Wudinna Gold Project Rights Acquisition Completed

Barton Gold Holdings (OTCQB:BGDFF) has successfully secured rights to acquire the Wudinna Gold Project following approval from Cobra Resources PLC shareholders on July 24, 2025. The Wudinna Project, located in South Australia's Eyre Peninsula, contains 279,000 oz Au with a grade of 1.5 g/t Au across multiple deposits.

The acquisition terms include total consideration of $5.5 million, comprising $500,000 in cash and $5 million in Barton shares. Additional contingent benefits include $2 million in shares upon reaching a 500koz gold JORC resource and up to $7.5 million in production benefits. With this acquisition, Barton's total JORC Mineral Resources have increased to 2.14Moz Au (78.9Mt @ 0.85g/t Au) and 3.10Moz Ag.

Barton Gold Holdings (OTCQB:BGDFF) ha ottenuto con successo i diritti per acquisire il Progetto Oro di Wudinna dopo l'approvazione degli azionisti di Cobra Resources PLC il 24 luglio 2025. Il Progetto Wudinna, situato nella Penisola di Eyre, nell'Australia Meridionale, contiene 279.000 oz di oro con una gradazione di 1,5 g/t Au distribuita su più giacimenti.

I termini dell'acquisizione prevedono una considerazione totale di 5,5 milioni di dollari, di cui 500.000 dollari in contanti e 5 milioni in azioni Barton. Benefici contingenti aggiuntivi includono 2 milioni di dollari in azioni al raggiungimento di una risorsa aurea JORC di 500.000 once e fino a 7,5 milioni di dollari in benefici di produzione. Con questa acquisizione, le risorse minerarie JORC totali di Barton sono aumentate a 2,14 milioni di once di oro (78,9 Mt a 0,85 g/t Au) e 3,10 milioni di once di argento.

Barton Gold Holdings (OTCQB:BGDFF) ha asegurado con éxito los derechos para adquirir el Proyecto de Oro Wudinna tras la aprobación de los accionistas de Cobra Resources PLC el 24 de julio de 2025. El Proyecto Wudinna, ubicado en la PenÃnsula de Eyre, Australia del Sur, contiene 279.000 oz de oro con una ley de 1,5 g/t Au en múltiples depósitos.

Los términos de la adquisición incluyen una consideración total de 5,5 millones de dólares, compuesta por 500.000 dólares en efectivo y 5 millones en acciones de Barton. Beneficios contingentes adicionales incluyen 2 millones en acciones al alcanzar un recurso de oro JORC de 500.000 oz y hasta 7,5 millones en beneficios por producción. Con esta adquisición, los recursos minerales totales JORC de Barton han aumentado a 2,14 millones de oz de oro (78,9 Mt a 0,85 g/t Au) y 3,10 millones de oz de plata.

Barton Gold Holdings (OTCQB:BGDFF)ë� 2025ë � 7ì� 24ì� Cobra Resources PLC 주주ë¤ì ì¹ì¸ í� Wudinna ê¸� íë¡ì í¸ ì¸ì ê¶ë¦¬ë¥� ì±ê³µì ì¼ë¡� íë³´íìµëë¤. ë¨í¸ì£� ìì´ì� ë°ëì� ìì¹í� Wudinna íë¡ì í¸ë� ì¬ë¬ ê´ìì� ê±¸ì³ 279,000 ì¨ì¤ ê¸�ê³� 1.5 g/t Au ë±ê¸ì� ë³´ì íê³ ììµëë¤.

ì¸ì ì¡°ê±´ì ì´� 550ë§� ë¬ë¬ë¡�, íê¸ 50ë§� ë¬ë¬ì Barton 주ì 500ë§� ë¬ë¬ë¡� 구ì±ë©ëë�. ì¶ê°ë¡� 50ë§� ì¨ì¤ ê¸� JORC ìì ë¬ì± ì� 200ë§� ë¬ë¬ ìë¹ì� 주ìê³� ìµë 750ë§� ë¬ë¬ì� ìì° ì´ìµì� í¬í¨ë©ëë�. ì´ë² ì¸ìë¡� Bartonì� ì´� JORC ê´ë¬¼ ììì 214ë§� ì¨ì¤ ê¸� (78.9Mt @ 0.85g/t Au) ë°� 310ë§� ì¨ì¤ ìì¼ë¡ ì¦ê°íìµëë¤.

Barton Gold Holdings (OTCQB:BGDFF) a réussi à obtenir les droits d'acquérir le projet aurifère de Wudinna suite à l'approbation des actionnaires de Cobra Resources PLC le 24 juillet 2025. Le projet Wudinna, situé dans la péninsule d'Eyre en Australie-Méridionale, contient 279 000 oz d'or avec une teneur de 1,5 g/t Au répartie sur plusieurs gisements.

Les conditions d'acquisition incluent une contrepartie totale de 5,5 millions de dollars, comprenant 500 000 dollars en espèces et 5 millions en actions Barton. Des avantages conditionnels supplémentaires comprennent 2 millions de dollars en actions lors de l'atteinte d'une ressource aurifère JORC de 500 000 oz et jusqu'à 7,5 millions de dollars en avantages liés à la production. Avec cette acquisition, les ressources minérales JORC totales de Barton ont augmenté à 2,14 millions d'onces d'or (78,9 Mt à 0,85 g/t Au) et 3,10 millions d'onces d'argent.

Barton Gold Holdings (OTCQB:BGDFF) hat erfolgreich die Rechte zum Erwerb des Wudinna-Goldprojekts nach der Zustimmung der Aktionäre von Cobra Resources PLC am 24. Juli 2025 gesichert. Das Wudinna-Projekt, gelegen auf der Eyre-Halbinsel in Südaustralien, enthält 279.000 Unzen Gold mit einem Gehalt von 1,5 g/t Au über mehrere Lagerstätten.

Die Ãbernahmebedingungen umfassen eine Gesamtvergütung von 5,5 Millionen US-Dollar, bestehend aus 500.000 US-Dollar in bar und 5 Millionen in Barton-Aktien. Zusätzliche bedingte Vorteile beinhalten 2 Millionen US-Dollar in Aktien bei Erreichen einer 500.000 Unzen Gold JORC-Ressource und bis zu 7,5 Millionen US-Dollar an Produktionsvorteilen. Mit dieser Ãbernahme sind Bartons gesamte JORC-Mineralressourcen auf 2,14 Mio. Unzen Gold (78,9 Mt @ 0,85 g/t Au) und 3,10 Mio. Unzen Silber gestiegen.

- Increases Barton's total gold resources to 2.14Moz Au, strengthening their South Australian portfolio

- Acquisition of high-grade resources averaging 1.5 g/t Au across 279,000 oz

- Favorable payment terms with significant portion in shares and contingent payments

- Strategic expansion of regional development platform with integration opportunities

- Only 18,000 oz (6.5%) of the 279,000 oz resource is in Indicated category, rest is Inferred

- Additional cash payments of $450,000 still pending for completion

- Future contingent payments could reach $9.5M ($2M in shares plus $7.5M production benefit)

HIGHLIGHTS

Acquisition of 279koz Au Wudinna Gold Project approved by vendor shareholders1

Barton now has binding rights to project ownership pending tenement grant or transfer

Barton total South Australian JORC Mineral Resources now 2.14Moz (78.9Mt @ 0.85g/t Au)

ADELAIDE, AUSTRALIA / / July 24, 2025 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to announce completion of its rights to acquire the Wudinna Gold Project (Wudinna) from Cobra Resources PLC (Cobra). Cobra shareholders have approved the Transaction at a general meeting held yesterday, 24 July 2025 in the UK. Following this approval, Barton now has binding rights to ownership of Wudinna, and will work with Cobra to facilitate transfer of the Sale Assets to Barton, and Final Settlement.

Commenting on the acquisition of Wudinna, Barton Managing Director Alexander Scanlon said:

"We are pleased to obtain Cobra shareholder approval for Barton's acquisition of the Wudinna Gold Project. Wudinna is a highly valuable addition to Barton's South Australian gold platform, which is now over 2Moz and set to grow further with the pending re-estimation of the Challenger underground mine.

"With this transaction approved, we will now continue our evaluation of opportunities to integrate Wudinna into our long-term regional development objectives. These assets offer significant optionality given our professional capabilities and planned future infrastructure. We look forward to sharing updates as we advance this project."

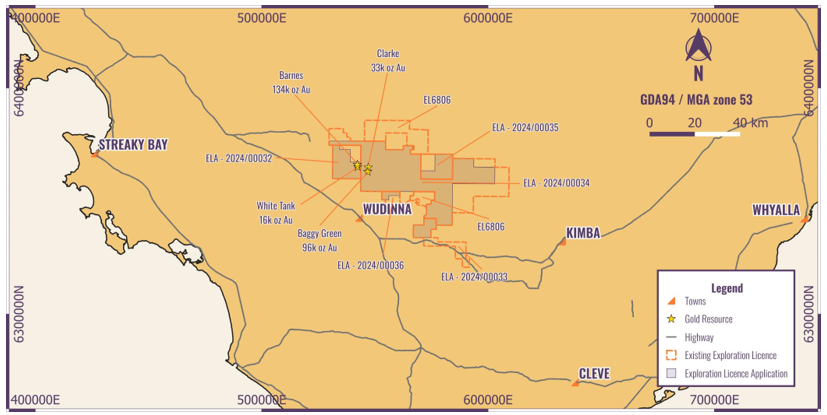

Wudinna Gold Project JORC Resources

The Wudinna Gold Project is comprised of the Barns, White Tank, Clarke and Baggy Green Deposits hosting a combined JORC (2012) Mineral Resources Estimate (MRE) of 279,000oz Au (5.81Mt @ 1.5 g/t Au).2

Deposit | Classification | Tonnes (Mt) | Grade (g/t Au) | Gold Ounces |

Barnes | Indicated | 0.44 | 1.3 | 18,000 |

Inferred | 2.19 | 1.6 | 116,000 | |

White Tank | Inferred | 0.33 | 1.5 | 16,000 |

Baggy Green | Inferred | 2.12 | 1.4 | 96,000 |

Clarke | Inferred | 0.73 | 1.4 | 33,000 |

Total | 5.81 | 1.5 | 279,000 |

Table 1 - Wudinna Gold Project September 2023 JORC (2012) Mineral Resources Estimate2

Key terms of acquisition

The Wudinna acquisition was agreed on compelling terms for Barton, and in a framework of significant mutual benefit to each of Barton and Cobra. Cobra's shareholders will continue to hold a gold exposure through Barton and its considerably larger regional gold development platform, and each of Barton and Cobra will focus on their respective areas of development interest, gold and rare earths (respectively).

Barton has paid to Cobra a non-refundable deposit of

Agreement signing | New Tenements3 | Final Settlement | Total | |

Cash | ||||

Barton shares4 | ||||

Total |

Table 2 - Wudinna Gold Project acquisition consideration payable2

Barton will also pay to Cobra certain contingent benefits, including:2

Upon definition of a JORC MRE over 500koz gold,

$2,000,000 worth of Barton Shares;6A Production Benefit up to

$7.5m cash ($50 /oz Au) which Barton can buyback for50% of its value;7

Other key terms of acquisition include:2

All Barton shares issued pursuant to the Transaction will be subject to 1 year's escrow (for

40% of them) and 2 years' escrow (for60% of them) from their respective dates of issue (Escrow); andCobra's dealing in any Barton shares will be subject to an Orderly Market Agreement granting Barton a first right to facilitate their sale to Barton's nominees at a fixed discount of

7.5% to their 20 trading day volume weighted average price (VWAP);

Barton and Cobra will now complete an Escrow Agreement and the Orderly Market Agreement, pursuant to which the tranche of

Barton will provide further updates as the Transaction proceeds toward Final Settlement.

1 Refer to ASX announcement dated 2 July 2025; capitalised terms in this document have the same meaning as defined in that document

2 Refer to ASX announcement dated 2 July 2025; capitalised terms have the same meaning as defined in that document

3 Cobra has the right to acquire the Exploration Licenses over which the ELAs have been issued pursuant to Section 30AA of the South Australian Mining Act (Original Tenements). If the New Tenements are not granted, the Parties may pursue the issue of new Exploration Licenses (and Final Settlement) through an application for subdivision of the Original Tenements in favour of Barton for those areas representing the Sale Assets or, if this is unsuccessful, Barton shall have the right to elect to either (a) take the Original Tenements in lieu, or (b) terminate the Transaction.

4 All Barton Shares issues pursuant to the Agreement will be issued pursuant to Barton's ASX Listing Rule 7.1 capacity.

5 Number of Barton shares calculated by reference to VWAP for the 30 trading days up to, but not including, the Agreement date, being approximately

6 Number of Barton shares calculated by reference to VWAP for the 30 trading days up to, but not including, the Exploration Milestone date.

7 Number of Barton shares calculated by reference to VWAP for the 30 trading days up to, but not including, the Production Benefit buyback date.

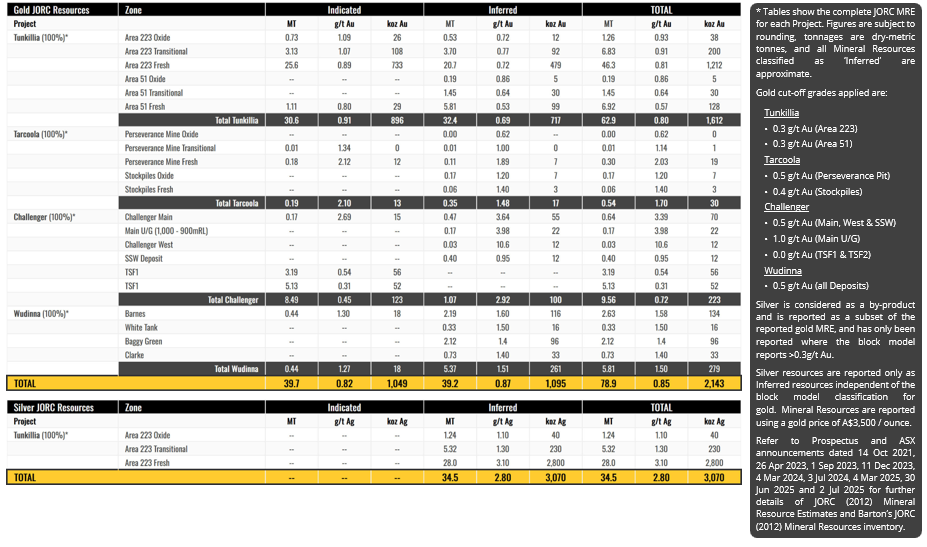

Updated Company JORC Mineral Resources Statement

Further to the MRE for the Wudinna Gold Project detailed in this announcement:*

Barton's total JORC (2012) Mineral Resources Au endowment is now 2.14Moz (78.9Mt @ 0.85 g/t Au); and

Barton's total JORC (2012) Mineral Resources Ag endowment is now 3.10Moz (34.5Mt @ 2.80 g/t Au).

Authorised by the Board of Directors of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

Competent Persons Statements

The information in this announcement that relates to the estimation and reporting of the gold Mineral Resource estimates for the Barns, Baggy Green and White Tank Deposits has been compiled by Mrs Christine Standing BSc Hons (Geology), MSc (Min Econs), MAusIMM, MAIG. Mrs Standing is a Member of the Australian Institute of Geoscientists and the Australian Institute of Mining and Metallurgy and is a full-time employee of Snowden Optiro (Optiro Pty Ltd) and has acted as an independent consultant. The information in this announcement that relates to the estimation and reporting of the gold Mineral Resource estimate for Clarke has been compiled by Ms Justine Tracey BSc Hons (Geology), MSc (Geostatistics), MAusIMM. Ms Tracey is a Member of the Australian Institute of Geoscientists and is a full-time employee of Snowden Optiro (Optiro Pty Ltd) and has acted as an independent consultant.

Mrs Christine Standing and Ms Justine Tracey have sufficient experience with the style of mineralisation, deposit type under consideration and to the activities undertaken to qualify as Competent Persons as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (The JORC Code). Mrs Standing and Ms Tracey consent to the inclusion in this announcement of the contained technical information relating the Mineral Resource estimations in the form and context in which it appears.

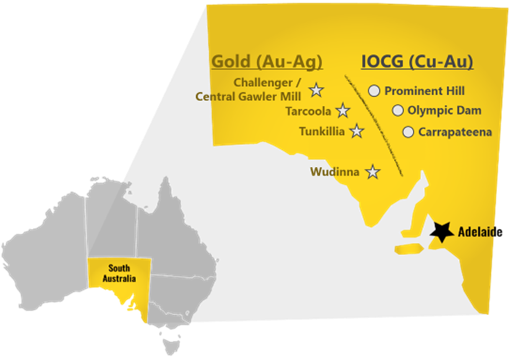

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 2.1Moz Au & 3.1Moz Ag JORC Mineral Resources (78.9Mt @ 0.85 g/t Au), brownfield mines, and

Challenger Gold Project

Tarcoola Gold Project

Tunkillia Gold Project

Wudinna Gold Project

|  |

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Wudinna Mineral Resource (Clarke Deposit) | Ms Justine Tracey | AusIMM | Member |

Wudinna Mineral Resource (all other Deposits) | Mrs Christine Standing | AusIMM / AIG | Member / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at or on the ASX website . The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 25 July 2025. Total Barton JORC (2012) Mineral Resources include 1,049koz Au (39.7Mt @ 0.82 g/t Au) in Indicated category and 1,095koz Au (39.2Mt @ 0.87 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

Cautionary Statement RegardingWudinna Gold Project MRE

The resource estimates contained herein were prepared in accordance with the JORC (2012) Code by the Competent Persons for Cobra Resource PLC in 2023. The information has not materially changed since it was last reported. Nothing causes Barton to question the accuracy or reliability of the Competent Persons estimates. Barton accepts the quoted estimates and the Competent Persons view that the resource classification appropriately reflects the deposit's knowledge level. It is possible that following evaluation and/or further exploration work the currently reported estimates may materially change and hence need to be reported afresh under and in accordance with the JORC (2012) Code. Barton has not independently validated the former owner's estimates and is not to be regarded as reporting, adopting, or endorsing those estimates.

Full disclosures are required to comply with ASX's "Mining Report Rules for Mining Entities: See Frequently Asked Questions" FAQ 37 (Appendix 1) .

APPENDIX 1

Additional Information in terms of ASX Mining FAQ 37 regarding the Wudinna Gold Project MRE. This material has also been previously published by Barton - refer to ASX announcement dated 2 July 2025.

Obligation under Question 37 | Answer |

The estimates have been reported by the former owner rather than the acquirer; |

|

State the source and date of the reporting of the estimates - the announcement must attach a copy of the original report of the estimates of Mineral Resources or Ore Reserves by the former owner or state the location where the report can be viewed by interested readers; |

|

Which edition of the JORC Code they were reported under and the fact that the reporting of those estimates may not conform to the requirements in the JORC Code 2012; |

|

The acquirer's view on the reliability of the estimates, including by reference to any of the criteria in Table 1 of the JORC Code 2012 which are relevant to understanding the reliability of estimates (in the case of Ore Reserves, the acquirer must specifically comment on the continuing reliability 19/22 of the applicable Modifying Factors, including the Economic Modifying Factor used by the former owner); |

|

A summary of the work programs on which the estimates were based and a summary of the key assumptions, mining and processing parameters and methods used to prepare the estimates; |

|

Any more recent estimates or data relevant to the reported mineralisation available to the entity; |

|

What evaluation and/or exploration work that needs to be completed to report the estimates as Mineral Resources or Ore Reserves in accordance with the JORC Code 2012; |

|

The proposed timing of any evaluation and/or exploration work that the acquirer intends to undertake and a comment on how the acquirer intends to fund that work; |

|

A statement by a named Competent Person(s) that the information in the market announcement provided is an accurate representation of the available data and studies for the material mining project; |

|

A cautionary statement proximate to, and with equal prominence as, the reported estimates stating that:

|

|

The announcement is not otherwise misleading. |

|

8 Refer to ASX announcement dated 27 May 2025

SOURCE: Barton Gold Holdings Limited

View the original on ACCESS Newswire