Liberty Gold Reports Strong Phase 5A Column Leach Metallurgical Results at Black Pine, Confirming Consistent Oxide Gold Recoveries Across Newly Tested Zones

Liberty Gold (OTCQX: LGDTF) reported strong metallurgical test results from its Phase 5A program at the Black Pine Oxide Gold Project in Idaho. The tests achieved a weighted average gold extraction of 80.6% from 24 column leach tests, with individual composites reaching up to 90.8%. The results demonstrated consistent recoveries across multiple zones including previously untested areas.

Key findings include strong correlation between bottle roll (78.9%) and column leach (80.6%) data, supporting a simple run-of-mine heap leach processing strategy. The company is conducting additional metallurgical programs, with Phase 5B results expected in Q3 2025, Phase 7 in Q4 2025, and Phases 6 and 8 in early H1 2026. These studies will support the feasibility study targeted for completion in Q4 2026.

Liberty Gold (OTCQX: LGDTF) ha comunicato solidi risultati metallurgici dal programma Fase 5A presso il progetto Black Pine Oxide Gold in Idaho. I test hanno ottenuto un recupero d'oro medio ponderato dell'80,6% su 24 prove in colonna, con alcuni compositi che hanno raggiunto fino al 90,8%. I risultati mostrano recuperi costanti in più zone, comprese aree non precedentemente testate.

I punti chiave includono una forte correlazione tra i test bottle roll (78,9%) e quelli in colonna (80,6%), a supporto di una semplice strategia di trattamento heap leach su materiale run-of-mine. La società sta svolgendo programmi metallurgici aggiuntivi: i risultati della Fase 5B sono attesi nel terzo trimestre 2025, quelli della Fase 7 nel quarto trimestre 2025 e le Fasi 6 e 8 nella prima metà del 2026. Questi studi sosterranno lo studio di fattibilità previsto per il completamento nel quarto trimestre 2026.

Liberty Gold (OTCQX: LGDTF) informó sólidos resultados metalúrgicos del programa Fase 5A en el proyecto Black Pine Oxide Gold en Idaho. Las pruebas alcanzaron una extracción de oro media ponderada del 80,6% en 24 ensayos de lixiviación en columna, con algunos compuestos llegando hasta el 90,8%. Los resultados mostraron recuperaciones consistentes en varias zonas, incluidas áreas no probadas previamente.

Los hallazgos clave incluyen una fuerte correlación entre los datos de bottle roll (78,9%) y de lixiviación en columna (80,6%), lo que respalda una estrategia simple de procesamiento heap leach sobre mineral run-of-mine. La compañía está llevando a cabo programas metalúrgicos adicionales: se esperan los resultados de la Fase 5B en el tercer trimestre de 2025, de la Fase 7 en el cuarto trimestre de 2025 y de las Fases 6 y 8 a principios del primer semestre de 2026. Estos estudios respaldarán el estudio de viabilidad previsto para completarse en el cuarto trimestre de 2026.

Liberty Gold (OTCQX: LGDTF)�� 아이다호�� Black Pine Oxide Gold 프로젝트에서 진행�� 5A단계 시험�� 우수�� 야금학적 결과�� 발표했습니다. 24개의 컬럼 침출 시험에서 가�� 평균 �� 회수�� 80.6%�� 달성했으��, 개별 시료�� 최대 90.8%�� 이르렀습니��. 결과�� 이전�� 테스트되지 않았�� 구간�� 포함�� 여러 지점에�� 일관�� 회수율을 보였습니��.

주요 결과로는 bottle roll(78.9%)�� 컬럼 침출(80.6%) 데이�� �� 높은 상관관계가 확인되어, 원광(run-of-mine)�� 이용�� 단순�� heap leach 처리 전략�� 뒷받침합니다. 회사�� 추가 야금�� 프로그램�� 진행 중이��, 5B 단계 결과�� 2025�� 3분기, 7단계�� 2025�� 4분기, 6·8단계�� 2026�� 상반�� 초에 발표�� 예정입니��. 이들 연구�� 2026�� 4분기 완료�� 목표�� 하는 타당성 조사�� 기여�� 것입니다.

Liberty Gold (OTCQX: LGDTF) a publié de solides résultats métallurgiques issus de son programme Phase 5A au projet Black Pine Oxide Gold dans l'Idaho. Les essais ont obtenu une récupération aurifère moyenne pondérée de 80,6% sur 24 essais de lixiviation en colonne, certains composites atteignant jusqu'à 90,8%. Les résultats ont montré des récupérations constantes sur plusieurs zones, y compris des secteurs jusque-là non testés.

Les conclusions clés incluent une forte corrélation entre les données bottle roll (78,9%) et la lixiviation en colonne (80,6%), soutenant une stratégie de traitement simple par heap leach en run-of-mine. La société mène des programmes métallurgiques supplémentaires : les résultats de la Phase 5B sont attendus au T3 2025, la Phase 7 au T4 2025 et les Phases 6 et 8 au début du premier semestre 2026. Ces études appuieront l'étude de faisabilité prévue pour achèvement au T4 2026.

Liberty Gold (OTCQX: LGDTF) meldete starke metallurgische Testergebnisse aus dem Phase-5A-Programm des Black Pine Oxide Gold-Projekts in Idaho. Die Tests erzielten eine gewichtete mittlere Goldausbeute von 80,6% aus 24 Säulenauslaugungstests, wobei einzelne Verbundproben bis zu 90,8% erreichten. Die Ergebnisse zeigten konsistente Rückgewinnungsraten über mehrere Zonen, einschließlich zuvor nicht getesteter Bereiche.

Wesentliche Erkenntnisse sind die starke Korrelation zwischen Bottle-Roll-Daten (78,9%) und Säulenauslaugung (80,6%), was eine einfache Run-of-Mine-Heap-Leach-Verarbeitungsstrategie stützt. Das Unternehmen führt weitere metallurgische Programme durch: Ergebnisse von Phase 5B werden im Q3 2025 erwartet, Phase 7 im Q4 2025 und die Phasen 6 und 8 Anfang H1 2026. Diese Studien werden die auf Q4 2026 angepeilte Machbarkeitsstudie unterstützen.

- Strong weighted average gold extraction of 80.6% with peaks of 90.8%

- Consistent metallurgical performance across multiple zones including previously untested areas

- Over 80% of gold extraction achieved in under 10 days

- Strong correlation between bottle roll and column leach results validates process predictability

- Additional silver recovery potential with extractions ranging from 13.7% to 72.3%

- Feasibility study completion not expected until Q4 2026

- Some zones like F Zone showed lower recovery rates (67.3%) compared to other areas

VANCOUVER, British Columbia, Aug. 19, 2025 (GLOBE NEWSWIRE) -- Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold�� or the “Company��) is pleased to report results from its Phase 5A metallurgical program at the Company’s Black Pine Oxide Gold Project (“Black Pine��) in southeast Idaho. The new results confirm consistent, robust gold recoveries across previously untested areas, supporting the feasibility development of a run-of-mine (“ROM��) heap leach processing flowsheet at Black Pine.

Highlights

- Consistent Gold Extractions and Leach Performance: Weighted average column leach gold extraction of

80.6% , with individual composites reaching up to90.8% , demonstrating metallurgical continuity across multiple mineralized zones; all of the Phase 5A composites tested exhibit the typical Black Pine leach result of greater than80% of the eventual gold extraction achieved in under 10 days. - Corroborated Bottle Roll Data: Gold and silver extractions from coarse crush bottle roll tests strongly correlate with column leach results,

78.9% vs80.6% , respectively, in line with previous metallurgical results. - De-risking Project Development: Phase 5A column tests reinforce the suitability of ROM heap leach processing and provide key inputs into the ongoing feasibility study metallurgical model.

- Expanded Metallurgical Coverage: Phase 5A testing included composites from Back Range and J Zone, areas not previously tested and variability composites infilling previous sampling in the M Zone, Tallman and F zones.

- Ongoing Programs: Phase 5B (additional variability infill composites) results are expected in Q3, 2025, Phase 7 (cut-off-grade (“COG��) composites) results expected in Q4, 2025 and Phase 6 (bulk samples) and Phase 8 (legacy heap facility (“HLF��) sonic drilling composites) expected in early H1, 2026.

Jon Gilligan, President and CEO, Liberty Gold, commented, ��These results further demonstrate that Black Pine’s oxide gold mineralization is highly amenable to ROM heap leaching, including areas outside the main deposit zones. As we advance toward the completion of our feasibility study, this growing metallurgical dataset will help optimize processing parameters, underpin robust project economics, and reduce technical risk.��

Phase 5A Metallurgical Test Summary

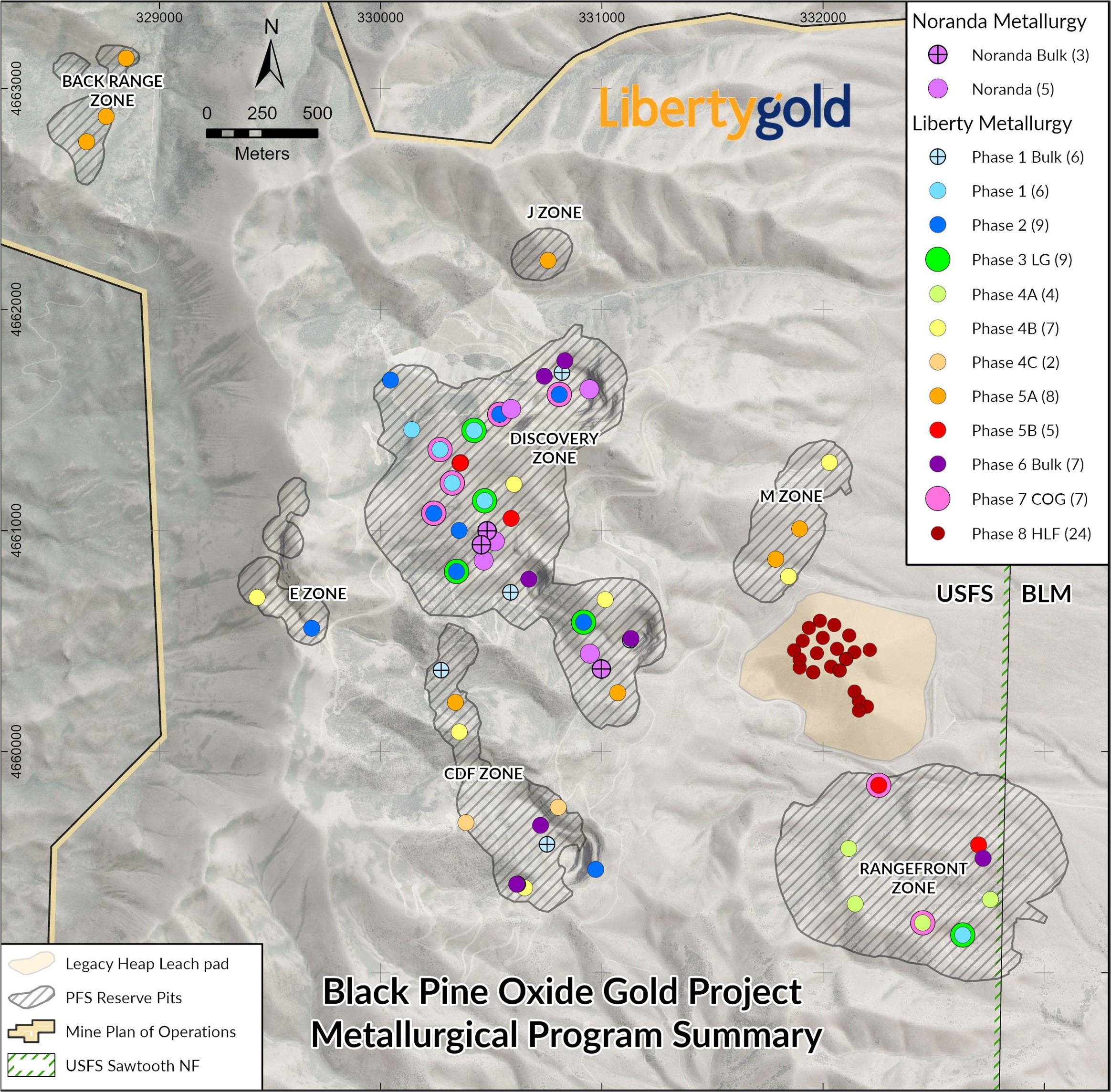

The Phase 5A program was designed to expand the metallurgical dataset into areas not previously tested and fill gaps in the main deposit areas, confirming consistency of recoveries across the broader mineralized footprint. See Figure 1 below for Phase 5A variability composite metallurgical drill core locations. Metallurgical composites were made from PQ sized core drilled in 2023. A total of 24 column leach tests were completed under standard test conditions for Black Pine oxide gold mineralized material, with results summarized below in Table 1.

Figure 1 �� Summary map of Black Pine Metallurgical Program Sample Locations

Table 1 �� Weighted Average Gold Extraction Results by Zone �� Coarse Bottle Roll and Column Leach Tests

| Zone | Average Calculated Head Grade Au (ppm) | Weighted Average Bottle Roll Gold Recovery (%) P80 | Weighted Average Column Leach Gold Recovery (%) P80 |

| Back Range Zone | 1.68 | ||

| J Zone | 0.59 | ||

| Tallman Zone | 0.63 | ||

| M Zone | 0.58 | ||

| F Zone | 0.42 | ||

| All Zones | �� | 78.9% | 80.6% |

Notes: Average Calculated Head Grade is the average of the composite column head grades tested within each zone. Detailed sample-level results are provided in Table 2 below.

Silver

Column leach tests also showed silver (“Ag��) extractions ranging from

Interpretation

- Phase 5A gold extractions are in line with previous metallurgical testing across the main mineralized zones.

- The strong correlation between bottle roll and column leach data validates process predictability and supports a simple, low-cost ROM leach processing flowsheet for Black Pine oxide ores.

- These results further de-risk the processing strategy ahead of the feasibility study.

Ongoing Metallurgical Program

Liberty Gold has an active feasibility-level metallurgical program:

- Phase 5B: Twenty-one “infill�� variability composites from Rangefront and Discovery Zone have completed column leaching and final results are expected in Q3, 2025.

- Phase 6: Seven (Six in-pit and one surface) 20 tonne ROM surface bulk samples sourced from the main mineralized lithology types, will be tested in Pilot-Scale columns (4 feet diameter x 20 feet high) at Kappes, Cassiday & Associates (“KCA��) in Reno. Three bulk samples are currently under leach and the remaining four are in sample collection and preparation. Results are expected in H1 2026.

- Phase 7: Nine cut-off grade variability composites currently under column leach.

- Phase 8: 24 sonic drill holes (~1,400 meters) have been completed in the legacy heap leach pad, with initial gold assays received. Metallurgical studies and composites are currently being planned. It is expected that test work will commence in late Q3, 2025. This material will be tested for the potential to act as over-liner material and also as direct leach feed.

These programs are designed to finalize gold leach recoveries and optimize process design criteria as inputs to the Feasibility Study targeted for completion in Q4, 2026.

Quality Assurance �� Quality Control

All metallurgical work at Black Pine was conducted at KCA Labs in Reno and is supervised by Gary Simmons, MMSA, formerly Director of Metallurgy and Technology for Newmont Mining Corp. Mr. Simmons has managed metallurgical programs on multiple Carlin-style oxide deposits in the Great Basin.

Peter Shabestari, P.Geo., Vice President Exploration, Liberty Gold, is the Qualified Person responsible for reviewing and approving the technical content of this release.

Table 2 �� Phase 5A Gold Extraction Results

| Sample ID | Test Area | Bottle Roll % Extraction | Calculated Head Grade Au (ppm) | Column Leach % Au Ext | Calculated Head Grade Au (ppm) |

| 98104 B | Backrange | 66.6 | 0.433 | 64.3 | 0.412 |

| 98105 A | Backrange | 83.9 | 2.143 | 85.5 | 2.107 |

| 98106 A | Backrange | 80.9 | 5.039 | 80.1 | 4.689 |

| 98107 B | Backrange | 86.8 | 1.167 | 89.6 | 1.116 |

| 98107 A | Backrange | 75.3 | 0.347 | 76.5 | 0.306 |

| 98108 B | Backrange | 64.1 | 0.381 | 61.8 | 0.340 |

| 98110 B | Backrange | 83.6 | 3.983 | 85.4 | 4.682 |

| 98111 B | Backrange | 75.4 | 1.372 | 79.6 | 1.355 |

| 98112 A | Backrange | 48.4 | 0.173 | 37.6 | 0.125 |

| 98113 A | J Zone | 78.6 | 0.562 | 81.2 | 0.527 |

| 98114 B | J Zone | 62.7 | 0.417 | 64.7 | 0.337 |

| 98115 A | J Zone | 79.9 | 1.057 | 81.0 | 0.919 |

| 98116 A | J Zone | 86.0 | 0.836 | column abandoned | |

| 98117 B | Tallman | 70.4 | 0.492 | 81.0 | 0.400 |

| 98118 B | Tallman | 65.6 | 0.342 | 71.0 | 0.276 |

| 98119 A | Tallman | 81.0 | 1.191 | 83.5 | 1.204 |

| 98120 A | M Zone | 64.2 | 0.735 | 73.6 | 0.747 |

| 98121 B | M Zone | 73.9 | 0.263 | 82.6 | 0.242 |

| 98122 A | M Zone | 83.4 | 0.509 | 86.6 | 0.461 |

| 98123 B | M Zone | 68.7 | 0.321 | 72.8 | 0.309 |

| 98124 B | M Zone | 82.2 | 0.859 | 77.5 | 0.883 |

| 98125 B | M Zone | 84.9 | 0.779 | 90.8 | 0.840 |

| 98126 B | F Zone | 69.3 | 0.849 | 67.3 | 0.837 |

| 98127 B | F Zone | 56.2 | 0.245 | 56.1 | 0.244 |

| 98128 A | F Zone | 71.6 | 0.165 | 81.8 | 0.187 |

| ��Averages | 78.9% | 0.986 ppm Au | 80.6% | 0.981 ppm Au | |

Footnote: ppm = parts per million or grams per tonne (g/t)

ABOUT LIBERTY GOLD

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine Project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource and strong economic potential. We know the Great Basin and are driven to advance big gold deposits that can be mined profitably in open-pit scenarios and in an environmentally responsible manner.

For more information, visit or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

This news release contains “forward-looking information�� and “forward-looking statements�� within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals; receipt of a financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, , the scalability of results of metallurgical testing, results or timing of any mineral resources, feasibility study, EIS, mineral reserves, or pre-feasibility study; the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; recoveries being inconsistent with metallurgical test results; the timing or results of the publication of any mineral resources, mineral reserves EIS or feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at .

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information.��All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources��, “indicated resources��, “inferred resources�� and “mineral reserves��. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM��) �� CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC��) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules��) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

A figure accompanying this announcement is available at