Ero Copper Intercepts 105 Meters at 1.54% CuEq¹ at Furnas Copper-Gold Project �� Successfully Completes Phase 1 Drill Program

Ero Copper (NYSE: ERO) has successfully completed its Phase 1 drill program at the Furnas Copper-Gold Project in Brazil's Carajás Mineral Province. The 28,000-meter program revealed significant results, including an impressive intercept of 105 meters at 1.54% CuEq in the Southeast zone.

Key highlights include extending mineralization to a maximum depth of 730 meters down-dip from surface, compared to the previous average depth of 300 meters. The program demonstrated strong continuity of high-grade mineralization, with only one of 66 holes failing to intercept mineralization. Currently, eight drill rigs are operating on the Phase 2 program, which will include at least 17,000 meters of drilling with increased focus on step-out drilling.

The company plans to use these results for an updated mineral resource estimate and a preliminary economic assessment (PEA), scheduled for completion in first half of 2026.

Ero Copper (NYSE: ERO) ha completato con successo il programma di perforazione di Fase 1 presso il progetto Furnas Copper-Gold nella provincia mineraria di Carajás, Brasile. Il programma di 28.000 metri ha rivelato risultati significativi, tra cui un notevole intervallo di 105 metri al 1,54% CuEq nella zona Sud-Est.

I punti salienti includono l'estensione della mineralizzazione fino a una profondità massima di 730 metri in discesa rispetto alla superficie, rispetto alla precedente profondità media di 300 metri. Il programma ha dimostrato una forte continuità di mineralizzazione ad alto tenore, con solo uno dei 66 fori senza intercettare mineralizzazione. Attualmente, otto trivelle sono operative nel programma di Fase 2, che prevederà almeno 17.000 metri di perforazioni con un maggiore focus sullo step-out drilling.

L'azienda prevede di utilizzare questi risultati per una stima aggiornata delle risorse minerarie e una valutazione economica preliminare (PEA), prevista per la prima metà del 2026.

Ero Copper (NYSE: ERO) ha completado con éxito su programa de perforación de Fase 1 en el Proyecto Furnas Copper-Gold en la Provincia Mineral de Carajás, Brasil. El programa de 28,000 metros reveló resultados significativos, incluyendo una impresionante intersección de 105 metros con 1.54% CuEq en la zona Sureste.

Los aspectos destacados incluyen la extensión de la mineralización a una profundidad máxima de 730 metros hacia abajo desde la superficie, en comparación con la profundidad media previa de 300 metros. El programa demostró una fuerte continuidad de mineralización de alta ley, con solo uno de 66 taladros sin interceptar mineralización. Actualmente, ocho equipos de perforación están operando en el programa de Fase 2, que incluirá al menos 17,000 metros de perforación con un mayor enfoque en perforaciones de extensión.

La compañía planea utilizar estos resultados para una estimación actualizada de recursos minerales y una evaluación económica preliminar (PEA), prevista para la primera mitad de 2026.

Ero Copper (NYSE: ERO)�� 브라�� 카라자스 광물 지대�� 위치�� Furnas Copper-Gold 프로젝트에서 1단계 시추 프로그램�� 성공적으�� 완료했습니다. 28,000미터�� 프로그램에서 동남부 지역에�� 1.54% CuEq�� 105미터 구간이라�� 인상적인 결과�� 얻었습니��.

주요 성과로는 이전 평균 깊이 300미터�� 비해 표면에서 최대 730미터 깊이까지 광물�� 연장�� 확인�� 점입니다. 프로그램은 66�� 시추�� �� �� 1개만 광물화를 놓칠 정도�� 고품�� 광물화의 강한 연속성을 보여주었습니��. 현재 8대�� 시추 장비가 2단계 프로그램에서 가�� 중이��, 최소 17,000미터 이상�� 시추�� 통해 확장 시추�� 중점�� �� 예정입니��.

회사�� �� 결과�� 바탕으로 광물 자원 추정치를 업데이트하고, 2026�� 상반�� 완료 예정�� 예비 경제�� 평가(PEA)�� 진행�� 계획입니��.

Ero Copper (NYSE : ERO) a mené à bien son programme de forage de phase 1 sur le projet Furnas Copper-Gold dans la province minérale de Carajás au Brésil. Le programme de 28 000 mètres a révélé des résultats significatifs, notamment une interception impressionnante de 105 mètres à 1,54 % CuEq dans la zone Sud-Est.

Les points clés incluent l'extension de la minéralisation jusqu'à une profondeur maximale de 730 mètres en plongée depuis la surface, contre une profondeur moyenne précédente de 300 mètres. Le programme a démontré une forte continuité de la minéralisation à haute teneur, avec seulement un des 66 trous ne rencontrant pas de minéralisation. Actuellement, huit foreuses sont en activité dans le cadre du programme de phase 2, qui comprendra au moins 17 000 mètres de forage avec un accent accru sur le forage d'extension.

La société prévoit d'utiliser ces résultats pour une mise à jour de l'estimation des ressources minérales et une évaluation économique préliminaire (PEA), prévue pour le premier semestre 2026.

Ero Copper (NYSE: ERO) hat sein Phase-1-Bohrprogramm beim Furnas Copper-Gold-Projekt in der Carajás-Mineralprovinz Brasiliens erfolgreich abgeschlossen. Das 28.000-Meter-Programm ergab bedeutende Ergebnisse, darunter einen beeindruckenden Abschnitt von 105 Metern mit 1,54% CuEq in der Südostzone.

Wichtige Highlights sind die Erweiterung der Mineralisierung auf eine maximale Tiefe von 730 Metern unter der Oberfläche, verglichen mit der bisherigen durchschnittlichen Tiefe von 300 Metern. Das Programm zeigte eine starke Kontinuität der hochgradigen Mineralisierung, wobei nur eines von 66 Bohrlöchern keine Mineralisierung antraf. Derzeit sind acht Bohrgeräte im Phase-2-Programm im Einsatz, das mindestens 17.000 Meter Bohrungen mit verstärktem Fokus auf Erweiterungsbohrungen umfassen wird.

Das Unternehmen plant, diese Ergebnisse für eine aktualisierte Mineralressourcenschätzung und eine vorläufige wirtschaftliche Bewertung (PEA) zu verwenden, die für die erste Hälfte 2026 geplant ist.

- Strong drill results with 105 meters at 1.54% CuEq, indicating high-grade mineralization

- Significant extension of mineralization depth from 300m to 730m, expanding resource potential

- Exceptional drilling success rate with 65 of 66 holes intercepting mineralization

- Eight drill rigs currently operating with additional 17,000-meter Phase 2 program underway

- PEA completion not expected until first half of 2026, indicating lengthy development timeline

- Only 10,000 meters of 28,000-meter program results received so far, creating uncertainty about full potential

Insights

Ero Copper's Furnas drill results show significant high-grade copper-gold intercepts extending mineralization depth by 150m, boosting underground mining potential.

Ero Copper's Phase 1 drilling at Furnas has delivered exceptional high-grade intercepts that substantially extend the deposit's known dimensions. The standout result of 105 meters at 1.54% copper equivalent demonstrates both the thickness and grade that make this deposit particularly attractive. Most significant is the successful extension of mineralization to 730 meters down-dip from surface - approximately 150 meters deeper than previously defined limits.

What's technically impressive is the continuity of mineralization, with only 1 of 66 holes missing the target zone. This exceptional hit rate dramatically reduces geological risk and suggests the deposit geometry is becoming well understood. The copper equivalent grades exceeding 1.5-2.0% place this firmly in the high-grade category for copper deposits globally, especially considering the substantial widths encountered.

The results are particularly meaningful considering they're from just ~36% (10,000m of 28,000m) of the Phase 1 program, with eight rigs now advancing the 17,000m Phase 2 campaign. This aggressive exploration approach signals management's confidence in the asset. The focus on defining high-grade zones (>1% CuEq) aligns perfectly with developing an efficient underground operation capable of producing high-margin ore.

The Carajás Mineral Province context adds significant value - this region hosts world-class deposits including Vale's massive operations. Ero's partnering with Vale Base Metals provides both validation and potential development advantages. With results feeding into both an updated resource estimate and preliminary economic assessment expected in H1 2026, Furnas is rapidly progressing from exploration to development stage, representing a potential step-change in Ero's production profile.

VANCOUVER, British Columbia, July 10, 2025 (GLOBE NEWSWIRE) -- Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or the “Company��) is pleased to announce the completion of its Phase 1 drill program at the Furnas Copper-Gold Project ("Furnas" or the "Project"), located in the Carajás Mineral Province in Pará State, Brazil.

Initial results from the completed 28,000-meter Phase 1 program are highlighted by significant down-dip intercepts, including:

- FURN-DD-00284: 105 meters at

1.17% copper and 0.77 grams per tonne ("gpt") gold (1.54% CuEq1), including 63 meters at1.30% copper and 1.13 gpt gold (1.84% CuEq1), drilled in the Southeast zone at the limit of the previously defined indicated resource; and,

- FURN-DD-00271: 75 meters at

1.02% copper and 0.59 gpt gold (1.30% CuEq1), including 30 meters at1.71% copper and 1.05 gpt gold (2.21% CuEq1), and 15 meters at2.30% copper and 1.60 gpt gold (3.06% CuEq1), also drilled in the Southeast zone, approximately 70 meters down-dip from the previously known extent of mineralization.

To date, assay results have been received for approximately 10,000 meters of the 28,000-meter drill program. The results continue to both demonstrate continuity and extend the known limits of mineralization within the high-grade mineralized zones (greater than

The Phase 1 drill program was primarily focused on confirming continuity of high-grade mineralization through infill drilling, as well as increasing confidence at the down-dip limits of the current mineral resource. The remaining portion of the program, approximately

1. Where applicable, copper equivalent ("CuEq") in this press release has been calculated using the following formula: Cu grade + (Au grade x 0.03215 x (

"The results from our Phase 1 drill program at Furnas are highly encouraging and reinforce the potential for Furnas to be a significant large-scale, high-grade underground mining operation," said Makko DeFilippo, President and Chief Executive Officer. "Extending high-grade mineralization to a down-dip depth of approximately 730 meters, while demonstrating strong high-grade continuity, is an important step in allowing us to evaluate the potential scale of a future mining operation alongside our partners at Vale Base Metals.

"We look forward to receiving the remaining assay results from the Phase 1 program and advancing the Phase 2 drill campaign to further inform the emerging potential of the Furnas �ʰ������.��

There are currently eight drill rigs operating on the Project, where the Phase 2 drill program is underway. This program is expected to comprise a minimum of 17,000 meters of drilling and includes a greater focus on step-out drilling aimed at further extending known mineralization.

The complete results from the Phase 1 drill program will serve as the foundation for an updated NI 43-101 mineral resource estimate as well as a preliminary economic assessment ("PEA") of the Project. The PEA, which was initiated earlier this year, remains on track for completion during the first half of 2026.

ABOUT THE FURNAS COPPER-GOLD PROJECT

Furnas is an iron oxide copper-gold deposit located approximately 50 kilometers southeast of Vale Base Metal's ("VBM") Salobo operations and approximately 190 kilometers northeast of Ero's Tucumã Operations. Covering an area of approximately 2,400 hectares, the Project sits within fifteen kilometers of extensive regional infrastructure, including paved roads, an industrial-scale cement plant, a power substation and Vale S.A.'s railroad loadout facility.

In July 2024, the Company signed a definitive earn-in agreement ("Agreement") with Salobo Metais S.A, a subsidiary of VBM, to earn a

Prior to the commencement of the Phase 1 drill program, the Company published an initial NI 43-101 mineral resource estimate on the Project, based on approximately 90,000 meters of historical drilling. This estimate underscored the significant potential of the Project. Using a

- Indicated Mineral Resource: 35.2 million tonnes grading

1.04% copper and 0.69 gpt gold (1.36% CuEq1), containing an estimated 364,700 tonnes of copper and 775,300 ounces of gold - Inferred Mineral Resource: 61.3 million tonnes grading

1.06% copper and 0.63 gpt gold (1.36% CuEq1), containing an estimated 647,400 tonnes of copper and 1,235,600 ounces of gold

For additional information on the Project's mineral resource estimate, please see the Company's press release dated October 2, 2024 as well as the corresponding technical report titled “Furnas Copper Project �� Para State, Brazil �� NI 43-101 Mineral Resource Estimate Technical Report��, dated November 18, 2024 with an effective date of June 30, 2024.

1. Where applicable, copper equivalent ("CuEq") in this press release has been calculated using the following formula: Cu grade + (Au grade x 0.03215 x (

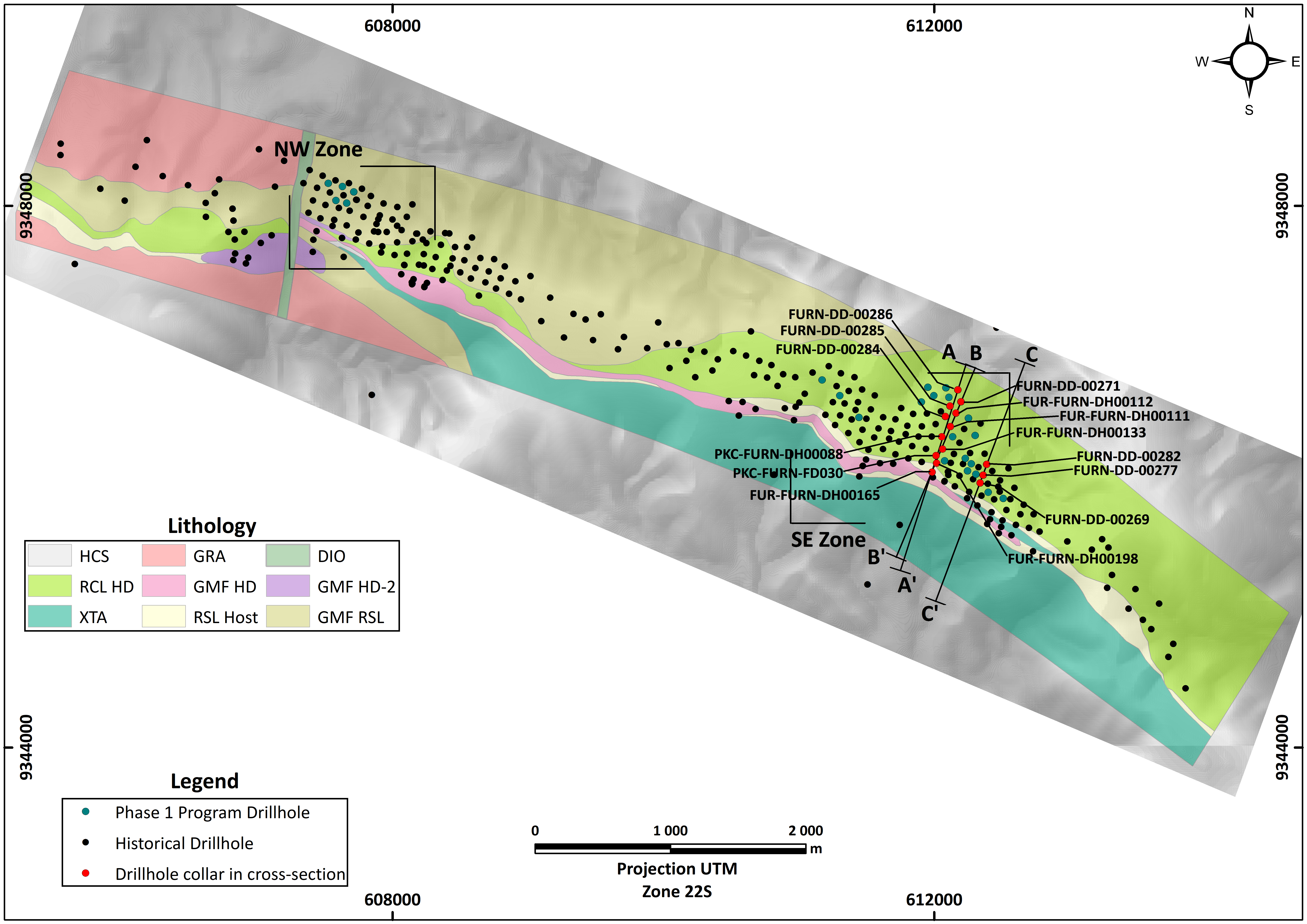

Figure 1: Furnas Plan View Map, including drill collar locations. Rock types include:

| Abbreviation | �� | Rock Type |

| �� | �� | �� |

| HCS | �� | Calcic-sodic hydrothermal rock |

| GRA | �� | Granite |

| DIO | �� | Diorite |

| RCL HD | �� | Chlorite-rich hydrothermal rock |

| GMF HD | �� | Grunerite-garnet-magnetite hydrothermal rock |

| GMF HD-2 | �� | Grunerite-garnet-magnetite hydrothermal rock |

| XTA | �� | Aluminous schist |

| RSL host | �� | Quartz-rich rock |

| GMF RSL | �� | Magnetite-rich hydrothermally altered rock / Quartz-rich rock |

| �� | �� | �� |

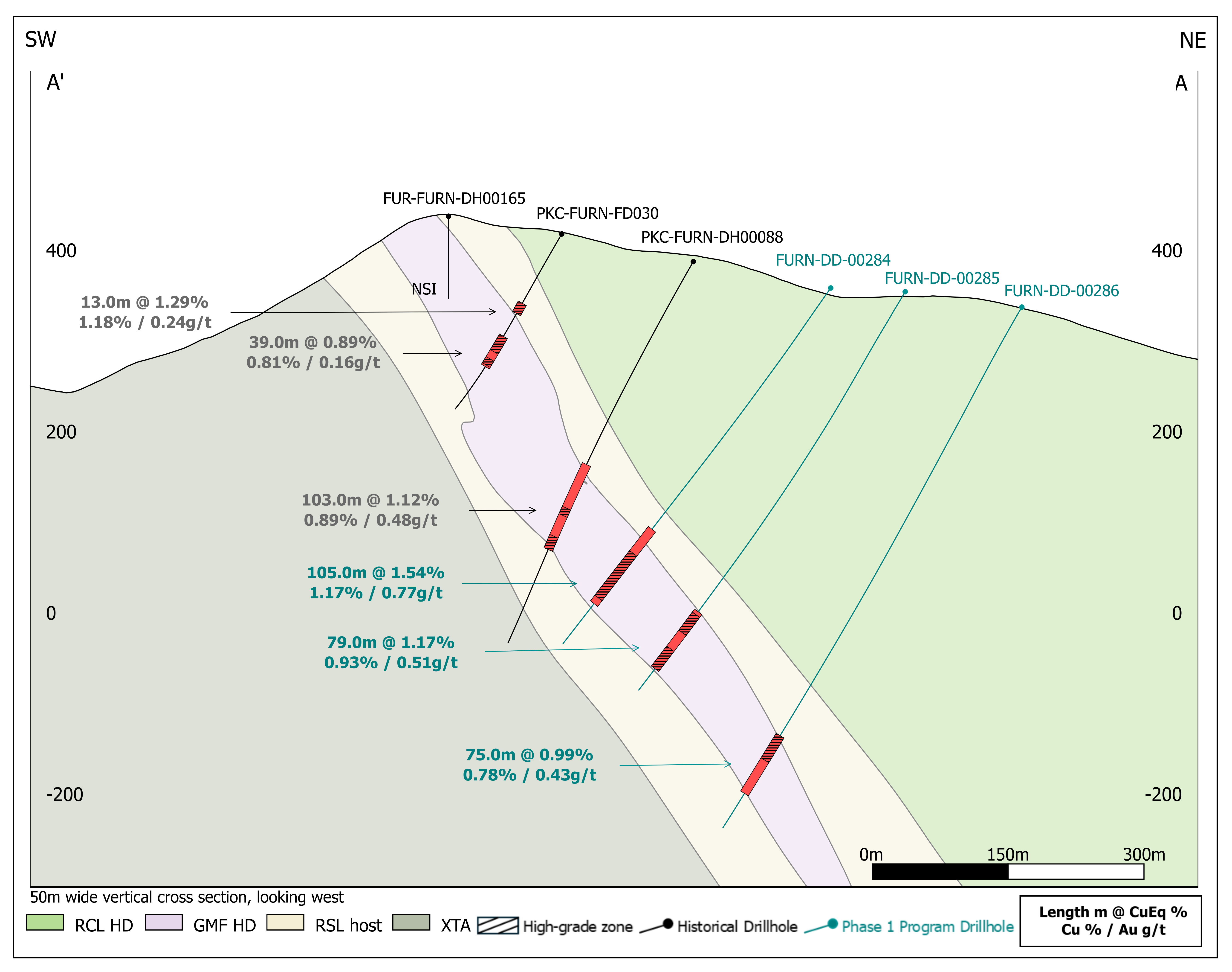

Figure 2: Cross section within the high-grade SE Zone of Furnas. Rock types include:

| Abbreviation | �� | Rock Type |

| �� | �� | �� |

| RCL HD | �� | Chlorite-rich hydrothermal rock |

| GMF HD | �� | Grunerite-garnet-magnetite hydrothermal rock |

| RSL host | �� | Quartz-rich rock |

| XTA | �� | Aluminous schist |

| �� | �� | �� |

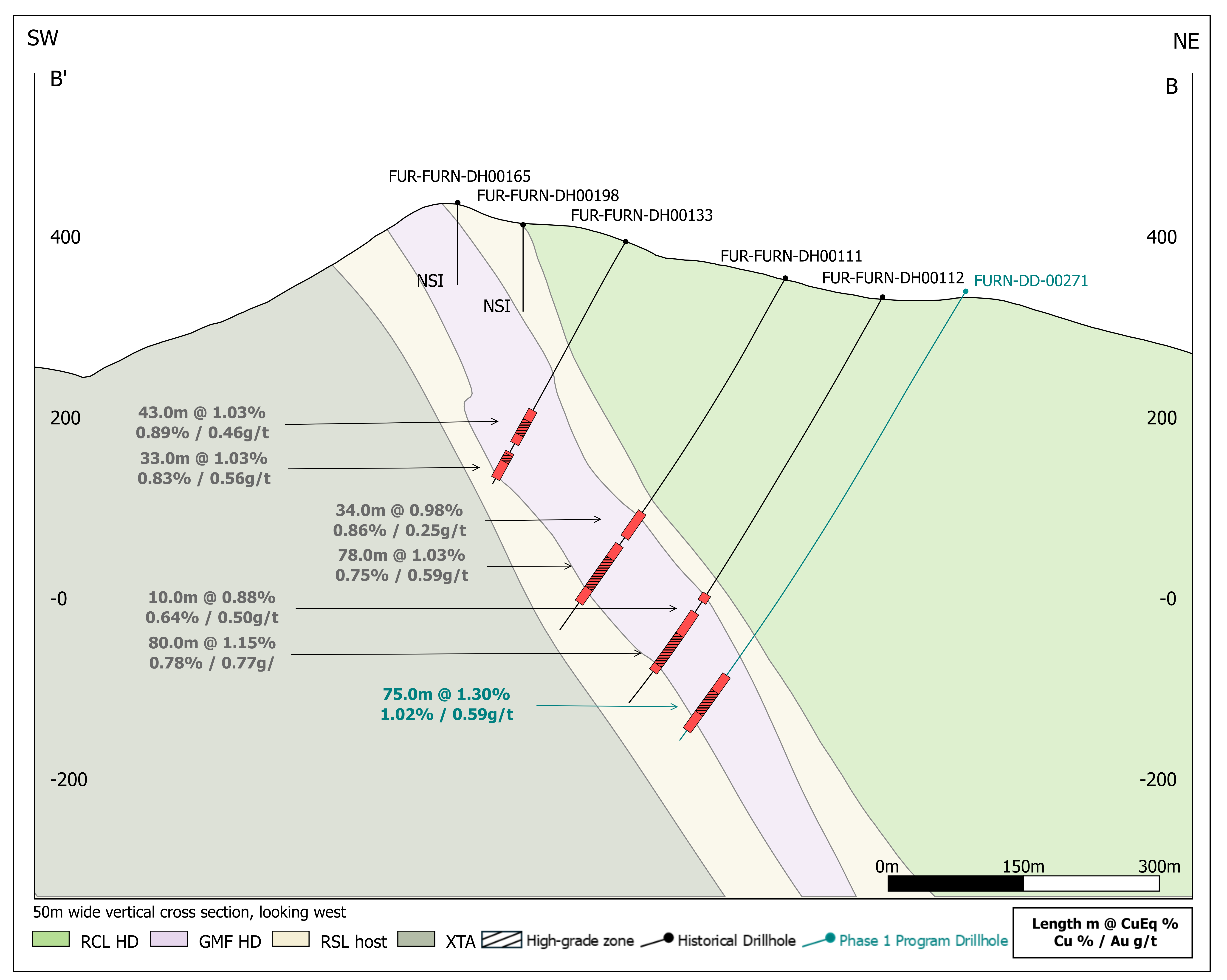

Figure 3: Cross section within the high-grade SE Zone of Furnas. Rock types include:

| Abbreviation | �� | Rock Type |

| �� | �� | �� |

| RCL HD | �� | Chlorite-rich hydrothermal rock |

| GMF HD | �� | Grunerite-garnet-magnetite hydrothermal rock |

| RSL host | �� | Quartz-rich rock |

| XTA | �� | Aluminous schist |

| �� | �� | �� |

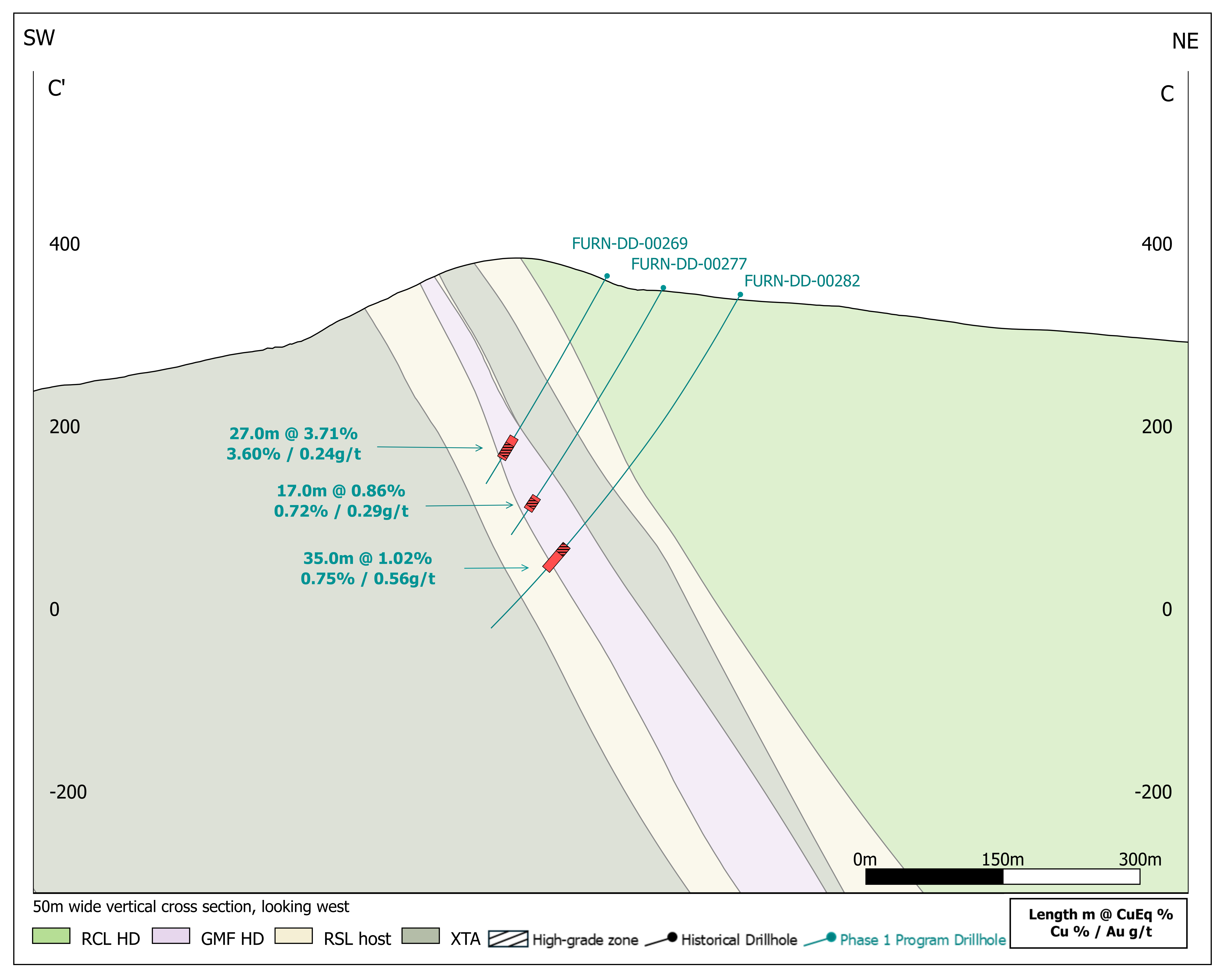

Figure 4: Cross section within the high-grade SE Zone of Furnas. Rock types include:

| Abbreviation | �� | Rock Type |

| �� | �� | �� |

| RCL HD | �� | Chlorite-rich hydrothermal rock |

| GMF HD | �� | Grunerite-garnet-magnetite hydrothermal rock |

| RSL host | �� | Quartz-rich rock |

| XTA | �� | Aluminous schist |

| �� | �� | �� |

DRILL RESULTS - SOUTHEAST ZONE

| Hole ID | �� | From (m) | �� | To (m) | �� | Length (m) | �� | Cu (%) | �� | Au (g/t) | �� | CuEq (%) |

| �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� |

| FURN-DD-00266 | �� | 463 | �� | 523 | �� | 60 | �� | 0.97 | �� | 0.71 | �� | 1.31 |

| incl | �� | 463 | �� | 505 | �� | 42 | �� | 1.11 | �� | 0.81 | �� | 1.50 |

| incl | �� | 495 | �� | 505 | �� | 10 | �� | 1.54 | �� | 1.35 | �� | 2.18 |

| FURN-DD-00267 | �� | 141 | �� | 214 | �� | 73 | �� | 0.93 | �� | 0.42 | �� | 1.13 |

| incl | �� | 170 | �� | 191 | �� | 21 | �� | 1.45 | �� | 0.73 | �� | 1.80 |

| FURN-DD-00268 | �� | 383 | �� | 454 | �� | 71 | �� | 0.79 | �� | 0.47 | �� | 1.01 |

| incl | �� | 410 | �� | 437 | �� | 27 | �� | 1.22 | �� | 0.73 | �� | 1.57 |

| incl | �� | 410 | �� | 418 | �� | 8 | �� | 1.73 | �� | 0.52 | �� | 1.98 |

| FURN-DD-00269 | �� | 204 | �� | 231 | �� | 27 | �� | 3.60 | �� | 0.24 | �� | 3.71 |

| incl | �� | 213 | �� | 228 | �� | 15 | �� | 5.98 | �� | 0.20 | �� | 6.08 |

| FURN-DD-00270 | �� | No Significant Intercept1 | ||||||||||

| FURN-DD-00271 | �� | 501 | �� | 576 | �� | 75 | �� | 1.02 | �� | 0.59 | �� | 1.30 |

| incl | �� | 523 | �� | 553 | �� | 30 | �� | 1.71 | �� | 1.05 | �� | 2.21 |

| incl | �� | 538 | �� | 553 | �� | 15 | �� | 2.30 | �� | 1.60 | �� | 3.06 |

| FURN-DD-00272 | �� | 396 | �� | 463 | �� | 67 | �� | 0.67 | �� | 0.47 | �� | 0.89 |

| incl | �� | 397 | �� | 411 | �� | 14 | �� | 0.89 | �� | 0.64 | �� | 1.20 |

| FURN-DD-00273 | �� | 214 | �� | 244 | �� | 30 | �� | 0.97 | �� | 0.37 | �� | 1.15 |

| incl | �� | 232 | �� | 245 | �� | 13 | �� | 1.23 | �� | 0.12 | �� | 1.29 |

| FURN-DD-00274 | �� | 475 | �� | 546 | �� | 71 | �� | 0.96 | �� | 0.37 | �� | 1.14 |

| incl | �� | 522 | �� | 546 | �� | 24 | �� | 1.44 | �� | 0.47 | �� | 1.66 |

| FURN-DD-00275 | �� | 209 | �� | 246 | �� | 37 | �� | 0.97 | �� | 0.47 | �� | 1.19 |

| incl | �� | 209 | �� | 228 | �� | 19 | �� | 1.13 | �� | 0.56 | �� | 1.40 |

| FURN-DD-00276 | �� | 176 | �� | 199 | �� | 23 | �� | 1.27 | �� | 0.63 | �� | 1.57 |

| incl | �� | 178 | �� | 192 | �� | 14 | �� | 1.55 | �� | 0.87 | �� | 1.97 |

| FURN-DD-00277 | �� | 268 | �� | 285 | �� | 17 | �� | 0.72 | �� | 0.29 | �� | 0.86 |

| incl | �� | 272 | �� | 281 | �� | 9 | �� | 0.85 | �� | 0.38 | �� | 1.03 |

| FURN-DD-00278 | �� | 296 | �� | 328 | �� | 32 | �� | 0.62 | �� | 0.29 | �� | 0.76 |

| incl | �� | 306 | �� | 322 | �� | 16 | �� | 0.85 | �� | 0.34 | �� | 1.01 |

| FURN-DD-00279 | �� | 252 | �� | 280 | �� | 28 | �� | 1.06 | �� | 0.36 | �� | 1.23 |

| incl | �� | 266 | �� | 278 | �� | 12 | �� | 1.36 | �� | 0.14 | �� | 1.43 |

| FURN-DD-00282 | �� | 335 | �� | 370 | �� | 35 | �� | 0.75 | �� | 0.56 | �� | 1.02 |

| incl | �� | 335 | �� | 347 | �� | 12 | �� | 0.89 | �� | 0.77 | �� | 1.26 |

| FURN-DD-00284 | �� | 332 | �� | 437 | �� | 105 | �� | 1.17 | �� | 0.77 | �� | 1.54 |

| incl | �� | 366 | �� | 429 | �� | 63 | �� | 1.30 | �� | 1.13 | �� | 1.84 |

| FURN-DD-00285 | �� | 421 | �� | 500 | �� | 79 | �� | 0.93 | �� | 0.51 | �� | 1.17 |

| incl | �� | 425 | �� | 450 | �� | 25 | �� | 1.32 | �� | 0.52 | �� | 1.57 |

| incl | �� | 472 | �� | 500 | �� | 28 | �� | 1.09 | �� | 0.81 | �� | 1.48 |

| FURN-DD-00286 | �� | 543 | �� | 618 | �� | 75 | �� | 0.78 | �� | 0.43 | �� | 0.99 |

| incl | �� | 543 | �� | 575 | �� | 32 | �� | 1.05 | �� | 0.63 | �� | 1.35 |

| FURN-DD-00287 | �� | 259 | �� | 304 | �� | 45 | �� | 0.75 | �� | 0.57 | �� | 1.02 |

| incl | �� | 281 | �� | 302 | �� | 21 | �� | 1.02 | �� | 0.93 | �� | 1.46 |

| FURN-DD-00288 | �� | 207 | �� | 293 | �� | 86 | �� | 0.71 | �� | 0.24 | �� | 0.82 |

| incl | �� | 274 | �� | 293 | �� | 19 | �� | 1.37 | �� | 0.33 | �� | 1.53 |

| FURN-DD-00289 | �� | 295 | �� | 401 | �� | 106 | �� | 0.65 | �� | 0.32 | �� | 0.80 |

| incl | �� | 304 | �� | 351 | �� | 47 | �� | 0.83 | �� | 0.31 | �� | 0.98 |

| FURN-DD-00290 | �� | 192 | �� | 251 | �� | 59 | �� | 0.65 | �� | 0.25 | �� | 0.77 |

| incl | �� | 217 | �� | 250 | �� | 33 | �� | 0.81 | �� | 0.31 | �� | 0.96 |

| FURN-DD-00293 | �� | 280 | �� | 371 | �� | 91 | �� | 1.08 | �� | 0.25 | �� | 1.20 |

| incl | �� | 331 | �� | 371 | �� | 40 | �� | 1.77 | �� | 0.37 | �� | 1.95 |

| �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� |

1This drill hole intercepted a non-mineralized dike west of the main southeast zone.

DRILL HOLE INFORMATION

| Hole ID | �� | Easting | �� | Northing | �� | Elevation | �� | Azimuth | �� | Dip | �� | Length (m) |

| �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� | �� |

| FURN-DD-00266 | �� | 611,998 | �� | 9,346,599 | �� | 364 | �� | 200 | �� | 60 | �� | 600.1 |

| FURN-DD-00267 | �� | 612,078 | �� | 9,346,117 | �� | 405 | �� | 200 | �� | 60 | �� | 255.1 |

| FURN-DD-00268 | �� | 611,905 | �� | 9,346,552 | �� | 356 | �� | 200 | �� | 60 | �� | 495.9 |

| FURN-DD-00269 | �� | 612,340 | �� | 9,345,954 | �� | 364 | �� | 200 | �� | 60 | �� | 263.7 |

| FURN-DD-00270 | �� | 611,172 | �� | 9,346,715 | �� | 408 | �� | 200 | �� | 60 | �� | 331.3 |

| FURN-DD-00271 | �� | 612,199 | �� | 9,346,554 | �� | 339 | �� | 200 | �� | 60 | �� | 590.0 |

| FURN-DD-00272 | �� | 612,303 | �� | 9,346,305 | �� | 304 | �� | 200 | �� | 60 | �� | 507.4 |

| FURN-DD-00273 | �� | 612,511 | �� | 9,345,840 | �� | 361 | �� | 200 | �� | 60 | �� | 266.7 |

| FURN-DD-00274 | �� | 612,109 | �� | 9,346,587 | �� | 358 | �� | 200 | �� | 60 | �� | 576.9 |

| FURN-DD-00275 | �� | 612,247 | �� | 9,346,043 | �� | 402 | �� | 200 | �� | 55 | �� | 300.5 |

| FURN-DD-00276 | �� | 612,400 | �� | 9,345,886 | �� | 372 | �� | 200 | �� | 60 | �� | 272.0 |

| FURN-DD-00277 | �� | 612,362 | �� | 9,346,012 | �� | 351 | �� | 200 | �� | 60 | �� | 318.0 |

| FURN-DD-00278 | �� | 612,275 | �� | 9,346,096 | �� | 383 | �� | 200 | �� | 60 | �� | 362.3 |

| FURN-DD-00279 | �� | 612,309 | �� | 9,346,018 | �� | 374 | �� | 200 | �� | 60 | �� | 343.0 |

| FURN-DD-00282 | �� | 612,388 | �� | 9,346,092 | �� | 344 | �� | 200 | �� | 60 | �� | 459.0 |

| FURN-DD-00284 | �� | 612,083 | �� | 9,346,445 | �� | 358 | �� | 200 | �� | 55 | �� | 493.7 |

| FURN-DD-00285 | �� | 612,117 | �� | 9,346,522 | �� | 354 | �� | 200 | �� | 60 | �� | 530.1 |

| FURN-DD-00286 | �� | 612,175 | �� | 9,346,641 | �� | 336 | �� | 200 | �� | 60 | �� | 663.1 |

| FURN-DD-00287 | �� | 612,230 | �� | 9,346,136 | �� | 366 | �� | 200 | �� | 60 | �� | 382.4 |

| FURN-DD-00288 | �� | 607,661 | �� | 9,348,020 | �� | 270 | �� | 200 | �� | 60 | �� | 500.6 |

| FURN-DD-00289 | �� | 607,713 | �� | 9,348,103 | �� | 253 | �� | 200 | �� | 60 | �� | 407.6 |

| FURN-DD-00290 | �� | 607,581 | �� | 9,348,040 | �� | 252 | �� | 200 | �� | 60 | �� | 456.9 |

| FURN-DD-00293 | �� | 612,137 | �� | 9,346,294 | �� | 359 | �� | 200 | �� | 60 | �� | 465.8 |

NOTE ON NI 43-101 COMPLIANT TECHNICAL REPORT

The conversion of drill results presented in this press release into NI 43-101 compliant mineral resources or mineral reserves requires additional work and analysis that remains ongoing. Additional drilling and technical work are required to determine whether the results related to down-dip intercepts will be included in future NI 43-101 compliant mineral resource or reserve estimates.

QUALIFIED PERSON

Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148) of Ero Copper, a Qualified Person as defined in NI 43-101, has reviewed this press release on behalf of the Company and has approved the scientific and technical information contained in this press release.

QUALITY ASSURANCE & QUALITY CONTROL

Current QA/QC Program

At the Project, the Company is currently drilling with third-party contracted core drill rigs, operated by Major Drilling Group International Inc. and Drillgeo Geologia e Sondagem Ltda.���� independent contractors engaged from October 2024 to July 2025. Drill core is logged, photographed and split in half using a diamond core saw at the Company's core logging and storage facilities. Half of the drill core is retained on site and the other half-core is used for analysis, with samples collected at a minimum of 1.5 meters and a maximum of 2.5 meters with an average length of 2.0 meters. Sampling commences at least 3.0 meters before the start of the mineralized zone and continues at least 3.0 meters beyond the limit of the mineralized zone. Sample collection is performed at the Company's logging facilities with all sample preparation performed at ALS Brasil Ltda.'s laboratory, located in Parauapebas (PA), Brazil, who is independent of the Company. Samples are analyzed by the certified laboratory of ALS Peru S.A., who is independent of the Company. Copper content is determined by four- acid digestion followed by ICP-MS analysis, while gold content is analyzed using fire assay with ICP-AES. When copper grades exceed

QA/QC Validation

The QA/QC validation process undertaken for the Phase 1 drill program of the Project is consistent with the process set out in the NI 43-101 technical report with respect to Furnas , titled “Furnas Copper Project �� Para State, Brazil �� NI 43-101 Mineral Resource Estimate Technical Report��, dated November 18, 2024 with an effective date of June 30, 2024 and Ero’s internal guidelines and best practices.

NOTES ON MINERAL RESOURCES

The Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards (2014) were used for reporting mineral resources, which are effective as at June 30, 2024 and presented on a

Mineral resource estimates are prepared by or under the supervision of and verified by Mr. Cid Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148).��Mr. Monteiro is Manager, Resources & Reserves of the Company and is a “qualified person�� within the meanings of NI 43-101.

Mineral resources have been estimated using a copper price of US

ABOUT ERO COPPER CORP

Ero Copper is a high-margin, high-growth copper producer with operations in Brazil and corporate headquarters in Vancouver, B.C. The Company's primary asset is a

FOR MORE INFORMATION, PLEASE CONTACT

Courtney Lynn, Executive Vice President, External Affairs and Strategy (604) 335-7504

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking statements�� within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information�� within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements��). Forward-looking statements include statements that use forward-looking terminology such as “may��, “could��, “would��, “will��, “should��, “intend��, “target��, “plan��, “expect��, “budget��, “estimate��, “forecast��, “schedule��, “anticipate��, “believe��, “continue��, “potential��, “view�� or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Forward-looking statements may include, but are not limited to, statements with respect to the future drilling continuing to demonstrate continuity of high grade mineralization at depth, Ero's ability to complete the required 17,000 meter Phase 2 drill program and deliver a preliminary economic assessment during the first half of 2026, and any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual results, actions, events, conditions, performance or achievements to materially differ from those expressed or implied by the forward-looking statements, including, without limitation, risks discussed in this press release and in the Company’s most recent Annual Information Form (“AIF��) under the heading “Risk Factors��. The risks discussed in this press release and in the AIF are not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results, actions, events, conditions, performance or achievements to differ materially from those contained in forward-looking statements, there may be other factors that cause results, actions, events, conditions, performance or achievements to differ from those anticipated, estimated or intended.

Forward-looking statements are not a guarantee of future performance. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve statements about the future and are inherently uncertain, and the Company’s actual results, achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to herein and in the AIF under the heading “Risk Factors��.

The Company’s forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management on the date the statements are made, many of which may be difficult to predict and beyond the Company’s control. In connection with the forward-looking statements contained in this press release and in the AIF, the Company has made certain assumptions about, among other things: favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper, gold and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the Caraíba Operations, the Xavantina Operations, the Tucumã Operation and the Furnas Copper-Gold Project being as described in the respective technical report for each property; production costs; the accuracy of budgeted exploration, development and construction costs and expenditures; the price of other commodities such as fuel; future currency exchange rates, interest rates and tariff rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continuing to remain healthy in the face of prevailing epidemics, pandemics or other health risks, political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. Although the Company believes that the assumptions inherent in forward-looking statements are reasonable as of the date of this press release, these assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. The Company cautions that the foregoing list of assumptions is not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking statements contained in this press release. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all reserve and resource estimates included in this press release and the documents incorporated by reference herein have been prepared in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects and the CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards��). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC��), and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this press release and the documents incorporated by reference herein use the terms “measured resources,�� “indicated resources�� and “inferred resources�� as defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property disclosure requirements in the United States (the “U.S. Rules��) are governed by subpart 1300 of Regulation S-K of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act��) which differ from the CIM Standards. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system (the “MJDS��), Ero is not required to provide disclosure on its mineral properties under the U.S. Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If Ero ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the MJDS, then Ero will be subject to the U.S. Rules, which differ from the requirements of NI 43-101 and the CIM Standards.

Pursuant to the new U.S. Rules, the SEC recognizes estimates of “measured mineral resources��, “indicated mineral resources�� and “inferred mineral resources��. In addition, the definitions of “proven mineral reserves�� and “probable mineral reserves�� under the U.S. Rules are now “substantially similar�� to the corresponding standards under NI 43-101. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that Ero reports are or will be economically or legally mineable. Further, “inferred mineral resources�� have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Under Canadian securities laws, estimates of “inferred mineral resources�� may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms under the U.S. Rules are “substantially similar�� to the standards under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Ero may report as “proven mineral reserves��, “probable mineral reserves��, “measured mineral resources��, “indicated mineral resources�� and “inferred mineral resources�� under NI 43-101 would be the same had Ero prepared the reserve or resource estimates under the standards adopted under the U.S. Rules.

Photos��accompanying this announcement are available at