 oz of gold and 8,562 oz of silver were acquired at the time of acquisition, held on the balance sheet at market value of

Q1 2025 Mako Mining Highlights

Financial

$31.8 million in Revenue$19.9 million in Mine Operating Cash Flow ("MineOCF") (1) (4)$16.1 million in Adjusted EBITDA (1)$9.4 million Net Income$1,239 Cash Costs ($/oz sold) (1) (2)$1,411 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2)Twelve Trailing Months ("TTM") Return on Equity ("ROE") (1) of

47.5% and Return on Assets ("ROA") of30.9% (1)Delivered 40,500 oz of silver in Q1 2025 to the Sailfish Silver Loan. The final 13,500 oz installment was delivered in April 2025

$4.0 million payment of Income Tax Payable previously accrued in Fiscal Year 2024The Company purchased 0.5 million common shares under the normal course issuer bid ("NCIB") for

$1.4 million (C$2.0 million ) in Q1 2025On March 27th, 2025, the Company completed the Moss Acquisition

Growth

$1.5 million in exploration and evaluation expenses ($0.5 million in areas surrounding San Albino in Nicaragua and approximately$1.0 million at Eagle Mountain, Guyana)

Subsequent to March 31, 2025

Delivered the final installment of 13,500 oz of silver on the Sailfish Silver Loan

On April 28th, 2025, Sailfish exercised its option to purchase all refined silver produced from the Company's San Albino operations for an additional payment of

$1.0 million The Company granted 740,000 stock options with a C

$4.47 exercise price, 502,785 RSUs and 145,000 DSUs to its executive officers, directors and certain other employees and consultants

Q2 2025 (through May 31st) - Mako Mining Financial Highlights

$25.1 million in Revenue from 7,409 oz of gold at$3,327 /oz and 13,529 oz of silver at$33.03 /oz$22.0 million in Cash and Receivables and$3.3 million in Restricted Cash (50% will become unrestricted in June 2025)

Akiba Leisman, Chief Executive Officer, states that "Q1 was a transformative quarter for Mako. We acquired our second operating mine at Moss, which produces gold and silver through its residual leach operations. The acquisition was financed using a small fraction of this quarter's Mine Operating Cash Flow from San Albino. A new mining contractor for Moss was selected and will be mobilized to restart mining operations later this month. The San Albino mine continues to perform well, which helped Mako generate record Mine Operating Cash flow of US

Table 1 - Revenue

Table 2 - Operating and Financial Data

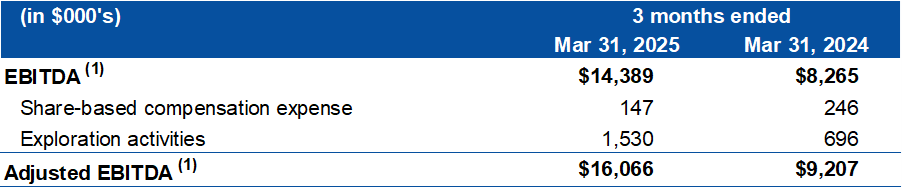

Table 3 - EBITDA Reconciliation

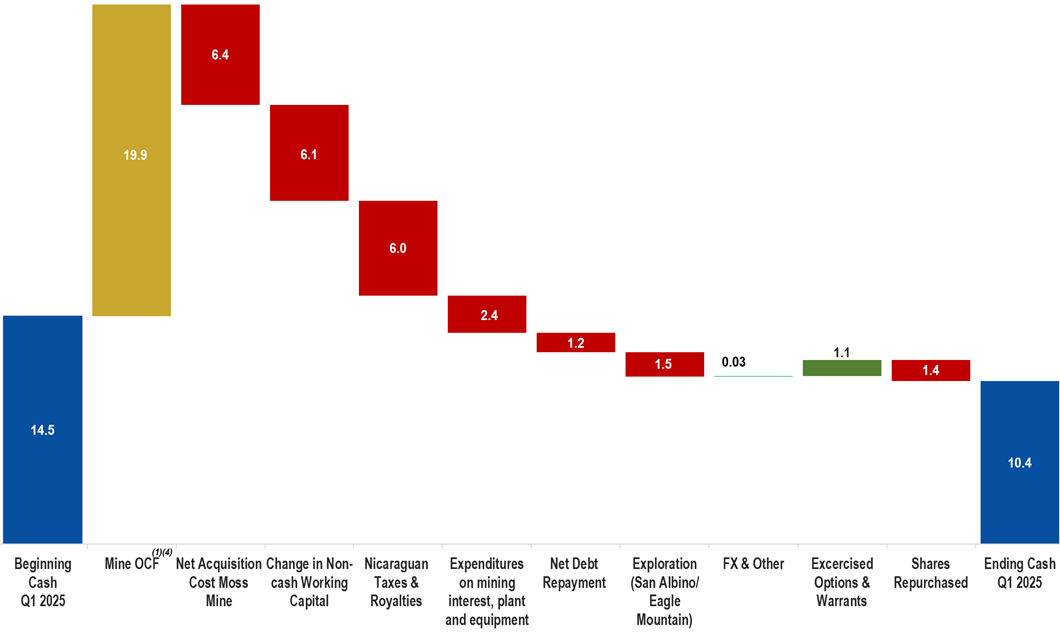

Chart 1

Q1 2025 - Mine OCF Calculation and Cash Reconciliation (in $ million)

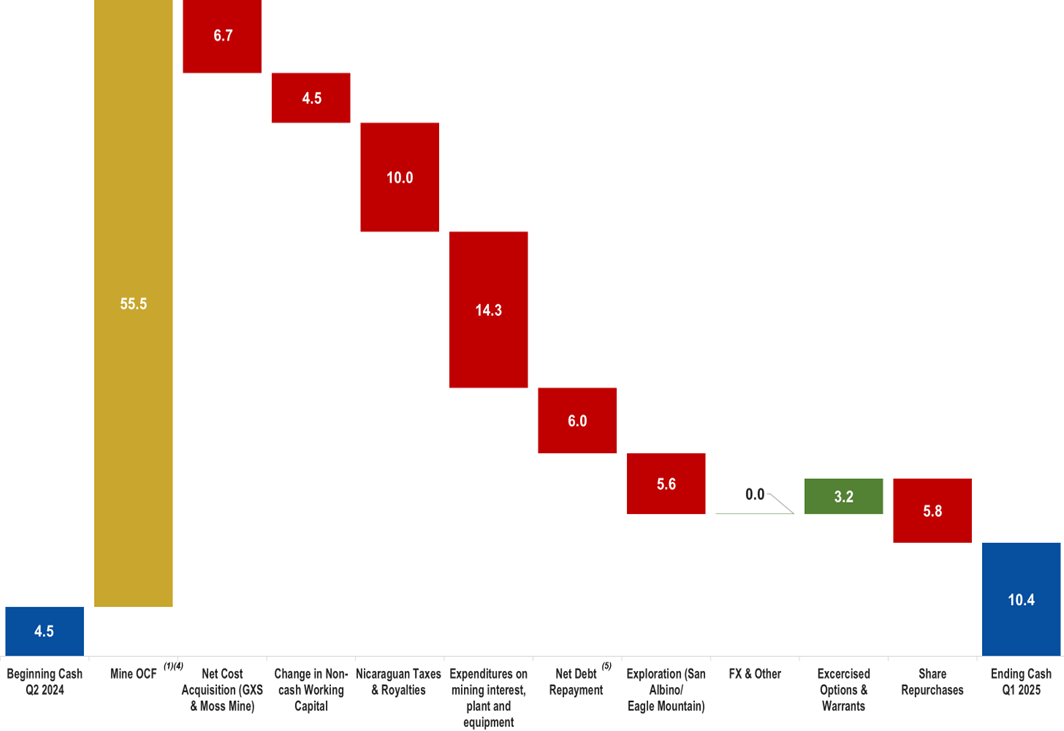

Chart 2

2025 - Mine OCF Calculation and Cash Reconciliation (in $ million)

End Notes

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

AG���˹ٷ�ized price before deductions from Sailfish gold streaming agreement.

Refer to "Chart 1 & 2 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Includes Repayment Silver Loan, Wexford Loan, Wexford Bridge Loan related to Goldsource Acquisition, Payment to GR Silver and other lease payments

For complete details, please refer to condensed interim consolidated financial statements and the associated management discussion and analysis for the three months ended March 31st, 2025, available on SEDAR+ () or on the Company's website ().

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"Total cash costs per ounce sold" is calculated by deducting revenues from silver sales from production cash costs and production taxes and royalties and dividing the sum by the number of gold ounces sold. Production cash costs include mining, milling, mine site security and mine site administration costs.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expense

"ROE" is calculated by dividing the twelve trailing months Net Income by the average shareholder's equity. The average shareholder's equity is calculated by adding the total equity at the end of the period to the total equity at the beginning of the period and dividing by two.

"ROA" is calculated by dividing the twelve trailing months Net Income by the average total assets. The average total assets is calculated by adding the total assets at the end of the period to the total assets at the beginning of the period and dividing by two.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona. Mako also holds a

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: [email protected] or visit our website at and SEDAR .

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, management's expectation that

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

View the original on ACCESS Newswire