Welcome to our dedicated page for Xenon Pharmaceut SEC filings (Ticker: XENE), a comprehensive resource for investors and traders seeking official regulatory documents including 10-K annual reports, 10-Q quarterly earnings, 8-K material events, and insider trading forms.

Parsing Xenon Pharmaceuticals�� dense biotech disclosures is no small task; a single 10-K can bury crucial details on epilepsy trial progress, cash runway, and royalty obligations deep inside footnotes. If you’ve ever wondered how to locate "Xenon Pharmaceuticals insider trading Form 4 transactions" or confirm the next XEN1101 milestone payment without skimming hundreds of pages, you’re not alone.

Stock Titan solves that problem. Our AI reads every 10-K annual report, 10-Q quarterly earnings report, 8-K material event, and Form 4 insider filing the instant they hit EDGAR and delivers plain-English takeaways. Think of it as "understanding Xenon Pharmaceuticals SEC documents with AI"—R&D burn rates, Phase 3 enrollment updates, or executive stock option grants are surfaced in seconds. AG���˹ٷ�-time alerts keep you ahead when "Xenon Pharmaceuticals Form 4 insider transactions" post mid-session.

- Xenon Pharmaceuticals quarterly earnings report 10-Q filing with pipeline spend broken down

- Xenon Pharmaceuticals annual report 10-K simplified—risk factors, cash position, dilution tables

- Xenon Pharmaceuticals executive stock transactions Form 4 and related proxy statement executive compensation

- Xenon Pharmaceuticals 8-K material events explained—FDA feedback, trial pauses, public offerings

- Xenon Pharmaceuticals earnings report filing analysis powered by AI

Whether you’re tracking "Xenon Pharmaceuticals insider trading Form 4 transactions real-time" before a data readout or comparing sequential R&D spend, our platform condenses complex biotech language into actionable insights. Save hours, reduce uncertainty, and focus on what matters: the science and the numbers.

On June 30, 2025, Xenon Pharmaceuticals Inc. (XENE) filed an 8-K announcing a leadership change under Item 5.02. Chief Financial Officer Sherry Aulin resigned the same day. The Board appointed current President & CEO Ian Mortimer as interim CFO, making him the company’s principal financial and accounting officer effective immediately. No modifications were made to Mortimer’s compensation package. Required biographical and related-party information for Mr. Mortimer was previously disclosed in Xenon’s April 24, 2025 proxy statement and is incorporated by reference. No other material transactions or financial data were included in the filing.

The dual CEO/CFO role is intended to be temporary, but the company did not specify the duration of the interim arrangement or outline a search process for a permanent CFO.

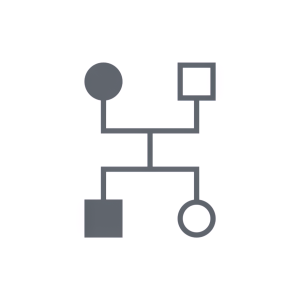

Xenon Pharmaceuticals Inc. (XENE) filed a Form 4 disclosing an equity-based compensation grant to Darren S. Cline, the company’s Chief Commercial Officer. The filing reports that on 23 June 2025 Cline received a stock option to purchase 185,800 common shares at an exercise price of $31.49 per share.

The option vests 25 % on 23 June 2026, with the remaining 75 % vesting in equal monthly installments over the following three years; the option expires on 22 June 2035. The transaction is coded “A�� (grant/acquisition), indicating the award was granted by the issuer rather than purchased on the open market. Following the grant, the executive beneficially owns 185,800 derivative securities; no changes were reported for non-derivative holdings.

This filing represents a routine incentive award designed to align executive interests with shareholders over a long-term horizon. It does not include any sale of shares or indicate changes to the company’s capital structure.

Form 3 overview: On 25 June 2025, Xenon Pharmaceuticals Inc. (XENE) filed an Initial Statement of Beneficial Ownership (Form 3) on behalf of newly disclosed officer Darren S. Cline, Chief Commercial Officer. The filing reports the event date as 23 June 2025 and confirms Mr. Cline’s Section 16 insider status.

Key disclosure: Both Table I (non-derivative holdings) and Table II (derivative holdings) state "No securities are beneficially owned,�� meaning Mr. Cline presently holds zero shares or options of Xenon. No amendments, joint filings, or indirect ownership structures are noted. The document is therefore a procedural compliance filing rather than a transaction or compensation event and contains no financial metrics, option grants, or purchase details.

For investors, the absence of insider ownership could be interpreted as a lack of immediate equity alignment, but the filing primarily signals timely regulatory compliance following Mr. Cline’s appointment.