Stellantis Publishes Preliminary and Unaudited Key Figures for First Half 2025

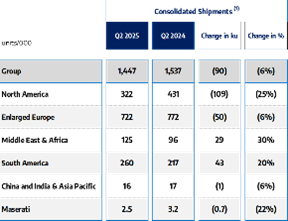

Stellantis (NYSE: STLA) has released preliminary and unaudited financial figures for H1 2025, revealing significant challenges. The company reported Ôé�74.3B in net revenues but faced a net loss of Ôé�2.3Á■ and negative industrial free cash flows of Ôé�3.0Á■. Q2 2025 global consolidated shipments declined 6% year-over-year to 1.4M units.

Key impacts include Ôé�3.3B in pre-tax net charges related to program cancellations, platform impairments, and restructuring. North American operations were particularly affected, with Q2 shipments down 25% y-o-y, while Enlarged Europe saw a 6% decline. However, other regions showed growth, with Middle East & Africa up 30% and South America increasing by 20%.

The company's performance was impacted by higher industrial costs, geographic mix factors, and Ôé�0.3B in US tariff-related costs.Stellantis (NYSE: STLA) ha pubblicato i dati finanziari preliminari e non revisionati per il primo semestre 2025, evidenziando sfide significative. L'azienda ha registrato ricavi netti per Ôé�74,3 miliardi, ma ha subito una perdita netta di Ôé�2,3 miliardi e flussi di cassa industriali liberi negativi per Ôé�3,0 miliardi. Le spedizioni consolidate globali del secondo trimestre 2025 sono diminuite del 6% su base annua, raggiungendo 1,4 milioni di unit├á.

Gli impatti principali includono oneri netti ante imposte per Ôé�3,3 miliardi derivanti da cancellazioni di programmi, svalutazioni di piattaforme e ristrutturazioni. Le operazioni in Nord America sono state particolarmente colpite, con una riduzione delle spedizioni del 25% nel secondo trimestre rispetto all'anno precedente, mentre l'Europa allargata ha registrato un calo del 6%. Tuttavia, altre regioni hanno mostrato crescita, con Medio Oriente e Africa in aumento del 30% e Sud America in crescita del 20%.

Le prestazioni dell'azienda sono state influenzate da costi industriali pi├╣ elevati, fattori legati alla composizione geografica e da costi legati ai dazi USA per Ôé�0,3 miliardi.

Stellantis (NYSE: STLA) ha publicado cifras financieras preliminares y no auditadas para el primer semestre de 2025, revelando desaf├şos significativos. La compa├▒├şa report├│ ingresos netos de Ôé�74.3 mil millones pero enfrent├│ una p├ęrdida neta de Ôé�2.3 mil millones y flujos de caja industriales libres negativos de Ôé�3.0 mil millones. Los env├şos consolidados globales del segundo trimestre de 2025 cayeron un 6% interanual a 1.4 millones de unidades.

Los impactos clave incluyen cargos netos antes de impuestos por Ôé�3.3 mil millones relacionados con cancelaciones de programas, deterioros de plataformas y reestructuraciones. Las operaciones en Norteam├ęrica se vieron particularmente afectadas, con env├şos en el segundo trimestre que bajaron un 25% interanual, mientras que Europa Ampliada tuvo una disminuci├│n del 6%. Sin embargo, otras regiones mostraron crecimiento, con Medio Oriente y ├üfrica aumentando un 30% y Sudam├ęrica creciendo un 20%.

El desempe├▒o de la compa├▒├şa se vio afectado por mayores costos industriales, factores de mezcla geogr├ífica y costos relacionados con aranceles de EE.UU. por Ôé�0.3 mil millones.

ýŐĄÝůöŰ×ÇÝő░ýŐĄ(NYSE: STLA)ŰŐ� 2025Űů� ýâüŰ░śŕŞ� ýśłŰ╣ä Ű░� Ű»Şŕ░Éýé� ý×ČŰČ┤ ýłśý╣śŰą� Ű░ťÝŝݼśŰę░ ýőČŕ░üÝĽ� ŰĆäýáäýŁ� ŰôťŰčČŰâłýŐÁŰőłŰőĄ. ÝÜîýéČŰŐ� 743ýľ� ýťáŰíťýŁ� ýłťŰžĄýÂ�ýŁ� Ű│┤ŕ│áÝľłýť╝Űé� 23ýľ� ýťáŰíťýŁ� ýłťýćÉýő�ŕ│� 30ýľ� ýťáŰíťýŁ� ŰÂÇýáĽýáü ýé░ýŚů ý×Éýťá Ýśäળ ÝŁÉŰŽäýŁ� ŕŞ░ŰíŁÝľłýŐÁŰőłŰőĄ. 2025Űů� 2ŰÂäŕŞ░ ŕŞÇŰíťŰ▓î ÝćÁÝĽę ýݼśŰčëýŁÇ ýáäŰůä ŰîÇŰ╣� 6% ŕ░ÉýćîÝĽ� 140Űž� ŰîÇŰą� ŕŞ░ŰíŁÝľłýŐÁŰőłŰőĄ.

ýú╝ýÜö ýśüÝľąýť╝ŰíťŰŐ� ÝöäŰíťŕĚŞŰ×Ę ýĚĘýćî, ÝöîŰןÝĆ� ýćÉýâü, ŕÁČýí░ýí░ýáĽŕ│� ŕ┤ÇŰáĘŰÉť ýäŞýáä ýłťý░Ęŕ░ÉýĽí 33ýľ� ýťáŰíťŕ░Ç ý׳ýŐÁŰőłŰőĄ. ŰÂüŰ»Ş ýžÇýŚ� ýÜ┤ýśüýŁ� ÝŐ╣Ý׳ ýśüÝľąýŁ� Ű░ŤýĽä 2ŰÂäŕŞ░ ýݼśŰčëýŁ┤ ýáäŰůä ŰîÇŰ╣� 25% ŕ░ÉýćîÝľłýť╝Űę�, ÝÖĽŰîÇ ýťáŰčŻýŁÇ 6% ŕ░ÉýćîÝľłýŐÁŰőłŰőĄ. Ű░śŰę┤ ýĄĹŰĆÖ Ű░� ýĽäÝöäŰŽČý╣┤ŰŐ� 30%, ŰéĘŰ»ŞŰŐ� 20% ýä▒ý׹ݾłýŐÁŰőłŰőĄ.

ÝÜîýéČýŁ� ýőĄýáüýŁÇ ŰćĺýŁÇ ýé░ýŚů Ű╣äýÜę, ýžÇŰŽČýáü Ýś╝ÝĽę ýÜöýŁŞ, ŕĚŞŰŽČŕ│� Ű»ŞŕÁş ŕ┤Çýä� ŕ┤ÇŰá� Ű╣äýÜę 3ýľ� ýťáŰíťýŁ� ýśüÝľąýŁ� Ű░ŤýĽśýŐÁŰőłŰő�.

Stellantis (NYSE : STLA) a publi├ę des chiffres financiers pr├ęliminaires et non audit├ęs pour le premier semestre 2025, r├ęv├ęlant des d├ęfis importants. La soci├ęt├ę a d├ęclar├ę 74,3 milliards d'euros de revenus nets mais a subi une perte nette de 2,3 milliards d'euros ainsi que des flux de tr├ęsorerie industriels libres n├ęgatifs de 3,0 milliards d'euros. Les livraisons consolid├ęes mondiales du deuxi├Ęme trimestre 2025 ont diminu├ę de 6 % en glissement annuel pour atteindre 1,4 million d'unit├ęs.

Les impacts cl├ęs incluent 3,3 milliards d'euros de charges nettes avant imp├┤ts li├ęes ├á des annulations de programmes, des d├ępr├ęciations de plateformes et des restructurations. Les op├ęrations en Am├ęrique du Nord ont ├ęt├ę particuli├Ęrement touch├ęes, avec une baisse des livraisons de 25 % au T2 par rapport ├á l'ann├ęe pr├ęc├ędente, tandis que l'Europe ├ęlargie a enregistr├ę une baisse de 6 %. Cependant, d'autres r├ęgions ont montr├ę une croissance, avec une hausse de 30 % au Moyen-Orient et en Afrique et une augmentation de 20 % en Am├ęrique du Sud.

La performance de la soci├ęt├ę a ├ęt├ę affect├ęe par des co├╗ts industriels plus ├ęlev├ęs, des facteurs li├ęs ├á la r├ępartition g├ęographique et des co├╗ts li├ęs aux tarifs am├ęricains de 0,3 milliard d'euros.

Stellantis (NYSE: STLA) hat vorl├Ąufige und ungepr├╝fte Finanzzahlen f├╝r das erste Halbjahr 2025 ver├Âffentlicht, die erhebliche Herausforderungen aufzeigen. Das Unternehmen meldete Nettoerl├Âse von 74,3 Mrd. Ôé�, verzeichnete jedoch einen Nettoverlust von 2,3 Mrd. Ôé� und negative industrielle Free Cashflows von 3,0 Mrd. Ôé�. Die global konsolidierten Auslieferungen im zweiten Quartal 2025 gingen im Jahresvergleich um 6 % auf 1,4 Mio. Einheiten │˙│▄░¨├╝│Ž░ý.

Wesentliche Auswirkungen umfassen steuerliche Nettoaufwendungen vor Steuern in H├Âhe von 3,3 Mrd. Ôé� im Zusammenhang mit Programmstornierungen, Wertminderungen von Plattformen und Restrukturierungen. Die nordamerikanischen Aktivit├Ąten waren besonders betroffen, mit einem R├╝ckgang der Auslieferungen im zweiten Quartal um 25 % gegen├╝ber dem Vorjahr, w├Ąhrend das erweiterte Europa einen R├╝ckgang von 6 % verzeichnete. Andere Regionen zeigten jedoch Wachstum, mit einem Anstieg im Nahen Osten & Afrika um 30 % und in S├╝damerika um 20 %.

Die Unternehmensleistung wurde durch h├Âhere industrielle Kosten, geografische Mischfaktoren und US-Zollkosten in H├Âhe von 0,3 Mrd. Ôé� ▓˙▒▒ż▒▓ď│┘░¨├Ą│Ž│ˇ│┘ż▒▓Á│┘.

- Growth in emerging markets with Middle East & Africa up 30% and South America up 20%

- Jeep and Ram brands collectively delivered 13% higher sales y-o-y in North America

- Smart Car platform shipments increased 45% sequentially in Q2 2025

- Maintained market leadership position in South America

- Net loss of Ôé�2.3Á■ in H1 2025

- Negative industrial free cash flows of Ôé�3.0Á■

- Global shipments declined 6% y-o-y to 1.4M units in Q2

- Ôé�3.3B in pre-tax net charges for program cancellations and impairments

- North American shipments dropped 25% y-o-y in Q2

- Ôé�0.3B impact from US tariffs plus related production disruptions

Insights

Stellantis reports concerning preliminary H1 2025 results with Ôé�2.3Á■ net loss, plummeting profit margins, and major operational challenges.

Stellantis has released concerning preliminary H1 2025 figures showing a Ôé�2.3 billion net loss and dramatically reduced Adjusted Operating Income of just Ôé�0.5 billion, a severe deterioration from the company's historical performance. The preliminary data indicates major operational challenges across multiple fronts, with negative cash flows from operations at -Ôé�2.3 billion and industrial free cash flow at -Ôé�3.0 billion.

The company identified several factors behind this poor performance, including Ôé�3.3 billion in pre-tax charges related to program cancellations, platform impairments, and restructuring costs. US tariffs have created a Ôé�0.3 billion direct financial impact plus additional losses from production disruptions. Q2 consolidated shipments declined by 6% year-over-year to 1.4 million units, with North America particularly hard-hit, showing a 25% drop in shipments.

These results reflect both external pressures and internal challenges, including product transition issues in Europe. The company appears to be in a precarious position, with the negative cash flow particularly troubling as it indicates the company is burning through capital while attempting to navigate multiple challenges. The Ôé�74.3 billion in net revenues demonstrates the company still has significant scale, but profitability has essentially evaporated with the AOI margin now below 1%.

Notably, the suspension of financial guidance on April 30, 2025, already signaled potential problems, but these preliminary figures confirm the severity of the situation. The company is banking on new products in H2 2025 to improve performance, but the current figures represent a significant deviation from analyst expectations, which explains the unusual preliminary release ahead of the scheduled July 29 full financial report.

Stellantis Publishes Preliminary and Unaudited Key Figures for First Half 2025

- Q2 2025 Estimated Global Consolidated Shipments of 1.4 Million Units, -

6% y-o-y

AMSTERDAM, July 21, 2025 ÔÇ� Stellantis N.V. is publishing today certain preliminary and unaudited financial information for the First Half of 2025, in addition to its global quarterly consolidated shipment estimates and commentary on related trends.

In the absence of financial guidance, which was suspended by the Company on April 30, 2025, financial analyst consensus forecasts currently constitute the primary metric for market expectations. The disclosure of the following preliminary financial data for the First Half 2025 is intended to address the difference between these analyst consensus forecasts and the CompanyÔÇÖs performance for the period.

Preliminary financial information for the First Half 2025(2):

| ╠ř | First Half 2025 |

| Estimate (ÔéČB) | |

| Net revenues | ╠ř╠ř╠ř╠ř╠ř╠ř |

| Net loss | ( |

| Adjusted operating income(3) | |

| Cash Flows from operating activities | ( |

| Industrial free cash flows(4) | ( |

The following factors had a significant impact on results in the first half of 2025:

- The early stage of actions being taken to improve performance and profitability, with new products expected to deliver larger benefits in the Second Half of 2025

- Approximately

Ôé�3.3 billion of pre-tax net charges, primarily related to program cancellation costs and platform impairments, net impact of the recent legislation eliminating the CAFE penalty rate, and restructuring, which are excluded from Adjusted Operating Income(3) consistent with the CompanyÔÇÖs definition of AOI - Adverse impacts to AOI from higher industrial costs, geographic and other mix factors, and changes in foreign exchange rates

- The early effects of US tariffs ÔÇ�

Ôé�0.3 billion of net tariffs incurred as well as loss of planned production related to implementation of the Company's response plan

Financial results for the First Half 2025 will be released as scheduled on July 29, 2025 and a call will be hosted on that day by CEO Antonio Filosa and CFO Doug Ostermann.

Global consolidated shipment volumes for the Second Quarter of 2025:

Stellantis today also publishes its consolidated shipment estimates. The term ÔÇťshipmentsÔÇ� describes the volume of vehicles delivered to dealers, distributors, or directly from the Company to retail and fleet customers, which drive revenue recognition.

Consolidated shipments for the three months ending June 30, 2025, were an estimated 1.4 million units, representing a

Refer to page 4 for an explanation of the items referenced on this page

╠ř

- In North America, Q2 shipments declined approximately 109 thousand units compared to the same period in 2024, representing a

25% y-o-y decline, due to factors including the reduced manufacture and shipments of imported vehicles, most impacted by tariffs, and lower fleet channel sales. Total sales declined10% y-o-y, with U.S. retail sales relatively flat, and with the regionÔÇÖs two largest brands, Jeep┬« and Ram, collectively delivering13% higher sales y-o-y.╠ř╠ř - Enlarged Europe Q2 shipments declined approximately 50 thousand units, representing a

6% y-o-y decline, due primarily to product transition factors. The recently-launched ÔÇťSmart CarÔÇ� platform B-segment vehicles continue to ramp up to their full production levels, and prior year comparisons are affected by the hiatus of Fiat 500 ICE pending the arrival of its mild-hybrid successor.╠ř Shipments of the four Smart Cars (Citro├źn C3 and C3 Aircross, Opel/Vauxhall Frontera and Fiat Grande Panda) increased45% sequentially in the Q2 2025 period, or 25 thousand units, compared to the Q1 2025 period. - Across StellantisÔÇ� other regions, shipments grew 71 thousand units in aggregate, representing a

22% increase y-o-y, mainly driven by a30% increase in Middle East & Africa and a20% increase in South America. In Middle East & Africa shipments were up 29 thousand units, mainly driven by increased volumes in T├╝rkiye and positive developments in Egypt, Algeria and Morocco. Stellantis continues its leadership in South America, with a 43 thousand unit y-o-y increase benefiting from higher industry volumes, especially in Argentina and Brazil.

Refer to page 4 for an explanation of the items referenced on this page

Management Conference Call:

Stellantis CFO Doug Ostermann will host a conference call to discuss the preliminary first half of 2025 financial figures, and answer analyst questions.

Time: ╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř Monday, July 21, at 8:30 a.m. EDT / 2:30 p.m. CEST

Dial-In:╠ř ╠ř╠ř╠ř╠ř╠ř Available in the Investors section of the CompanyÔÇÖs ╠ř╠ř

╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř╠ř website (www.stellantis.com)

NOTES

- Consolidated shipments only include shipments by CompanyÔÇÖs consolidated subsidiaries, which represent new vehicles invoiced to third party (dealers/importers or final customers).╠ř Consolidated shipment volumes for Q2 2025 presented here are unaudited and may be adjusted.

- Final figures will be provided in our H1 2025 Results. Analysts should interpret these numbers with the understanding that they are preliminary and subject to change.

- Adjusted Operating Income/(Loss) excludes from Net profit/(loss) adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company's ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit). Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company's ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis' core operations; facility-related costs stemming from Stellantis' plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers.╠ř

╠ř╠ř╠ř╠ř╠ř╠ř╠ř Adjusted Operating Income/(Loss) Margin is calculated as Adjusted operating income/(loss) divided by Net revenues

(4)╠ř╠ř Industrial Free Cash Flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities, (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net intercompany payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the CompanyÔÇÖs control.╠ř In addition Industrial free cash flows is one of the metrics used in the determination of the annual performance for eligible employees, including members of the Senior Management.

###

About Stellantis

Stellantis N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is a leading global automaker, dedicated to giving its customers the freedom to choose the way they move, embracing the latest technologies and creating value for all its stakeholders. Its unique portfolio of iconic and innovative brands includes Abarth, Alfa Romeo, Chrysler, Citro├źn, Dodge, DS Automobiles, FIAT, Jeep┬«, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. For more information, visit .

| ╠ř | @Stellantis | ╠ř | Stellantis | ╠ř | Stellantis | ╠ř | Stellantis | |

| ╠ř For more information, contact: [email protected] Fern├úo SILVEIRA +31 6 43 25 43 41 ÔÇ� [email protected] www.stellantis.com ╠ř ╠ř ╠ř | ╠ř | |||||||

| ╠ř | ╠ř | ╠ř | ╠ř | ╠ř | ╠ř | ╠ř | ╠ř | ╠ř |

Stellantis Forward-looking Statements

This communication contains forward-looking statements. In particular, statements regarding future events and anticipated results of operations, business strategies, the anticipated benefits of the proposed transaction, future financial and operating results, the anticipated closing date for the proposed transaction and other anticipated aspects of our operations or operating results are forward-looking statements. These statements may include terms such as ÔÇťmayÔÇ�, ÔÇťwillÔÇ�, ÔÇťexpectÔÇ�, ÔÇťcouldÔÇ�, ÔÇťshouldÔÇ�, ÔÇťintendÔÇ�, ÔÇťestimateÔÇ�, ÔÇťanticipateÔÇ�, ÔÇťbelieveÔÇ�, ÔÇťremainÔÇ�, ÔÇťon trackÔÇ�, ÔÇťdesignÔÇ�, ÔÇťtargetÔÇ�, ÔÇťobjectiveÔÇ�, ÔÇťgoalÔÇ�, ÔÇťforecastÔÇ�, ÔÇťprojectionÔÇ�, ÔÇťoutlookÔÇ�, ÔÇťprospectsÔÇ�, ÔÇťplanÔÇ�, or similar terms. Forward-looking statements are not guarantees of future performance. Rather, they are based on StellantisÔÇ� current state of knowledge, future expectations and projections about future events and are by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them.

Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the ability of Stellantis to launch new products successfully and to maintain vehicle shipment volumes; changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality; StellantisÔÇ� ability to successfully manage the industry-wide transition from internal combustion engines to full electrification; StellantisÔÇ� ability to offer innovative, attractive products and to develop, manufacture and sell vehicles with advanced features including enhanced electrification, connectivity and autonomous-driving characteristics; StellantisÔÇ� ability to produce or procure electric batteries with competitive performance, cost and at required volumes; StellantisÔÇ� ability to successfully launch new businesses and integrate acquisitions; a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in StellantisÔÇ� vehicles; exchange rate fluctuations, interest rate changes, credit risk and other market risks; increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in StellantisÔÇ� vehicles; changes in local economic and political conditions; changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations; the level of governmental economic incentives available to support the adoption of battery electric vehicles; the impact of increasingly stringent regulations regarding fuel efficiency requirements and reduced greenhouse gas and tailpipe emissions; various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits; material operating expenditures in relation to compliance with environmental, health and safety regulations; the level of competition in the automotive industry, which may increase due to consolidation and new entrants; StellantisÔÇ� ability to attract and retain experienced management and employees; exposure to shortfalls in the funding of StellantisÔÇ� defined benefit pension plans; StellantisÔÇ� ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the operations of financial services companies; StellantisÔÇ� ability to access funding to execute its business plan; StellantisÔÇ� ability to realize anticipated benefits from joint venture arrangements; disruptions arising from political, social and economic instability; risks associated with StellantisÔÇ� relationships with employees, dealers and suppliers; StellantisÔÇ� ability to maintain effective internal controls over financial reporting; developments in labor and industrial relations and developments in applicable labor laws; earthquakes or other disasters; risks and other items described in StellantisÔÇ� Annual Report on Form 20-F for the year ended December 31, 2024 and Current Reports on Form 6-K and amendments thereto filed with the SEC; and other risks and uncertainties.

Any forward-looking statements contained in this communication speak only as of the date of this document and Stellantis disclaims any obligation to update or revise publicly forward-looking statements. Further information concerning Stellantis and its businesses, including factors that could materially affect StellantisÔÇ� financial results, is included in StellantisÔÇ� reports and filings with the U.S. Securities and Exchange Commission and AFM.

Attachment