Wudinna Testwork Indicates Gold Recoveries of up to 99.3%

Barton Gold Holdings (OTCQB:BGDFF) has announced promising metallurgical testwork results from its Wudinna Gold Project in South Australia. The tests revealed exceptional gold recoveries of up to 99.3% using conventional gravity and leaching processes. At the Barns Deposit, approximately 90% of contained gold can be concentrated to grades of 20-25 g/t Au through efficient flotation, with overall recoveries of 97-99%. The Baggy Green Deposit showed gold recoveries of 91% in the supergene zone and 98-99% in the primary zone.

The company is exploring options to leverage its existing Central Gawler Mill and future Tunkillia mill infrastructure by trucking high-grade concentrates. At current gold prices, the concentrate would have a contained value of over AUD $4,000 per tonne, making transportation economically viable.

Barton Gold Holdings (OTCQB:BGDFF) ha annunciato risultati metallurgici promettenti dal suo Wudinna Gold Project in Australia Meridionale. I test hanno mostrato recuperi d'oro eccezionali fino al 99,3% utilizzando processi convenzionali di gravità e lisciviazione. Al Barns Deposit circa il 90% dell'oro contenuto può essere concentrato a tenori di 20-25 g/t Au tramite flottazione efficiente, con recuperi complessivi del 97-99%. Il Baggy Green Deposit ha evidenziato recuperi d'oro del 91% nella zona supergene e del 98-99% nella zona primaria.

L'azienda sta valutando opzioni per sfruttare il proprio Central Gawler Mill esistente e la futura infrastruttura del Tunkillia mill trasportando su strada concentrati ad alto tenore. Ai prezzi attuali dell'oro, il concentrato avrebbe un valore contenuto superiore a AUD $4,000 per tonne, rendendo il trasporto economicamente fattibile.

Barton Gold Holdings (OTCQB:BGDFF) ha anunciado resultados metalúrgicos prometedores de su proyecto Wudinna Gold en el sur de Australia. Las pruebas mostraron recuperaciones de oro excepcionales de hasta el 99,3% usando procesos convencionales de gravedad y lixiviación. En el Barns Deposit aproximadamente el 90% del oro contenido puede concentrarse a leyes de 20-25 g/t Au mediante flotación eficiente, con recuperaciones totales del 97-99%. El Baggy Green Deposit mostró recuperaciones de oro del 91% en la zona supergénica y del 98-99% en la zona primaria.

La compañÃa está estudiando opciones para aprovechar su molino Central Gawler existente y la futura planta de Tunkillia transportando por carretera concentrados de alto grado. A los precios actuales del oro, el concentrado tendrÃa un valor contenido de más de AUD $4,000 por tonne, lo que hace que el transporte sea económicamente viable.

Barton Gold Holdings (OTCQB:BGDFF)ë� ë¨í¸ì£� Wudinna ê¸� íë¡ì í¸ì� ì ë§í� ì ë ¨(ê´ì°) ìí ê²°ê³¼ë¥� ë°ííìµëë¤. ìí ê²°ê³¼, ì¤ë ¥ ë°� 침ì¶ì� 기존 ê³µì ì� ì¬ì©í� ìµë 99.3%ì� ë°ì´ë� ê¸� íìì¨ì ë³´ììµëë�. Barns Depositììë� í¨ì ê¸ì ì� 90%ë¥� í¨ì¨ì ì¸ ë¶ì ì ë³ë¡ 20â�25 g/t Auì� íìë¡� ëì¶í� ì� ìì¼ë©�, ì ì²´ íìì¨ì 97â�99%ì ëë�. Baggy Green Depositë� ìë¶ ííëìì 91%, ììë(ìê´)ìì 98â�99%ì� ê¸� íìì¨ì ëíëìµëë¤.

íì¬ë� ê³ íì� ëì¶ë¬¼ì í¸ëì¼ë¡ ì´ì¡í� 기존ì� Central Gawler ë° ë°� í¥í Tunkillia ë° ì¸íë¼ë¥¼ íì©íë ë°©ìì� ê²í� ì¤ì ëë¤. í� ê¸� ìì¸ ê¸°ì¤ì¼ë¡ ëì¶ë¬¼ì í¨ì ê°ì¹ë AUD $4,000 per tonneë¥� ì´ê³¼í� ì´ì¡ì� ê²½ì ì ì¼ë¡� íë¹í©ëë¤.

Barton Gold Holdings (OTCQB:BGDFF) a annoncé des résultats métallurgiques prometteurs pour son projet Wudinna Gold en Australie-Méridionale. Les tests ont révélé des récupérations d'or exceptionnelles allant jusqu'à 99,3% en utilisant des procédés conventionnels de gravité et de lixiviation. Au Barns Deposit, environ 90% de l'or contenu peut être concentré à des teneurs de 20â�25 g/t Au par flottation efficace, avec des récupérations globales de 97â�99%. Le Baggy Green Deposit a montré des récupérations d'or de 91% en zone supergène et de 98â�99% en zone primaire.

La société étudie des options pour tirer parti de sa Central Gawler Mill existante et de la future usine de Tunkillia en transportant par camion des concentrés à haute teneur. Aux cours actuels de l'or, le concentré aurait une valeur contenue supérieure à AUD $4,000 per tonne, rendant le transport économiquement viable.

Barton Gold Holdings (OTCQB:BGDFF) hat vielversprechende metallurgische Testergebnisse aus seinem Wudinna Gold Project in Südaustralien bekannt gegeben. Die Tests zeigten auÃergewöhnliche Goldrückgewinnungen von bis zu 99,3% unter Verwendung konventioneller Schwerkraft- und Auslaugungsprozesse. Im Barns Deposit können etwa 90% des enthaltenen Goldes mittels effizienter Flotation auf Gehalte von 20â�25 g/t Au konzentriert werden, mit Gesamtgewinnungsraten von 97â�99%. Das Baggy Green Deposit ergab Goldrückgewinnungen von 91% in der Supergenzone und 98â�99% in der Primärzone.

Das Unternehmen prüft Optionen, vorhandene Central Gawler Mill- und die zukünftige Tunkillia-Mill-Infrastruktur zu nutzen, indem hochgradige Konzentrate per Lkw transportiert werden. Bei den aktuellen Goldpreisen hätte das Konzentrat einen enthaltenen Wert von über AUD $4,000 per tonne, was den Transport wirtschaftlich sinnvoll macht.

- None.

- Transportation costs and logistics required for concentrate trucking

- Project requires integration with existing or future mill infrastructure

Potential to truck high-grade concentrate for blending at CGM, Tunkillia

HIGHLIGHTS

Preliminary Wudinna metallurgical testwork indicates significant regional optionality, where:

Barns Deposit:

efficient flotation of ~

90% of contained gold to concentrates grading 20 - 25 g/t Au; andgold recoveries of ~97 -

99% in all zones via a conventional gravity + leaching flowsheet;

Baggy Green Deposit:

gold recoveries of ~

91% in the supergene zone via the same conventional flowsheet; andgold recoveries of ~98 -

99% in the primary zone via the same conventional flowsheet.

Potential to truck high-grade concentrates to Central Gawler Mill and/or Tunkillia, leveraging current and future processing infrastructure for lower costs and enhanced returns

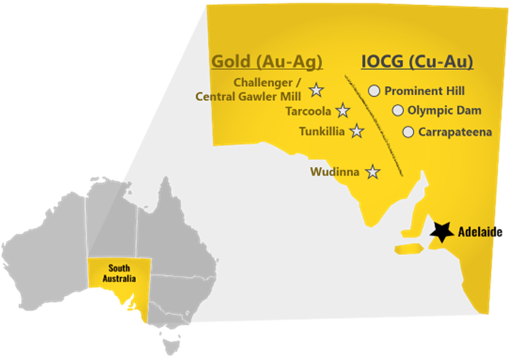

ADELAIDE, AU / / September 9, 2025 / Barton Gold Holdings Limited (ASX:BGD)(OTCQB:BGDFF)(FRA:BGD3) ( Barton or Company ) is pleased to provide an update on its review of strategic options for its new South Australian Wudinna Gold Project ( Wudinna ). Wudinna is located ~400km southeast of Barton's Challenger Gold Project ( Challenger ) which hosts the Central Gawler Mill ( CGM ), and ~200km southeast of Barton's Tunkillia Gold Project ( Tunkillia ) and future Tunkillia mill.

Metallurgical testwork for Wudinna suggests opportunities to leverage the installed capital of the CGM or future Tunkillia mill. Flotation testwork indicates the ability to concentrate ~

The ability to leverage the installed capital value of the Company's existing and future processing infrastructure through regional blending strategies is highly attractive and was a key factor in Barton's acquisition of Wudinna.

Full details are contained in the complete announcement, which can be accessed on the ASX website, the investor section of Barton's website, or directly by clicking .

Commenting on the Wudinna metallurgical analyses, Barton Managing Director Alex Scanlon said :

"Tunkillia's May 2025 OSS demonstrates not only the financial and capital leverage available to large-scale processing, but also the considerable 'economic torque' to marginal grade available to such infrastructure. Tunkillia's 'Starter Pit', grading approximately 1.2 g/t Au, is modelled to produce over 200koz gold at a cash cost of less than AUD

"The opportunity to blend high-grade concentrates into our future Tunkillia processing infrastructure is therefore very attractive, with the potential to extend these 'Starter Pit' style returns over a longer operating horizon at Tunkillia.

"At current gold prices, such a concentrate would have a contained value of over AUD

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.2Moz Au & 3.1Moz Ag JORC Mineral Resources (79.9Mt @ 0.87g/t Au), brownfield mines, and

Challenger Gold Project

Tarcoola Gold Project

Tunkillia Gold Project

Wudinna Gold Project

|  |

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy ( AusIMM ), Australian Institute of Geoscientists ( AIG ) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 ( JORC ).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (above 215mRL) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource (below 90mRL) | Mr Dale Sims | AusIMM / AIG | Fellow / Member |

Wudinna Mineral Resource (Clarke Deposit) | Ms Justine Tracey | AusIMM | Member |

Wudinna Mineral Resource (all other Deposits) | Mrs Christine Standing | AusIMM / AIG | Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at or on the ASX website . The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

1 Refer to ASX announcement dated 5 May 2025

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 8 September 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,186koz Au (40.2Mt @ 0.92 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original on ACCESS Newswire