Vox Royalty Acquires Wyloo North Iron Ore Royalty in Pilbara Region of Western Australia

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) has announced the acquisition of a 1.5% Gross Revenue Royalty over the Wyloo North iron ore project in Western Australia for A$1.5 million. The royalty covers the first 15 million tonnes of iron ore production from the deposit, which is operated by Fortescue Metals Group.

The Wyloo North deposit is a 7km-long satellite orebody located within 30km of the producing Eliwana Iron Ore Operation. The deposit features high-grade iron content of 59.6% Fe, superior to the Greater Western Hub average of 56.8% Fe. The mineralization extends over 7km in the central project area, with additional extensions in the western and eastern regions, and reaches thicknesses up to 95m.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ha annunciato l'acquisizione di una royalty sul ricavo lordo dell'1,5% sul progetto di minerale di ferro Wyloo North, nell'Australia Occidentale, per 1,5 milioni di dollari australiani. La royalty si applica ai primi 15 milioni di tonnellate di produzione di minerale di ferro del deposito, gestito da Fortescue Metals Group.

Il deposito Wyloo North è un corpo mineralizzato satellite lungo 7 km situato a meno di 30 km dall'operazione di produzione Eliwana Iron Ore. Il giacimento presenta un contenuto di ferro ad alto tenore pari al 59,6% Fe, superiore alla media del Greater Western Hub del 56,8% Fe. La mineralizzazione si estende per 7 km nell'area centrale del progetto, con ulteriori estensioni a ovest e a est, e raggiunge spessori fino a 95 m.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) ha anunciado la adquisición de una regalía sobre ingresos brutos del 1,5% del proyecto de mineral de hierro Wyloo North en Australia Occidental por 1,5 millones de dólares australianos. La regalía cubre las primeras 15 millones de toneladas de producción de mineral de hierro del yacimiento, operado por Fortescue Metals Group.

El depósito Wyloo North es un cuerpo satélite de mineral de 7 km de longitud situado a menos de 30 km de la operación en producción Eliwana Iron Ore. El yacimiento presenta un alto grado de hierro del 59,6% Fe, superior a la media del Greater Western Hub del 56,8% Fe. La mineralización se extiende 7 km en el área central del proyecto, con extensiones adicionales en las zonas oeste y este, y alcanza espesores de hasta 95 m.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR)�� 서호�� Wyloo North 철광�� 프로젝트�� 대�� 총수�� 로열�� 1.5%�� 호주달러 150�� 달러�� 인수했다�� 발표했습니다. �� 로열티는 Fortescue Metals Group�� 운영하는 해당 매장지�� 최초 1,500�� �� 철광�� 생산분에 적용됩니��.

Wyloo North 매장지�� 생산 중인 Eliwana Iron Ore 운영지에서 30km 이내�� 위치�� 길이 7km�� 위성 광체입니��. �� 광상은 �� 함량 59.6% Fe�� 고품����, Greater Western Hub 평균 56.8% Fe�� 상회합니��. 광화대�� 중앙 프로젝트 지역에�� 7km�� 걸쳐 확장되며 서쪽�� 동쪽으로�� 추가 연장되고, 두께�� 최대 95m�� 달합니다.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) a annoncé l'acquisition d'une redevance sur le chiffre d'affaires brute de 1,5% sur le projet de minerai de fer Wyloo North en Australie-Occidentale pour 1,5 million de dollars australiens. La redevance couvre les 15 premiers millions de tonnes de production de minerai de fer du gisement, exploité par Fortescue Metals Group.

Le gisement Wyloo North est un corps minéralisé satellite de 7 km de long situé à moins de 30 km de l'exploitation Eliwana Iron Ore en production. Le gisement présente un teneur en fer élevée de 59,6% Fe, supérieure à la moyenne du Greater Western Hub de 56,8% Fe. La minéralisation s'étend sur 7 km dans la zone centrale du projet, avec des extensions supplémentaires à l'ouest et à l'est, et atteint des épaisseurs allant jusqu'à 95 m.

Vox Royalty Corp. (TSX:VOXR)(NASDAQ:VOXR) hat den Erwerb einer 1,5% Bruttoerlös-Royalty am Wyloo North Eisenerzprojekt in Westaustralien für 1,5 Mio. AUD bekanntgegeben. Die Royalty gilt für die ersten 15 Millionen Tonnen Eisenerzproduktion des Vorkommens, das von Fortescue Metals Group betrieben wird.

Das Wyloo North Vorkommen ist ein 7 km langer Satellitenerzkörper, der sich innerhalb von 30 km zur produzierenden Eliwana Iron Ore-Anlage befindet. Das Projekt weist einen hochgradigen Eisengehalt von 59,6% Fe auf, höher als der Durchschnitt des Greater Western Hub von 56,8% Fe. Die Mineralisierung erstreckt sich über 7 km im zentralen Projektbereich, mit weiteren Ausdehnungen nach Westen und Osten, und erreicht Mächtigkeiten von bis zu 95 m.

- None.

- Project still requires EPA approval and Ministerial Decision for development

- Resource currently classified as inferred, requiring further definition

- Royalty limited to first 15 million tonnes of production

Insights

Vox adds potential growth asset with A$1.5M acquisition of royalty on high-grade iron deposit operated by mining giant Fortescue.

This acquisition of the Wyloo North iron ore royalty represents a strategic expansion of Vox's royalty portfolio with several positive attributes. The A$1.5 million (

The royalty's value proposition hinges on three key factors: location, operator quality, and deposit characteristics. Located within 30km of Fortescue's producing Eliwana operation (30Mtpa capacity), Wyloo North benefits from proximity to existing infrastructure. Fortescue's

The deposit's metallurgical characteristics are particularly favorable, with high-grade ore that would likely command premium pricing in a market increasingly focused on quality. The substantial 7km strike length with thicknesses up to 95m suggests meaningful production potential, though investors should note the royalty's 15Mt cap limits upside from total resource extraction.

For context, at current iron ore prices around $100/t and assuming the

While clearly a medium-term opportunity requiring development approvals and capital investment decisions by Fortescue, the project's characteristics align with Vox's strategy of acquiring royalties on assets with reasonable paths to production operated by capable mining companies.

DENVER, COLORADO / / August 25, 2025 / Vox Royalty Corp. ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to announce that it has executed a binding agreement to acquire an iron ore royalty over the Wyloo North iron ore project in the Pilbara region of Western Australia (the "Royalty"), currently operated by Fortescue Metals Group ("Fortescue"), from an Australian company (the "Vendor") for A

Spencer Cole, Chief Investment Officer stated: "We are pleased to announce the Wyloo North royalty acquisition in Western Australia, which aligns with Vox's focus on large high-grade orebodies, operated by large-cap mining companies with medium-term development potential via existing infrastructure. The Wyloo North Royalty is expected to generate meaningful returns once it enters production. Vox management is confident that the deposit has the potential to be fast-tracked towards production by the A

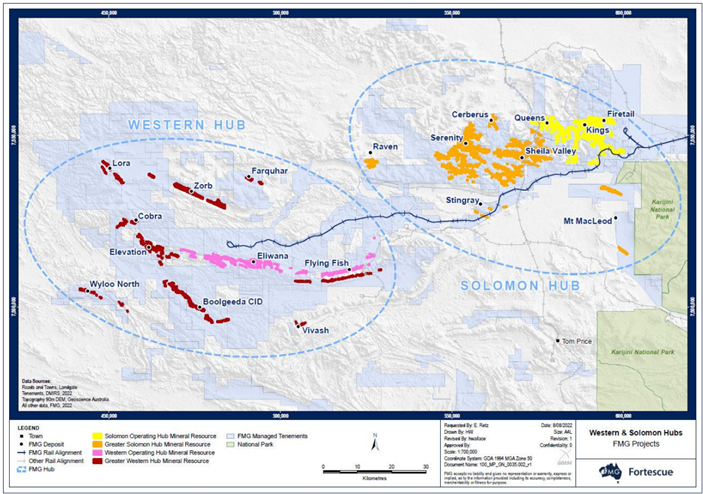

Figure 1 - Wyloo North deposit within Fortescue's Western Hub

(Source: )

Project Overview - Wyloo North(1)

The Wyloo North iron ore deposit is a large 7km-long satellite orebody located within 30km of the producing Eliwana Iron Ore Operation, which currently produces 30Mtpa iron ore annually. Wyloo North contains some of the highest-grade iron content of any deposit within Fortescue's Greater Western Hub (

FMG Pilbara Pty Ltd ("FMGP") Ltd, which is a subsidiary of Fortescue, is the operator of the key Wyloo North mining lease M47/1567 (formerly M47/1488, M47/1489, M47/1490, M47/1508, E47/1395 and E47/1650), which is part of a package of tenements collectively known as the Wyloo North Project. Exploration mapping and drilling have been carried out on the project area since mid-2006 and through the results of that drilling, FMGP has identified significant iron ore mineralization within the tenement boundaries. During 2006 through to 2016, FMGP conducted extensive mapping programmes throughout the Wyloo North project. From the mapping focusing on the Marra Mamba and Brockman Iron Formation bedrock, areas of mineralization were identified for Reverse Circulation ("RC") drilling to test for bedded iron deposits and detrital iron deposits.

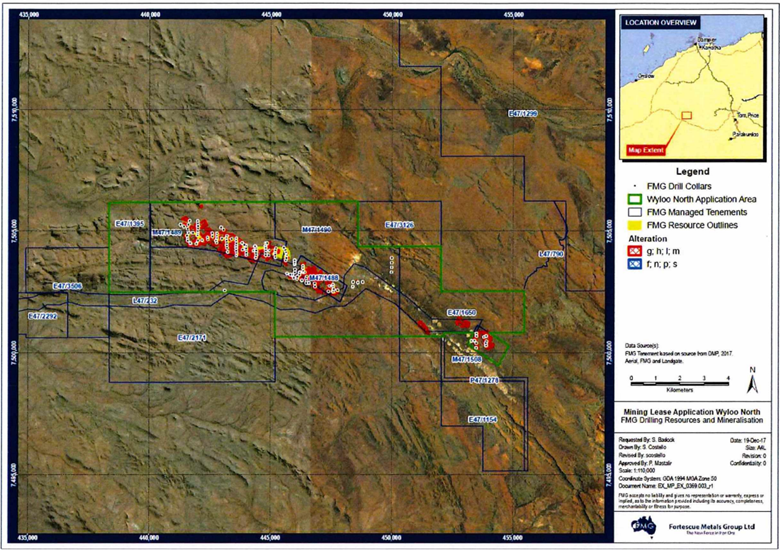

Figure 2 - Wyloo North key mining lease M47/1567

(Source: )

The iron ore deposits at Wyloo North are variably dipping to the north and north-east ranging from 20 to 60 degrees dip, and thicknesses up to 95m in vertical thickness. The combined strike length of mineralization through the central project area is over 7kms long, with additional 1.5km - 2km strike length mineralization in the western region and 800m - 1km strike length of mineralization on the east of M47/1567. The deposits occur as bedded iron deposits and are hosted within the Brockman Iron Formation, Marra Mamba Iron Formation and, in part, the Weeli Wolli Formation.

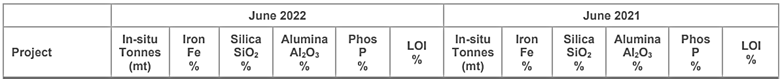

The most recent Wyloo North inferred mineral resource estimate disclosed by Fortescue, prior to its consolidation within the Greater Western Hub mineral resource total, is as follows:

Table 1 - Wyloo North Mineral Resource within Greater Western Hub (June 2022)

(Source: )

Based on the results obtained from the ongoing RC drilling programs across Wyloo North, JORC compliant resource models have been estimated on an ongoing basis by Fortescue. From the completion of these prior resource models, Fortescue formed the opinion that a significant body of potentially economic mineralization exists in the area covered by former tenements M47/1488, M47/1489, M47/1490, M47/1508, E47/1395 and E47/1650 - which formed the basis of a mining lease application for ML47/1567. This mining lease application was based on a reasonable prospect that this mineralization will be mined at some future point in time.

Upcoming potential catalysts for Wyloo North Royalty:

Updated resource and reserve classification for Wyloo North deposit;

Lodgement of a Referral Form with the Western Australia EPA for Wyloo North development approval; and

Receipt of Ministerial Decision to commence mine development.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 60 royalties.

Further information on Vox can be found at .

For further information contact:

Spencer Cole | Kyle Floyd |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards"). In addition to NI 43-101, a number of resource and reserve estimates have been prepared in accordance with the JORC Code (as such term is defined in NI 43-101), which differ from the requirements of NI 43-101 and U.S. securities laws but is defined in NI 43-101 as an "acceptable foreign code". Readers are cautioned that a qualified person has not carried out independent work to validate the JORC Code resource and reserve estimates referenced herein.

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934, as amended, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, as amended, the U.S. Securities Exchange Act of 1934, as amended, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator disclosure provided by management and the potential impact on the Company of such operator disclosure, statements regarding expectations for the timing of commencement of resource updates, development, construction at and/or resource production at Wyloo North, expectations regarding the size, quality and exploitability of the resources at Wyloo North, and requirements for and operator ability to receive regulatory approvals.

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements, including but not limited to: the impact of general business and economic conditions; the absence of control over mining operations from which Vox will purchase precious metals or from which it will receive royalty or stream payments, and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; the volatility of the stock market; competition; risks related to Vox's dividend policy; epidemics, pandemics or other public health crises, including the global outbreak of the novel coronavirus, geopolitical events and other uncertainties, such as the conflict in Ukraine, as well as those factors discussed in the section entitled "Risk Factors" in Vox's annual information form for the financial year ended December 31, 2024 available at and the SEC's website at (as part of Vox's Form 40-F).

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

None of the TSX, its Regulation Services Provider (as that term is defined in policies of the TSX) or The Nasdaq Stock Market LLC accepts responsibility for the adequacy or accuracy of this press release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than

References & Notes:

Wyloo North project commentary and maps sourced from the following December-2017 documents on the MINEDEX database:

Mineralisation Report in support of Application for Mining Lease application 47/xxxx (Wyloo North Project)

Mining Statement in support of Application for Mining Lease application 47/xxxx (Wyloo North Project)

Link to both documents:

SOURCE: Vox Royalty Corp.

View the original on ACCESS Newswire