MicroVision Announces Second Quarter 2025 Results

MicroVision (NASDAQ:MVIS), a pioneer in perception solutions for autonomy and mobility, reported its Q2 2025 financial results. The company achieved significant operational milestones, including full integration of MOVIA lidar into NVIDIA's DRIVE AGX platform and continued engagement with automotive OEMs.

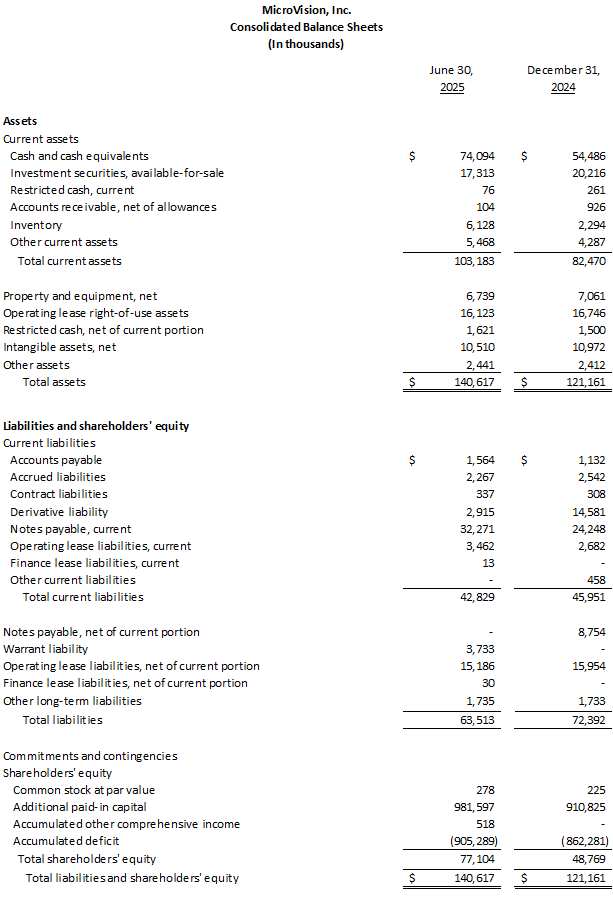

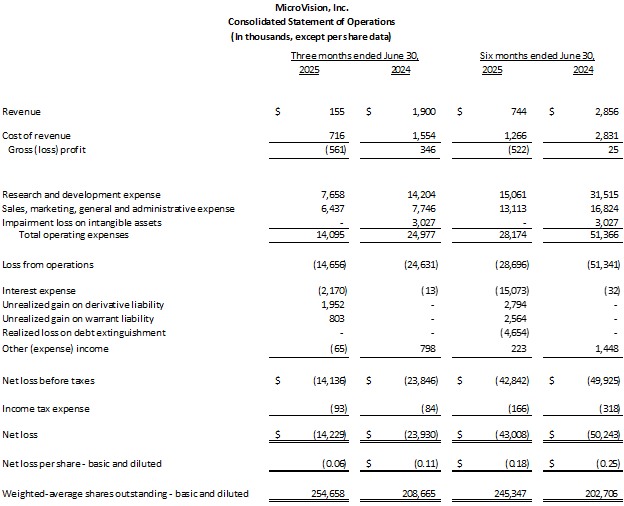

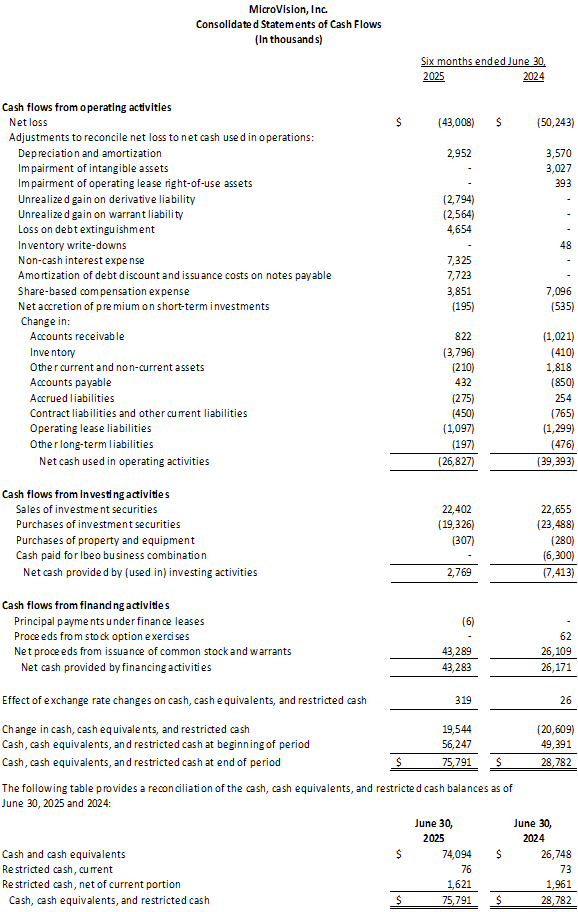

Financial results showed revenue of $0.2 million (down from $1.9M in Q2 2024), operating expenses of $14.1 million (44% YoY decline), and a net loss of $14.2 million ($0.06 per share). The company maintains a strong financial position with $91.4 million in cash and cash equivalents and access to additional $106.5 million in capital through ATM and convertible note facilities.

Strategic developments include expansion into defense tech sectors, board appointments strengthening industrial robotics expertise, and production commitments with ZF for high-volume deliveries.

MicroVision (NASDAQ:MVIS), pioniere nelle soluzioni di percezione per autonomia e mobilità , ha comunicato i suoi risultati finanziari del secondo trimestre 2025. L'azienda ha raggiunto importanti traguardi operativi, tra cui l'integrazione completa del lidar MOVIA nella piattaforma DRIVE AGX di NVIDIA e il continuo coinvolgimento con i produttori automobilistici OEM.

I risultati finanziari mostrano un fatturato di 0,2 milioni di dollari (in calo rispetto a 1,9 milioni nel Q2 2024), spese operative per 14,1 milioni di dollari (con una riduzione del 44% su base annua) e una perdita netta di 14,2 milioni di dollari (0,06 dollari per azione). L'azienda mantiene una solida posizione finanziaria con 91,4 milioni di dollari in liquidità e equivalenti e accesso a ulteriori 106,5 milioni di dollari di capitale tramite strutture ATM e note convertibili.

Gli sviluppi strategici includono l'espansione nei settori tecnologici della difesa, nomine nel consiglio di amministrazione che rafforzano l'expertise nella robotica industriale e impegni produttivi con ZF per consegne ad alto volume.

MicroVision (NASDAQ:MVIS), pionero en soluciones de percepción para autonomÃa y movilidad, reportó sus resultados financieros del segundo trimestre de 2025. La compañÃa logró importantes hitos operativos, incluyendo la integración completa del lidar MOVIA en la plataforma DRIVE AGX de NVIDIA y la continua colaboración con fabricantes de automóviles OEM.

Los resultados financieros mostraron ingresos de 0,2 millones de dólares (una disminución respecto a 1,9 millones en el Q2 2024), gastos operativos de 14,1 millones de dólares (una caÃda interanual del 44%) y una pérdida neta de 14,2 millones de dólares (0,06 dólares por acción). La empresa mantiene una sólida posición financiera con 91,4 millones de dólares en efectivo y equivalentes y acceso a 106,5 millones de dólares adicionales en capital mediante facilidades ATM y notas convertibles.

Los desarrollos estratégicos incluyen la expansión en sectores tecnológicos de defensa, nombramientos en la junta que fortalecen la experiencia en robótica industrial y compromisos de producción con ZF para entregas de alto volumen.

MicroVision (NASDAQ:MVIS)ë� ìì¨ì£¼í ë°� 모ë¹ë¦¬í°ë¥� ìí ì¸ì ì루ì � ë¶ì¼ì� ì ë주ìë¡ì 2025ë � 2ë¶ê¸° ì¬ë¬´ ê²°ê³¼ë¥� ë°ííìµëë¤. íì¬ë� NVIDIAì� DRIVE AGX íë«í¼ì MOVIA ë¼ì´ë¤ë¥¼ ìì í� íµí©íê³ ìëì°� OEMê³¼ì ì§ìì ì� íë ¥ì� í¬í¨í� ì¤ìí� ì´ì ì±ê³¼ë¥� ë¬ì±íìµëë¤.

ì¬ë¬´ ê²°ê³¼ë� ë§¤ì¶ 20ë§� ë¬ë¬(2024ë � 2ë¶ê¸° 190ë§� ë¬ë¬ ëë¹� ê°ì), ìì ë¹ì© 1,410ë§� ë¬ë¬(ì ë ëë¹� 44% ê°ì), ììì� 1,420ë§� ë¬ë¬(ì£¼ë¹ 0.06ë¬ë¬)ë¥� 기ë¡íìµëë¤. íì¬ë� 9,140ë§� ë¬ë¬ì� íê¸ ë°� íê¸ì� ìì°ê³� ATM ë°� ì íì¬ì± ìì¤ì� íµí´ ì¶ê°ë¡� 1ì� 650ë§� ë¬ë¬ì� ì본ì� ì ê·¼í� ì� ìë ê°ë ¥í� ì¬ë¬´ ìíë¥� ì ì§íê³ ììµëë¤.

ì ëµì � ë°ì ì¼ë¡ë� ë°©ì 기ì ë¶ì¼ë¡ì íì¥, ì°ì ì� ë¡ë´ ì 문ì±ì ê°ííë ì´ì¬í� ìëª , ZFìì� ëë� ìì° ê³ì½ ì²´ê²°ì� í¬í¨ë©ëë�.

MicroVision (NASDAQ:MVIS), pionnier des solutions de perception pour l'autonomie et la mobilité, a annoncé ses résultats financiers du deuxième trimestre 2025. L'entreprise a atteint des jalons opérationnels importants, notamment l'intégration complète du lidar MOVIA dans la plateforme DRIVE AGX de NVIDIA et une collaboration continue avec les constructeurs automobiles OEM.

Les résultats financiers indiquent un chiffre d'affaires de 0,2 million de dollars (en baisse par rapport à 1,9 million au T2 2024), des dépenses d'exploitation de 14,1 millions de dollars (baisse de 44 % en glissement annuel) et une perte nette de 14,2 millions de dollars (0,06 dollar par action). L'entreprise conserve une position financière solide avec 91,4 millions de dollars en liquidités et équivalents et un accès à 106,5 millions de dollars supplémentaires en capital via des facilités ATM et des billets convertibles.

Les développements stratégiques incluent une expansion dans les secteurs de la technologie de défense, des nominations au conseil d'administration renforçant l'expertise en robotique industrielle, ainsi que des engagements de production avec ZF pour des livraisons en grande série.

MicroVision (NASDAQ:MVIS), ein Pionier für Wahrnehmungslösungen in den Bereichen Autonomie und Mobilität, berichtete über seine Finanzergebnisse für das zweite Quartal 2025. Das Unternehmen erreichte bedeutende operative Meilensteine, darunter die vollständige Integration des MOVIA-Lidars in die DRIVE AGX-Plattform von NVIDIA sowie die fortgesetzte Zusammenarbeit mit Automobil-OEMs.

Die Finanzergebnisse zeigten einen Umsatz von 0,2 Millionen US-Dollar (Rückgang von 1,9 Mio. USD im Q2 2024), Betriebsausgaben von 14,1 Millionen US-Dollar (44 % Rückgang im Jahresvergleich) und einen Nettoverlust von 14,2 Millionen US-Dollar (0,06 USD pro Aktie). Das Unternehmen verfügt über eine starke Finanzlage mit 91,4 Millionen US-Dollar an liquiden Mitteln und Zugang zu zusätzlichen 106,5 Millionen US-Dollar Kapital durch ATM- und Wandelanleihe-Fazilitäten.

Strategische Entwicklungen umfassen die Expansion in den Verteidigungstechnologiesektor, Vorstandsernennungen zur Stärkung der Expertise im Bereich Industrierobotik sowie Produktionsverpflichtungen mit ZF für GroÃserienlieferungen.

- Full integration achieved with NVIDIA's DRIVE AGX platform for autonomous vehicles

- Operating expenses reduced by 44% year-over-year to $14.1 million

- Strong cash position of $91.4 million with access to additional $106.5 million in capital

- Secured production commitment with ZF for high-volume deliveries

- Expanded into defense tech and military sectors with strategic appointments

- Revenue declined 89% to $0.2 million from $1.9 million in Q2 2024

- Net loss of $14.2 million despite reduced operating expenses

- Cash burn of $12.7 million in operations during Q2 2025

Insights

MicroVision reported declining revenue but significantly reduced operating expenses amid strategic pivot to automotive, industrial, and defense sectors.

MicroVision's Q2 2025 results reveal a concerning revenue decline to just

The company has made meaningful progress in cost management, reducing operating expenses by

MicroVision's cash position has strengthened to

The integration with NVIDIA's DRIVE AGX platform represents a significant strategic achievement that could boost MicroVision's positioning in the autonomous vehicle sector. This partnership, combined with expanded engagement in defense and industrial sectors, demonstrates management's effort to diversify beyond its historically narrow focus.

However, the stark revenue decline creates immediate concerns about commercialization timeline and market adoption of MicroVision's technology. Management's confidence about 2025 revenue opportunities in the industrial vertical suggests near-term monetization efforts, but investors should watch closely whether these opportunities translate into actual revenue growth in coming quarters.

MicroVision's NVIDIA integration and multi-market approach show promise, but revenue decline signals challenging commercialization journey.

The integration of MicroVision's MOVIA lidar technology with NVIDIA's DRIVE AGX platform represents a significant technical achievement that validates the company's technology. NVIDIA's autonomous vehicle ecosystem is highly selective, suggesting MicroVision's lidar technology meets rigorous performance standards. This integration potentially positions MicroVision's solutions within the development environments used by numerous automotive and robotics companies building on NVIDIA's platform.

The company's solid-state architecture appears to be enabling competitive pricing while maintaining performance metrics necessary for autonomous applications. This architecture typically offers advantages in reliability, size, and manufacturing scalability compared to mechanical lidar systems with moving parts.

MicroVision is pursuing a multi-market strategy across automotive, industrial, and defense sectors - a prudent approach given the elongated timelines typical in automotive. The reformulated RFQs (Request for Quotations) from automotive OEMs suggest evolving requirements and potentially larger volume opportunities, though these remain in the qualification phase rather than production contracts.

The manufacturing partnership with ZF, a tier-1 automotive supplier, provides credibility and production capability necessary for high-volume deployment. This relationship helps address one of the critical challenges facing lidar companies: scaling from prototypes to automotive-grade mass production.

However, the dramatic revenue decrease underscores the challenging commercialization journey facing lidar technology companies. Despite technical progress, the

REDMOND, WASHINGTON / / August 7, 2025 / MicroVision, Inc. (NASDAQ:MVIS), a technology pioneer delivering advanced perception solutions in autonomy and mobility, today announced its second quarter 2025 results.

Key Business and Operational Highlights

Achieved full integration of MOVIA lidar into NVIDIA's DRIVE AGX platform to become part of their prestigious autonomous vehicle ecosystem.

Continued engagement with top-tier global automotive OEMs, with reformulated and higher-volume RFQs for passenger vehicles and custom development opportunities.

Driving momentum in industrial markets with a focus on near-term revenue opportunities with programs that leverage our full stack ADAS software and multi-modal sensor capability.

Continued production on high-volume automotive-qualified manufacturing line, ensuring continuous and uninterrupted supply of sensors and integrated software.

Progressed opportunities to accelerate strategic expansion in the defense tech and military sectors.

Deepened expertise on Board of Directors in industrial robotics and defense sectors, with Laura Peterson's appointment as a new independent director.

Expanded defense industry advisory board with the addition of technology strategist and esteemed veteran Scott Goldstein.

"As we aggressively yet diligently execute our strategic vision to be a leader in autonomy, we are able to drive optimal performance at very competitive pricing as a result of our solid-state architecture," said Sumit Sharma, MicroVision's Chief Executive Officer. "I am confident that MicroVision is well positioned to secure revenue opportunities for 2025 from the industrial vertical. Our unique value proposition continues to be our integrated perception software, and we offer compelling solutions to industrial customers and automotive OEMs at attractive price points."

"We are excited about the progress demonstrated in this quarter both commercially and financially. With the NVIDIA integration to increased momentum in the defense vertical, we are executing our strategic vision. We also expanded our Sales and Business Development team by bringing in some experienced talent from our competitors. In addition, our production commitment with ZF enables us to commit to high-volume deliveries to fulfil our revenue pipeline over the next 12-18 months. The recent capital raises have further expanded our financial runway and positioned MicroVision well in the marketplace with an improved cost structure to support customer demand." said Anubhav Verma, MicroVision's Chief Financial Officer.

Key Financial Highlights for Q2 2025

Revenue for the second quarter of 2025 was

$0.2 million , compared to$1.9 million for the second quarter of 2024 driven by industrial customers.Total operating expenses for the second quarter of 2025 were

$14.1 million , representing a44% decline YoY as compared to$25.0 million for the second quarter of 2024.Net loss for the second quarter of 2025 was

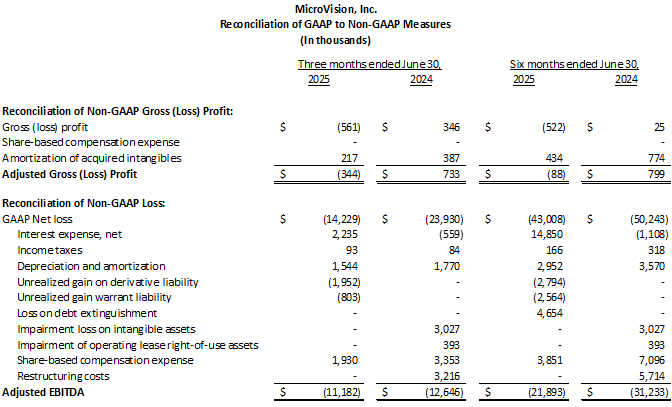

$14.2 million , or$0.06 per share, which includes$2.2 million of non-cash interest expense related to financings,$2.8 million related to non-cash unrealized gains on warrants and derivatives, and$1.9 million of non-cash share-based compensation expense, compared to a net loss of$23.9 million , or$0.11 per share, which includes$3.4 million of non-cash share-based compensation expense and$3.0 million of a non-cash asset impairment charge, for the second quarter of 2024.Adjusted EBITDA for the second quarter of 2025 was a

$11.2 million loss, compared to a$12.6 million loss for the second quarter of 2024.Cash used in operations in the second quarter of 2025 was

$12.7 million , compared to cash used in operations in the second quarter of 2024 of$18.6 million .The Company ended the second quarter of 2025 with

$91.4 million in cash and cash equivalents, including investment securities, compared to$74.7 million as of December 31, 2024.

As of June 30, 2025, the Company has access to

Conference Call and Webcast: Q2 2025 Results

MicroVision will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer session at 1:30 PM PT/4:30 PM ET on Thursday, August 7, 2025 to discuss the financial results and provide a business update. Analysts and investors may pose questions to management during the live webcast on August 7, 2025 and may submit questions in advance of the conference call.

The live webcast can be accessed on the Company's Investor Relations website under the Events tab . The webcast will be archived on the website for future viewing.

About MicroVision

MicroVision is at the forefront of driving the global adoption of innovative perception solutions, with the goal of making mobility and autonomy safer. Our engineering excellence, based in Redmond, Washington and Hamburg, Germany, enables us to develop and supply integrated lidar hardware and perception software solutions. Our proprietary technologies enhance safety and automation across various industrial applications, including robotics, automated warehouses, and agriculture, and are instrumental in the development of autonomous systems. MicroVision's core technology, initially developed for the automotive industry, continues to accelerate advanced driver-assistance systems (ADAS) and autonomous driving. Building on our history of providing technology to the military segment, our target offerings include semi- and fully autonomous airborne and terrestrial sensor systems. With our solid-state lidar technologies, encompassing MEMS-based long-range lidar and flash-based short-range lidar, integrated with our onboard perception software, MicroVision possesses the expertise to deliver safe mobility at the speed of life.

For more information, visit the Company's website at , on Facebook at , and LinkedIn at .

MicroVision, MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties of their respective owners.

Non-GAAP information

To supplement MicroVision's condensed financial statements presented in accordance with GAAP, the Company presents investors with the non-GAAP financial measures "adjusted EBITDA" and "adjusted Gross Profit." Adjusted EBITDA consists of GAAP net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization; non-cash gains and losses; share-based compensation; and restructuring costs. Adjusted Gross Profit is calculated as GAAP gross profit before share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

MicroVision believes that the presentation of adjusted EBITDA and adjusted Gross Profit provides important supplemental information to management and investors regarding financial and business trends, provides consistency and comparability with MicroVision's past financial reports, and facilitates comparisons with other companies in the Company's industry, many of which use similar non-GAAP financial measures to supplement their GAAP results. Internally, management uses these non-GAAP measures when evaluating operating performance because the exclusion of the items described above provides an additional useful measure of the Company's operating results and facilitates comparisons of the Company's core operating performance against prior periods and its business objectives. Externally, the Company believes that adjusted EBITDA and adjusted Gross Profit are useful to investors in their assessment of MicroVision's operating performance and the valuation of the Company.

Adjusted EBITDA and adjusted Gross Profit are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of MicroVision's business as determined in accordance with GAAP. The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from its non-GAAP financial measures should not be construed as an inference that these costs are unusual or infrequent.

The Company compensates for limitations of the adjusted EBITDA measure by prominently disclosing GAAP net income (loss), which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted EBITDA.

Similarly for adjusted Gross Profit, the Company compensates for limitations of the measure by prominently disclosing GAAP gross profit which is the difference between Revenue and Cost of revenue, which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation by backing out share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

Forward-Looking Statements

Certain statements contained in this release, including customer engagement and the likelihood of success; opportunities for revenue and cash; expense reduction; market position; product portfolio; product and manufacturing capabilities; access to capital and capital-raising opportunities; and expected revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of its commercial partners to perform as expected under its agreements; its financial and technical resources relative to those of its competitors; its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company's SEC reports, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changes in circumstances or any other reason.

Investor Relations Contact

Jeff Christensen

Darrow Associates Investor Relations

[email protected]

Media Contact

[email protected]

SOURCE: MicroVision, Inc

View the original on ACCESS Newswire