Avino Acquires Outstanding Royalties and Contingent Payments On La Preciosa, Achieving 100% Ownership and Lowering Operating Cost Profile

Avino Silver & Gold Mines (NYSE:ASM) has acquired complete ownership of its La Preciosa project by purchasing all outstanding royalties and contingent payment obligations from Deterra Royalties Limited for $22 million. The transaction includes a $13.25 million upfront payment and an $8.75 million deferred payment due in one year.

The acquisition eliminates a 1.25% net smelter returns royalty on the Gloria and Abundancia areas and a 2.00% gross value returns royalty on other areas of La Preciosa. The company funded the upfront payment from its $48 million cash reserves. La Preciosa, one of Mexico's largest undeveloped silver resources, is expected to commence production by late 2025.

Development progress includes the construction of a 360-meter San Fernando main access decline, with ongoing drilling operations planned through October 2025.

Avino Silver & Gold Mines (NYSE:ASM) ha acquistato la proprietà integrale del progetto La Preciosa, comprando da Deterra Royalties Limited tutte le royalties e le obbligazioni a pagamento condizionato per un importo totale di 22 milioni di dollari. L’operazione prevede un pagamento iniziale di 13,25 milioni di dollari e un pagamento differito di 8,75 milioni di dollari a scadenza tra un anno.

L’acquisizione elimina una royalty del 1,25% sui ricavi netti da fusione sulle aree Gloria e Abundancia e una royalty del 2,00% sul valore lordo su altre aree di La Preciosa. La società ha finanziato il pagamento iniziale con le sue riserve di cassa pari a 48 milioni di dollari. La Preciosa, una delle più grandi risorse d’argento non sviluppate del Messico, dovrebbe entrare in produzione entro la fine del 2025.

I lavori di sviluppo includono la costruzione di una galleria di accesso principale San Fernando lunga 360 metri, con attività di perforazione che proseguiranno fino a ottobre 2025.

Avino Silver & Gold Mines (NYSE:ASM) ha adquirido la propiedad total de su proyecto La Preciosa al comprar todas las regalías y obligaciones de pago contingentes pendientes de Deterra Royalties Limited por 22 millones de dólares. La operación incluye un pago inicial de 13,25 millones de dólares y un pago diferido de 8,75 millones de dólares con vencimiento en un año.

La adquisición elimina una regalía del 1,25% sobre el rendimiento neto de fundición en las zonas Gloria y Abundancia y una regalía del 2,00% sobre el valor bruto en otras áreas de La Preciosa. La compañía financió el pago inicial con sus reservas de caja de 48 millones de dólares. La Preciosa, uno de los mayores recursos de plata sin desarrollar en México, se espera que comience la producción a finales de 2025.

El avance en el desarrollo incluye la construcción de una galería de acceso principal San Fernando de 360 metros, con perforaciones en curso programadas hasta octubre de 2025.

Avino Silver & Gold Mines (NYSE:ASM)�� Deterra Royalties Limited로부�� 남아 있던 모든 로열티와 조건부 지�� 의무�� 매입하여 La Preciosa 프로젝트�� 완전�� 소유권을 확보했습니다. 거래 금액은 2,200�� 달러이며, 1,325�� 달러�� 선지���� 1�� �� 만기�� 875�� 달러�� 이연 지���� 포함합니��.

이번 인수�� Gloria �� Abundancia 지역에 대�� 1.25% �� 제련수익 로열��와 La Preciosa�� 다른 지역에 대�� 2.00% 총가�� 로열��가 제거됩니��. 회사�� 4,800�� 달러�� 현금 보유��에서 선지급금�� 충당했습니다. La Preciosa�� 멕시코에�� 가�� �� 미개�� 은 매장�� �� 하나��, 2025�� ��까지 생산�� 시작�� 것으�� 예상됩니��.

개발 진행 상황으로�� 360미터 길이�� San Fernando �� 통로 갱도 건설�� 포함되어 있으�� 시추 작업은 2025�� 10월까지 계속�� 예정입니��.

Avino Silver & Gold Mines (NYSE:ASM) a acquis la pleine propriété de son projet La Preciosa en rachetant à Deterra Royalties Limited toutes les redevances et obligations de paiement conditionnel restantes pour un montant de 22 millions de dollars. La transaction comprend un paiement initial de 13,25 millions de dollars et un paiement différé de 8,75 millions de dollars exigible dans un an.

Cette acquisition supprime une redevance de 1,25 % sur le rendement net de fusion pour les zones Gloria et Abundancia et une redevance de 2,00 % sur la valeur brute pour d’autres zones de La Preciosa. La société a financé le paiement initial à partir de ses réserves de trésorerie de 48 millions de dollars. La Preciosa, l’une des plus grandes ressources d’argent non développées du Mexique, devrait entrer en production d’ici la fin 2025.

Les travaux de développement incluent la construction d’une rive d’accès principale San Fernando de 360 mètres, avec des opérations de forage prévues jusqu’en octobre 2025.

Avino Silver & Gold Mines (NYSE:ASM) hat die vollständige Eigentümerschaft an seinem La Preciosa-Projekt erworben, indem es alle ausstehenden Royalties und bedingten Zahlungsverpflichtungen von Deterra Royalties Limited für 22 Millionen US-Dollar übernommen hat. Die Transaktion umfasst eine sofortige Zahlung von 13,25 Millionen US-Dollar und eine aufgeschobene Zahlung von 8,75 Millionen US-Dollar, fällig in einem Jahr.

Durch die Akquisition entfällt eine 1,25% Net Smelter Returns-Royalty auf die Bereiche Gloria und Abundancia sowie eine 2,00% Gross Value Returns-Royalty auf andere Bereiche von La Preciosa. Das Unternehmen finanzierte die Anzahlung aus seinen Barreserven von 48 Millionen US-Dollar. La Preciosa, eine der größten unerschlossenen Silberlagerstätten Mexikos, soll voraussichtlich bis Ende 2025 in Produktion gehen.

Der Entwicklungsfortschritt umfasst den Bau eines 360 Meter langen San Fernando Hauptstollens, und Bohrarbeiten sind bis Oktober 2025 geplant.

- Acquisition provides 100% ownership and control of La Preciosa project

- Elimination of royalty burden will lower operating costs and improve project economics

- Transaction is accretive to shareholders on NAV per share basis

- Company has strong balance sheet with $48M cash reserves

- Production expected to commence by late 2025

- Development and drilling operations progressing on schedule

- Significant immediate cash outlay of $13.25M reduces company liquidity

- Additional $8.75M payment obligation due within one year

- Project still in development phase with associated construction and execution risks

Insights

Avino's $22M royalty acquisition eliminates future payment obligations on La Preciosa, significantly improving project economics before production begins.

Avino's

The transaction's timing is particularly shrewd - executed just before production begins (expected late 2025), maximizing the NPV benefit of eliminated royalties while leveraging the company's strong

This financial restructuring improves La Preciosa's unit economics by removing royalties that would have permanently increased effective operating costs. For a substantial silver resource in Mexico approaching production, these margin improvements compound significantly over the project's life. Management's characterization of the deal as NAV-accretive appears justified - royalty buybacks typically create value when executed by operators with intimate project knowledge and accurate production forecasts.

The company's strong cash position (

VANCOUVER, BC / / August 25, 2025 / Avino Silver & Gold Mines Ltd. (TSX:ASM)(NYSE American:ASM)(FSE:GV6) ("Avino" or the "Company"), a long-standing silver producer in Mexico, is pleased to announce that the Company has acquired

Highlights of this transaction:

Restores full value and control of La Preciosa

Optimizes financial structure

Enhances project economics

Reduces administrative burdens

Manageable impact on financial liquidity

"Avino has seized upon a unique opportunity to buy back all the royalties on La Preciosa" said David Wolfin, President and CEO. "This cornerstone asset is now materially unencumbered, and this transaction represents a unique investment opportunity for Avino, as operators rarely get the chance to increase project value through the purchase of previously-granted royalties. By eliminating the royalty burden immediately prior to commencing production, we believe we will generate meaningful returns on our investment by lowering La Preciosa's operating cost profile, and ensuring that as much of La Preciosa's value remains with the operator and its stakeholders. The incremental cash outlay of only US

The La Preciosa Obligations are comprised of:

a cash payment of US

$8.75 million , to be paid no later than 12 months after initial production at La Preciosa (the "Contingent Production Payment");a

1.25% net smelter returns royalty on the Gloria and Abundancia areas of La Preciosa, and a2.00% gross value returns royalty on all other areas of La Preciosa; anda payment of US

$0.25 per silver equivalent ounce (subject to inflationary adjustment) of new mineral reserves (as defined by NI 43-101) discovered and declared outside of the current mineral resource area at La Preciosa, subject to a cap of US$50 million , with any such payments to be credited against any existing or future payments owing on the gross value returns royalty.

Background to the Transaction

The La Preciosa Obligations were initially issued to Coeur Mining, Inc. ("Coeur") in connection with the acquisition of La Preciosa by Avino in March 2022. Details of the Company's acquisition of La Preciosa are available on the Company's website . Following the acquisition, Coeur sold the La Preciosa Obligations to Trident Royalties Plc ("Trident") in May 2023, with Deterra subsequently acquiring the La Preciosa Obligations by way of its acquisition of Trident in September 2024.

Transaction Consideration

Avino acquired the La Preciosa Obligations from Deterra for immediate cash consideration of US

Transaction Rationale

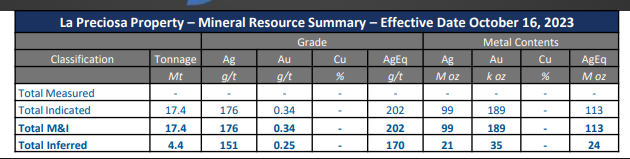

Avino has made excellent progress advancing La Preciosa with first production expected by the end of 2025 and significant production growth expected in the years thereafter which will see La Preciosa become a cornerstone asset for the Company. La Preciosa is one of the largest undeveloped silver resources in Mexico (see current NI 43-101 Resource Estimate below)located adjacent to Avino's existing mine and infrastructure. Eliminating the

Notes:

The stated mineral resources are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's "CIM Definition Standards - For Mineral Resources and Mineral Reserves" and are more particularly described in the Company's February 5, 2024 Prefeasiblity Study, available under the Company's profile at www.sedarplus.ca.

Mineral resources for La Preciosa are estimated at a cut-off grade of 120 g/t AgEq.

Mineral resources for La Preciosa are estimated using a long-term silver price of US

Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Tonnage and metal content figures are expressed in thousands and may not add up due to rounding.

La Preciosa Development Update

As seen in our latest press release dated , blasting and construction of the relatively short 360 meter San Fernando main access decline is underway, and equipment mobilization has been swift, allowing development to advance on plan. The new jumbo drill is working on this ramp as it progresses toward intercepting the Gloria and Abundancia veins. Recent photos showcasing the work at La Preciosa are available on the Avino website - click to view them.

A surface drill has been deployed to La Preciosa and drilling is expected to continue until the end of October. The drilling information will be utilized in underground mine planning and 3D modelling. The Company is also planning to update the current mineral resource estimate for Avino and La Preciosa was well as releasing its first mineral reserve estimate at the same time as the Company has now met the requirements for a Producing Issuer under the NI 43-101 standards of disclosure for mineral projects.

A more comprehensive drilling update will be released in the coming weeks.

Qualified Person(s)

Peter Latta, P.Eng., MBA, Avino's VP Technical Services, is a qualified person within the context of National Instrument 43-101, has reviewed and approved the technical data in this news release.

About Avino

Avino is a silver producer from its wholly owned Avino Mine near Durango, Mexico. The Company's silver, gold and copper production remains unhedged. The Company intends to maintain long term sustainable and profitable mining operations to reward shareholders and the community alike through our growth at the historic Avino Property and the strategic acquisition of the adjacent La Preciosa which was finalized in Q1 2022. Avino has a large silver equivalent resource base with consolidated mineral resources of 277 million AgEq ounces in the measured and indicated mineral resource category and 94 million AgEq ounces in the inferred mineral resource category. Early in 2024, the pre-feasibility Study on the Oxide Tailings Project was completed. This study represents a key milestone in our growth trajectory. As part of Avino's commitment to adopting sustainable practices, we have been operating a dry-stack tailings facility for more than two years with excellent results. We are committed to managing all business activities in a safe, environmentally responsible, and cost-effective manner, while contributing to the well-being of the communities in which we operate. We encourage you to connect with us on X (formerly Twitter) at and on LinkedIn at . To view the Avino Mine VRIFY tour, please click .

For Further Information, Please Contact:

Investor Relations

Tel: 604-682-3701

Email: [email protected]

This news release contains "forward-looking information" and "forward-looking statements" (together, the "forward looking statements") within the meaning of applicable securities laws and the United States Private Securities Litigation Reform Act of 1995. This information and these statements, referred to herein as "forward-looking statements" are made as of the date of this document. Forward-looking statements relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events and include, but are not limited to, statements with respect to the Company's payment of US

Cautionary note to U.S. Investors concerning estimates of Mineral Reserves and Mineral Resources

All reserve and resource estimates reported by Avino were estimated in accordance with the Canadian National Instrument 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards. The U.S. Securities and Exchange Commission ("SEC") now recognizes estimates of "measured mineral resources," "indicated mineral resources" and "inferred mineral resources" and uses new definitions of "proven mineral reserves" and "probable mineral reserves" that are substantially similar to the corresponding CIM Definition Standards. However, the CIM Definition Standards differ from the requirements applicable to US domestic issuers. US investors are cautioned not to assume that any "measured mineral resources," "indicated mineral resources," or "inferred mineral resources" that the Issuer reports are or will be economically or legally mineable. Further, "inferred mineral resources" are that part of a mineral resource for which quantity and grade are estimated on the basis of limited geologic evidence and sampling. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Avino Silver & Gold Mines Ltd.

View the original on ACCESS Newswire