Nasdaq Announces End-of-Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date July 31, 2025

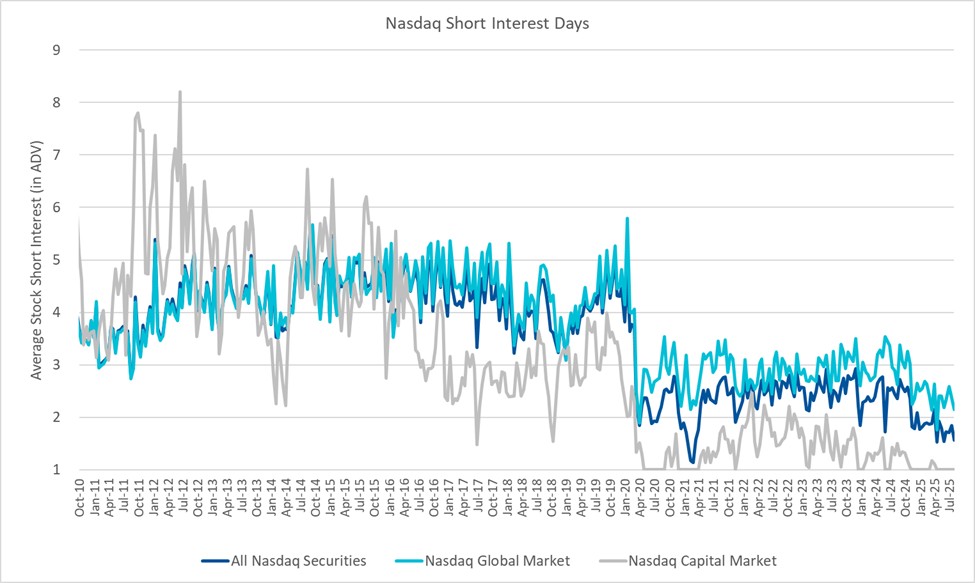

Nasdaq (NASDAQ:NDAQ) has released its end-of-month short interest report for the settlement date of July 31, 2025. The report shows total short interest across all 4,943 Nasdaq securities reached 16.59 billion shares, slightly down from 16.65 billion shares in the previous period.

In the Nasdaq Global Market, short interest in 3,285 securities totaled 13.68 billion shares, representing 2.15 days of average daily volume, down from 2.37 days in the prior period. The Nasdaq Capital Market saw short interest of 2.91 billion shares across 1,658 securities, maintaining a 1.00 day average daily volume.

Nasdaq (NASDAQ:NDAQ) ha pubblicato il rapporto di fine mese relativo alla data di regolamento del 31 luglio 2025. Il rapporto indica che l'interesse short complessivo su tutte le 4.943 società quotate al Nasdaq ha raggiunto 16,59 miliardi di azioni, in lieve diminuzione rispetto ai 16,65 miliardi del periodo precedente.

Nel Nasdaq Global Market, l'interesse short in 3.285 titoli è stato pari a 13,68 miliardi di azioni, corrispondenti a 2,15 giorni di volume medio giornaliero, in calo rispetto ai 2,37 giorni del periodo precedente. Il Nasdaq Capital Market ha registrato 2,91 miliardi di azioni su 1.658 titoli, con un volume medio giornaliero pari a 1,00 giorno.

Nasdaq (NASDAQ:NDAQ) ha publicado su informe de interés corto de fin de mes correspondiente a la fecha de liquidación del 31 de julio de 2025. El informe muestra que el interés corto total en las 4.943 emisiones del Nasdaq alcanzó 16,59 mil millones de acciones, ligeramente por debajo de los 16,65 mil millones del periodo anterior.

En el Nasdaq Global Market, el interés corto en 3.285 valores sumó 13,68 mil millones de acciones, lo que equivale a 2,15 días de volumen medio diario, frente a 2,37 días en el periodo anterior. El Nasdaq Capital Market presentó 2,91 mil millones de acciones en corto entre 1.658 valores, manteniendo un volumen medio diario de 1,00 día.

Nasdaq (NASDAQ:NDAQ)은 2025�� 7�� 31�� 결제�� 기준 월말 공매�� 잔고 보고서를 발표했습니다. 보고서에 따르�� 전체 4,943�� 나스�� 종목�� 공매�� 잔고�� 16,590,000,000����, 이전 기간�� 16,650,000,000주에�� 소폭 감소했습니다.

Nasdaq Global Market에서�� 3,285�� 종목�� 공매�� 잔고가 13,680,000,000���� 집계되어 일평�� 거래�� 기준으로 2.15일에 해당하며, 이전 기간�� 2.37일에�� 감소했습니다. Nasdaq Capital Market에서�� 1,658�� 종목�� 걸쳐 2,910,000,000주의 공매�� 잔고가 집계되었��, 일평�� 거래량은 1.00일을 유지했습니다.

Nasdaq (NASDAQ:NDAQ) a publié son rapport de fin de mois sur l'intérêt à la vente à découvert pour la date de règlement du 31 juillet 2025. Le rapport indique que l'intérêt à la vente total pour l'ensemble des 4 943 titres du Nasdaq a atteint 16,59 milliards d'actions, en légère baisse par rapport aux 16,65 milliards de la période précédente.

Sur le Nasdaq Global Market, l'intérêt à la vente dans 3 285 titres s'est élevé à 13,68 milliards d'actions, soit 2,15 jours de volume moyen quotidien, en baisse par rapport à 2,37 jours lors de la période antérieure. Le Nasdaq Capital Market a enregistré 2,91 milliards d'actions sur 1 658 titres, maintenant un volume moyen quotidien équivalent à 1,00 jour.

Nasdaq (NASDAQ:NDAQ) hat seinen Monatsendbericht zum Short-Interest für das Abrechnungsdatum 31. Juli 2025 veröffentlicht. Dem Bericht zufolge belief sich das gesamte Short-Interest über alle 4.943 Nasdaq-Werte auf 16,59 Milliarden Aktien, leicht rückläufig gegenüber 16,65 Milliarden im vorherigen Zeitraum.

Im Nasdaq Global Market summierte sich das Short-Interest in 3.285 Titeln auf 13,68 Milliarden Aktien, was 2,15 Tagen des durchschnittlichen Tagesvolumens entspricht, gegenüber 2,37 Tagen im vorherigen Zeitraum. Im Nasdaq Capital Market wurden 2,91 Milliarden Aktien über 1.658 Titel an Short-Positionen verzeichnet, bei einem durchschnittlichen Tagesvolumen von 1,00 Tag.

- None.

- None.

NEW YORK, Aug. 11, 2025 (GLOBE NEWSWIRE) -- At the end of the settlement date of July 31, 2025, short interest in 3,285 Nasdaq Global MarketSM securities totaled 13,683,072,188 shares compared with 13,792,841,090 shares in 3,260 Global Market issues reported for the prior settlement date of July 15, 2025. The mid-July short interest represents 2.15 days compared with 2.37 days for the prior reporting period.

Short interest in 1,658 securities on The Nasdaq Capital MarketSM totaled 2,910,549,464 shares at the end of the settlement date of July 31, 2025, compared with 2,853,251,720 shares in 1,647 securities for the previous reporting period. This represents a 1.00 day average daily volume; the previous reporting period’s figure was 1.00.

In summary, short interest in all 4,943 Nasdaq® securities totaled 16,593,621,652 shares at the July 31, 2025 settlement date, compared with 4,907 issues and 16,646,092,810 shares at the end of the previous reporting period. This is 1.56 days average daily volume, compared with an average of 1.84 days for the prior reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit

or .

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on , on X , or at .

Media Contact:

Maximilian Leitenberger

A photo accompanying this announcement is available at

NDAQO