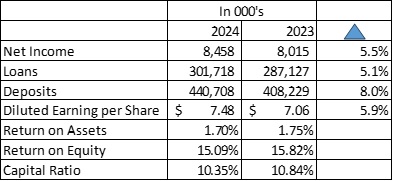

Trinity Bank Reports Results for 2024 Net Income Up 5.5% to $8,458,000 Return on Assets 1.70%

Trinity Bank N.A. (TYBT) reported strong financial results for Q4 and full-year 2024. Net Income after Taxes reached $8,458,000 in 2024, a 5.5% increase from $8,015,000 in 2023. Earnings per diluted share grew to $7.48, up 5.9% from $7.06 in 2023.

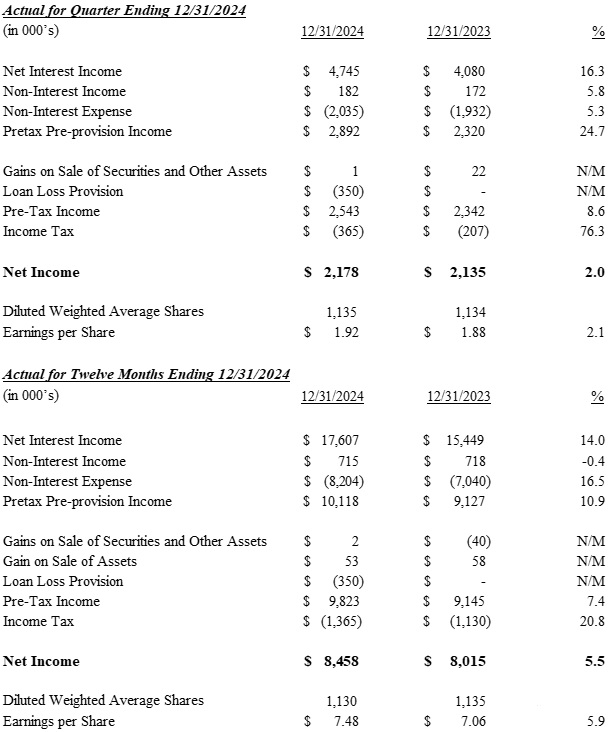

Q4 2024 was the most profitable quarter in the bank's history, with Net Income of $2,178,000, up 2.0% from Q4 2023. Key metrics include:

- Interest income increased 18.8% to $28,579,000

- Net Interest Income grew 14.0% to $17,607,000

- Total deposits increased 8.0% to $440,708,000

- Return on average assets was 1.70%

The bank reported strong growth in loans and deposits, with improved loan demand noted after the November election. Management remains focused on sound banking principles while investing in infrastructure, people, and technology for future growth.

Trinity Bank N.A. (TYBT) ha riportato risultati finanziari solidi per il quarto trimestre e per l'intero anno 2024. L'utile netto dopo le tasse ha raggiunto 8.458.000 dollari nel 2024, un aumento del 5,5% rispetto a 8.015.000 dollari nel 2023. L'utile per azione diluita è aumentato a 7,48 dollari, in crescita del 5,9% rispetto a 7,06 dollari nel 2023.

Il quarto trimestre del 2024 è stato il trimestre più profittevole nella storia della banca, con un utile netto di 2.178.000 dollari, in aumento del 2,0% rispetto al quarto trimestre del 2023. I principali indicatori comprendono:

- Il reddito da interessi è aumentato del 18,8%, raggiungendo 28.579.000 dollari

- Il reddito netto da interessi è cresciuto del 14,0%, toccando 17.607.000 dollari

- Il totale dei depositi è aumentato dell'8,0%, arrivando a 440.708.000 dollari

- Il rendimento medio degli attivi è stato dell'1,70%

La banca ha riportato una forte crescita nei prestiti e nei depositi, con una domanda di prestiti migliorata dopo le elezioni di novembre. La gestione rimane concentrata su principi bancari solidi, investendo in infrastrutture, persone e tecnologia per una crescita futura.

Trinity Bank N.A. (TYBT) reportó fuertes resultados financieros para el cuarto trimestre y el año completo 2024. El ingreso neto después de impuestos alcanzó los 8,458,000 dólares en 2024, un aumento del 5.5% respecto a 8,015,000 dólares en 2023. Las ganancias por acción diluida crecieron a 7.48 dólares, un incremento del 5.9% desde 7.06 dólares en 2023.

El cuarto trimestre de 2024 fue el trimestre más rentable en la historia del banco, con un ingreso neto de 2,178,000 dólares, un aumento del 2.0% con respecto al cuarto trimestre de 2023. Las métricas clave incluyen:

- Los ingresos por intereses aumentaron un 18.8% a 28,579,000 dólares

- El ingreso neto por intereses creció un 14.0% a 17,607,000 dólares

- Los depósitos totales aumentaron un 8.0% a 440,708,000 dólares

- El retorno sobre activos promedio fue del 1.70%

El banco reportó un fuerte crecimiento en préstamos y depósitos, con una demanda de préstamos mejorada después de las elecciones de noviembre. La dirección sigue enfocada en principios bancarios sólidos mientras invierte en infraestructura, personas y tecnología para un crecimiento futuro.

트리니티 뱅크 N.A. (TYBT)�� 2024�� 4분기 �� 연간 강력�� 재무 결과�� 보고했습니다. 2024�� 세후 순이익은 8,458,000달러�� 달하��, 2023�� 8,015,000달러에서 5.5% 증가했습니다. 희석주당순이익은 7.48달러�� 증가하며, 2023년의 7.06달러에서 5.9% 증가했습니다.

2024�� 4분기�� 은�� 역사�� 가�� 수익성이 높은 분기��, 4분기 순이익은 2,178,000달러�� 2023�� 4분기보다 2.0% 증가했습니다. 주요 지표는 다음�� 같습니다:

- 이자 수익은 18.8% 증가하여 28,579,000달러�� 달했습니��.

- 순이�� 수익은 14.0% 증가하여 17,607,000달러�� 달했습니��.

- �� 예금은 8.0% 증가하여 440,708,000달러�� 도달했습니다.

- 평균 자산 수익률은 1.70%였습니��.

은행은 대�� �� 예금�� 강력�� 성장�� 보고했으��, 11�� 선거 이후 대�� 수요가 개선되었습니��. 경영진은 향후 성장�� 위해 인프��, 인재 �� 기술�� 투자하는 한편 건전�� 은�� 원칙�� 집중하고 있습니다.

Trinity Bank N.A. (TYBT) a annoncé de solides résultats financiers pour le quatrième trimestre et pour l'ensemble de l'année 2024. Le revenu net après impôts a atteint 8 458 000 dollars en 2024, une augmentation de 5,5 % par rapport à 8 015 000 dollars en 2023. Le bénéfice par action diluée a augmenté à 7,48 dollars, soit une hausse de 5,9 % par rapport à 7,06 dollars en 2023.

Le quatrième trimestre 2024 a été le trimestre le plus rentable de l'histoire de la banque, avec un revenu net de 2 178 000 dollars, en hausse de 2,0 % par rapport au quatrième trimestre 2023. Les indicateurs clés comprennent :

- Le revenu d'intérêts a augmenté de 18,8 % pour atteindre 28 579 000 dollars

- Le revenu net d'intérêts a crû de 14,0 % pour atteindre 17 607 000 dollars

- Le total des dépôts a augmenté de 8,0 % pour atteindre 440 708 000 dollars

- Le rendement sur les actifs moyens était de 1,70 %

La banque a signalé une forte croissance des prêts et des dépôts, avec une demande de prêts améliorée après les élections de novembre. La direction reste concentrée sur des principes bancaires solides tout en investissant dans des infrastructures, des personnes et des technologies pour une croissance future.

Trinity Bank N.A. (TYBT) hat für das vierte Quartal und das gesamte Jahr 2024 starke Finanzdaten gemeldet. Der Nettogewinn nach Steuern betrug 8.458.000 US-Dollar im Jahr 2024, was einem Anstieg von 5,5% gegenüber 8.015.000 US-Dollar im Jahr 2023 entspricht. Der Gewinn pro verwässerter Aktie stieg auf 7,48 US-Dollar, ein Anstieg von 5,9% gegenüber 7,06 US-Dollar im Jahr 2023.

Das vierte Quartal 2024 war das profitabelste Quartal in der Geschichte der Bank, mit einem Nettogewinn von 2.178.000 US-Dollar, was einem Anstieg von 2,0% gegenüber dem vierten Quartal 2023 entspricht. Zu den wichtigen Kennzahlen gehören:

- Die Zinserträge stiegen um 18,8% auf 28.579.000 US-Dollar

- Der Nettozinsertrag wuchs um 14,0% auf 17.607.000 US-Dollar

- Die Gesamteinlagen erhöhten sich um 8,0% auf 440.708.000 US-Dollar

- Die Rendite auf durchschnittliche Aktiva betrug 1,70%

Die Bank berichtete von einem starken Wachstum bei Darlehen und Einlagen, wobei nach den Wahlen im November eine verbesserte Darlehensnachfrage verzeichnet wurde. Das Management konzentriert sich weiterhin auf solide Bankgrundsätze und investiert in Infrastruktur, Personal und Technologie für zukünftiges Wachstum.

- Record-breaking Q4 and full-year 2024 net income

- Net Income increased 5.5% to $8,458,000 in 2024

- Interest income grew 18.8% to $28,579,000

- Net Interest Income up 14.0% to $17,607,000

- Total deposits increased 8.0% to $440,708,000

- Strong return on assets at 1.70%

- Interest expense increased 27.4% to $10,972,000

- Non-interest expenses up 16.5% to $8,204,000

- Nonperforming assets increased to $1,047,000 in Q4 2024 from $658,000 in Q4 2023

FORT WORTH, TX / / February 5, 2025 / Trinity Bank N.A. (OTC PINK:TYBT) today announced operating results for the fourth quarter and the twelve months ending December 31, 2024.

Results of Operation

For the fourth quarter 2024, Trinity Bank, N.A. reported Net Income after Taxes of

For 2024, Net Income after Taxes was

Co-Chairman and CEO Matt R. Opitz stated, "We are pleased with both our fourth quarter and full year 2024 results. The fourth quarter was the most profitable quarter and 2024 was the most profitable year in history for Trinity Bank. We finished the year with strong growth in net income, loans and deposits."

"We have seen significant improvements in loan demand since the election in November. Further, corporate confidence throughout the State of Texas continues to increase, post-election, which is very encouraging as we embark on the new year."

"As we move into 2025, we remain focused on our commitment to remain true to the same sound banking principles and management practices that have made Trinity Bank successful over its 22-year history. We will also continue to invest in our people, facilities, technology and processes to ensure we have the proper infrastructure to remain positioned to take advantage of opportunities for continued growth not only in 2025 but for years to come."

"As always, thank you to our dedicated staff. Without them and their commitment to remaining focused on providing exceptional customer experiences, results like these would not be achievable."

Page 2 - Trinity Bank fourth quarter 2024 earnings

Page 3 - Trinity Bank fourth quarter 2024 earnings

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ended |

|

| Twelve Months Ending |

| |||||||||||||||||||

| December 31 |

|

| % |

|

| December 31 |

|

| % |

| |||||||||||||

EARNINGS SUMMARY |

| 2024 |

|

| 2023 |

|

| Change |

|

| 2024 |

|

| 2023 |

|

| Change |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Interest income |

| $ | 7,426 |

|

| $ | 6,818 |

|

|

| 8.9 | % |

| $ | 28,579 |

|

| $ | 24,060 |

|

|

| 18.8 | % |

Interest expense |

|

| 2,681 |

|

|

| 2,738 |

|

|

| -2.1 | % |

|

| 10,972 |

|

|

| 8,611 |

|

|

| 27.4 | % |

Net Interest Income |

|

| 4,745 |

|

|

| 4,080 |

|

|

| 16.3 | % |

|

| 17,607 |

|

|

| 15,449 |

|

|

| 14.0 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Service charges on deposits |

|

| 70 |

|

|

| 55 |

|

|

| 27.3 | % |

|

| 256 |

|

|

| 247 |

|

|

| 3.6 | % |

Other income |

|

| 112 |

|

|

| 117 |

|

|

| -4.3 | % |

|

| 459 |

|

|

| 471 |

|

|

| -2.5 | % |

Total Non Interest Income |

|

| 182 |

|

|

| 172 |

|

|

| 5.8 | % |

|

| 715 |

|

|

| 718 |

|

|

| -0.4 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Salaries and benefits expense |

|

| 1,343 |

|

|

| 1,314 |

|

|

| 2.2 | % |

|

| 5,254 |

|

|

| 4,699 |

|

|

| 11.8 | % |

Occupancy and equipment expense |

|

| 117 |

|

|

| 109 |

|

|

| 7.3 | % |

|

| 495 |

|

|

| 454 |

|

|

| 9.0 | % |

Other expense |

|

| 575 |

|

|

| 509 |

|

|

| 13.0 | % |

|

| 2,455 |

|

|

| 1,887 |

|

|

| 30.1 | % |

Total Non Interest Expense |

|

| 2,035 |

|

|

| 1,932 |

|

|

| 5.3 | % |

|

| 8,204 |

|

|

| 7,040 |

|

|

| 16.5 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pretax pre-provision income |

|

| 2,892 |

|

|

| 2,320 |

|

|

| 24.7 | % |

|

| 10,118 |

|

|

| 9,127 |

|

|

| 10.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gain on sale of Securities |

|

| 1 |

|

|

| (36 | ) |

|

| N/M |

|

|

| 2 |

|

|

| (40 | ) |

|

| N/M |

|

Gain on sale of Assets |

|

| 0 |

|

|

| 58 |

|

|

| N/M |

|

|

| 53 |

|

|

| 58 |

|

|

| N/M |

|

Provision for Loan Losses |

|

| 350 |

|

|

| 0 |

|

|

| N/M |

|

|

| 350 |

|

|

| 0 |

|

|

| N/M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earnings before income taxes |

|

| 2,543 |

|

|

| 2,342 |

|

|

| 8.6 | % |

|

| 9,823 |

|

|

| 9,145 |

|

|

| 7.4 | % |

Provision for income taxes |

|

| 365 |

|

|

| 207 |

|

|

| 76.3 | % |

|

| 1,365 |

|

|

| 1,130 |

|

|

| 20.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Earnings |

| $ | 2,178 |

|

| $ | 2,135 |

|

|

| 2.0 | % |

| $ | 8,458 |

|

| $ | 8,015 |

|

|

| 5.5 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic earnings per share |

|

| 2.01 |

|

|

| 1.96 |

|

|

| 2.5 | % |

|

| 7.83 |

|

|

| 7.36 |

|

|

| 6.4 | % |

Basic weighted average shares |

|

| 1,085 |

|

|

| 1,088 |

|

|

|

|

|

|

| 1,080 |

|

|

| 1,089 |

|

|

|

|

|

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted earnings per share - estimate |

|

| 1.92 |

|

|

| 1.88 |

|

|

| 2.1 | % |

|

| 7.48 |

|

|

| 7.06 |

|

|

| 5.9 | % |

Diluted weighted average shares outstanding |

|

| 1,135 |

|

|

| 1,134 |

|

|

|

|

|

|

| 1,130 |

|

|

| 1,135 |

|

|

|

|

|

| Average for Quarter |

|

|

|

|

| Average for Twelve Months |

| ||||||||||||||||

| December 31 |

|

| % |

|

| December 31 |

|

| % |

| |||||||||||||

BALANCE SHEET SUMMARY |

| 2024 |

|

| 2023 |

|

| Change |

|

| 2024 |

|

| 2023 |

|

| Change |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Total loans |

| $ | 297,595 |

|

| $ | 297,994 |

|

|

| -0.1 | % |

| $ | 301,718 |

|

| $ | 287,127 |

|

|

| 5.1 | % |

Total short term investments |

|

| 84,667 |

|

|

| 43,172 |

|

|

| 96.1 | % |

|

| 46,595 |

|

|

| 26,075 |

|

|

| 78.7 | % |

FRB Stock |

|

| 438 |

|

|

| 430 |

|

|

| 1.9 | % |

|

| 436 |

|

|

| 429 |

|

|

| 1.6 | % |

Total investment securities |

|

| 139,200 |

|

|

| 132,086 |

|

|

| 5.4 | % |

|

| 139,161 |

|

|

| 134,211 |

|

|

| 3.7 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earning assets |

|

| 521,900 |

|

|

| 473,252 |

|

|

| 10.3 | % |

|

| 487,910 |

|

|

| 447,842 |

|

|

| 8.9 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 529,766 |

|

|

| 481,952 |

|

|

| 9.9 | % |

|

| 495,755 |

|

|

| 455,520 |

|

|

| 8.8 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 140,237 |

|

|

| 138,527 |

|

|

| 1.2 | % |

|

| 132,835 |

|

|

| 140,837 |

|

|

| -5.7 | % |

Interest bearing deposits |

|

| 331,293 |

|

|

| 297,030 |

|

|

| 11.5 | % |

|

| 307,873 |

|

|

| 267,392 |

|

|

| 15.1 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 471,529 |

|

|

| 435,557 |

|

|

| 8.3 | % |

|

| 440,708 |

|

|

| 408,229 |

|

|

| 8.0 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 261 |

|

|

| N/M |

|

|

| 0 |

|

|

| 351 |

|

|

| N/M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' equity |

| $ | 58,388 |

|

| $ | 52,263 |

|

|

| 11.7 | % |

| $ | 56,039 |

|

| $ | 50,653 |

|

|

| 10.6 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Average for Quarter Ending | ||||||||||||||||||

| Dec 31, |

|

| Sep 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 | ||||||

BALANCE SHEET SUMMARY |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total loans |

| $ | 297,595 |

|

| $ | 300,487 |

|

| $ | 306,551 |

|

| $ | 302,296 |

|

| $ | 297,994 |

Total short term investments |

|

| 84,667 |

|

|

| 38,112 |

|

|

| 25,626 |

|

|

| 37,649 |

|

|

| 43,172 |

FRB Stock |

|

| 438 |

|

|

| 437 |

|

|

| 435 |

|

|

| 433 |

|

|

| 430 |

Total investment securities |

|

| 139,200 |

|

|

| 137,751 |

|

|

| 137,088 |

|

|

| 142,623 |

|

|

| 132,086 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earning assets |

|

| 521,900 |

|

|

| 476,787 |

|

|

| 469,700 |

|

|

| 483,001 |

|

|

| 473,682 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 529,766 |

|

|

| 485,034 |

|

|

| 477,700 |

|

|

| 490,262 |

|

|

| 481,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 140,237 |

|

|

| 131,659 |

|

|

| 131,609 |

|

|

| 127,766 |

|

|

| 138,527 |

Interest bearing deposits |

|

| 331,293 |

|

|

| 297,480 |

|

|

| 293,548 |

|

|

| 309,030 |

|

|

| 297,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 471,529 |

|

|

| 429,139 |

|

|

| 425,157 |

|

|

| 436,796 |

|

|

| 435,557 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 261 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' equity |

| $ | 58,388 |

|

| $ | 56,857 |

|

| $ | 54,951 |

|

| $ | 53,923 |

|

| $ | 52,263 |

| Quarter Ended |

| ||||||||||||||||||

| Dec 31, |

|

| Sep 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

| ||||||

HISTORICAL EARNINGS SUMMARY |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Interest income |

| $ | 7,426 |

|

| $ | 7,112 |

|

| $ | 7,107 |

|

| $ | 6,934 |

|

| $ | 6,818 |

|

Interest expense |

|

| 2,681 |

|

|

| 2,749 |

|

|

| 2,713 |

|

|

| 2,832 |

|

|

| 2,738 |

|

Net Interest Income |

|

| 4,745 |

|

|

| 4,363 |

|

|

| 4,394 |

|

|

| 4,102 |

|

|

| 4,080 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Service charges on deposits |

|

| 70 |

|

|

| 65 |

|

|

| 64 |

|

|

| 53 |

|

|

| 55 |

|

Other income |

|

| 112 |

|

|

| 109 |

|

|

| 121 |

|

|

| 121 |

|

|

| 117 |

|

Total Non Interest Income |

|

| 182 |

|

|

| 174 |

|

|

| 185 |

|

|

| 174 |

|

|

| 172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Salaries and benefits expense |

|

| 1,343 |

|

|

| 1,368 |

|

|

| 1,319 |

|

|

| 1,223 |

|

|

| 1,314 |

|

Occupancy and equipment expense |

|

| 117 |

|

|

| 133 |

|

|

| 122 |

|

|

| 122 |

|

|

| 109 |

|

Other expense |

|

| 575 |

|

|

| 601 |

|

|

| 657 |

|

|

| 620 |

|

|

| 509 |

|

Total Non Interest Expense |

|

| 2,035 |

|

|

| 2,102 |

|

|

| 2,098 |

|

|

| 1,965 |

|

|

| 1,932 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pretax pre-provision income |

|

| 2,892 |

|

|

| 2,435 |

|

|

| 2,481 |

|

|

| 2,311 |

|

|

| 2,320 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gain on sale of securities |

|

| 1 |

|

|

| 4 |

|

|

| (4 | ) |

|

| 0 |

|

|

| (36 | ) |

Gain on sale of Other Assets |

|

| 0 |

|

|

| 0 |

|

|

| 36 |

|

|

| 17 |

|

|

| 58 |

|

Provision for Loan Losses |

|

| 350 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earnings before income taxes |

|

| 2,543 |

|

|

| 2,439 |

|

|

| 2,514 |

|

|

| 2,328 |

|

|

| 2,342 |

|

Provision for income taxes |

|

| 365 |

|

|

| 340 |

|

|

| 360 |

|

|

| 300 |

|

|

| 207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Earnings |

| $ | 2,178 |

|

| $ | 2,099 |

|

| $ | 2,154 |

|

| $ | 2,028 |

|

| $ | 2,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted earnings per share |

| $ | 1.92 |

|

| $ | 1.86 |

|

| $ | 1.91 |

|

| $ | 1.80 |

|

| $ | 1.88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Ending Balance |

| ||||||||||||||||||

| Dec. 31, |

|

| Sept. 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

| ||||||

HISTORICAL BALANCE SHEET |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Total loans |

| $ | 305,864 |

|

| $ | 296,906 |

|

| $ | 304,810 |

|

| $ | 312,372 |

|

| $ | 297,423 |

|

FRB Stock |

|

| 439 |

|

|

| 438 |

|

|

| 435 |

|

|

| 435 |

|

|

| 430 |

|

Total short term investments |

|

| 69,746 |

|

|

| 59,576 |

|

|

| 10,003 |

|

|

| 38,009 |

|

|

| 40,334 |

|

Total investment securities |

|

| 138,306 |

|

|

| 137,510 |

|

|

| 136,331 |

|

|

| 139,598 |

|

|

| 140,403 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total earning assets |

|

| 514,355 |

|

|

| 494,430 |

|

|

| 451,579 |

|

|

| 490,414 |

|

|

| 478,590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Allowance for loan losses |

|

| (5,583 | ) |

|

| (5,230 | ) |

|

| (5,227 | ) |

|

| (5,225 | ) |

|

| (5,224 | ) |

Premises and equipment |

|

| 4,123 |

|

|

| 2,393 |

|

|

| 2,397 |

|

|

| 2,375 |

|

|

| 2,387 |

|

Other Assets |

|

| 9,339 |

|

|

| 9,739 |

|

|

| 14,711 |

|

|

| 8,149 |

|

|

| 10,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total assets |

|

| 522,234 |

|

|

| 501,332 |

|

|

| 463,460 |

|

|

| 495,713 |

|

|

| 486,044 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest bearing deposits |

|

| 146,834 |

|

|

| 137,594 |

|

|

| 128,318 |

|

|

| 130,876 |

|

|

| 130,601 |

|

Interest bearing deposits |

|

| 318,206 |

|

|

| 305,010 |

|

|

| 280,945 |

|

|

| 310,889 |

|

|

| 301,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total deposits |

|

| 465,040 |

|

|

| 442,604 |

|

|

| 409,263 |

|

|

| 441,765 |

|

|

| 432,204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fed Funds Purchased and Repurchase Agreements |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Other Liabilities |

|

| 2,711 |

|

|

| 2,901 |

|

|

| 2,804 |

|

|

| 2,618 |

|

|

| 2,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total liabilities |

|

| 467,751 |

|

|

| 445,505 |

|

|

| 412,067 |

|

|

| 444,383 |

|

|

| 434,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Shareholders' Equity Actual |

|

| 59,758 |

|

|

| 57,976 |

|

|

| 55,915 |

|

|

| 54,777 |

|

|

| 53,465 |

|

Unrealized Gain/Loss - AFS |

|

| (5,275 | ) |

|

| (2,149 | ) |

|

| (4,957 | ) |

|

| (3,883 | ) |

|

| (2,718 | ) |

Total Equity |

| $ | 54,483 |

|

| $ | 55,827 |

|

| $ | 50,958 |

|

| $ | 50,894 |

|

| $ | 50,747 |

|

| Quarter Ending |

| ||||||||||||||||||

| Dec. 31, |

|

| Sept. 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

| ||||||

NONPERFORMING ASSETS |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Nonaccrual loans |

| $ | 1,047 |

|

| $ | 0 |

|

| $ | 0 |

|

| $ | 0 |

|

| $ | 0 |

|

Restructured loans |

|

| 0 |

|

|

| 505 |

|

|

| 552 |

|

|

| 598 |

|

|

| 658 |

|

Other real estate & foreclosed assets |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Accruing loans past due 90 days or more |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Total nonperforming assets |

| $ | 1,047 |

|

| $ | 505 |

|

| $ | 552 |

|

| $ | 598 |

|

| $ | 658 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Accruing loans past due 30-89 days |

| $ | 0 |

|

| $ | 39 |

|

| $ | 1,274 |

|

| $ | 0 |

|

| $ | 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total nonperforming assets as a percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of loans and foreclosed assets |

|

| 0.34 | % |

|

| 0.17 | % |

|

| 0.18 | % |

|

| 0.19 | % |

|

| 0.22 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ending |

| ||||||||||||||||||

ALLOWANCE FOR |

| Dec. 31, |

|

| Sept. 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

| |||||

LOAN LOSSES |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Balance at beginning of period |

| $ | 5,230 |

|

| $ | 5,227 |

|

| $ | 5,224 |

|

| $ | 5,224 |

|

| $ | 5,222 |

|

Loans charged off |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Loan recoveries |

|

| 3 |

|

|

| 3 |

|

|

| 3 |

|

|

| 0 |

|

|

| 2 |

|

Net (charge-offs) recoveries |

|

| 3 |

|

|

| 3 |

|

|

| 3 |

|

|

| 0 |

|

|

| 2 |

|

Provision for loan losses |

|

| 350 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

Balance at end of period |

| $ | 5,583 |

|

| $ | 5,230 |

|

| $ | 5,227 |

|

| $ | 5,224 |

|

| $ | 5,224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Allowance for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of total loans |

|

| 1.83 | % |

|

| 1.76 | % |

|

| 1.71 | % |

|

| 1.67 | % |

|

| 1.76 | % |

Allowance for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of nonperforming assets |

|

| 533 | % |

|

| 1036 | % |

|

| 947 | % |

|

| 874 | % |

|

| 794 | % |

Net charge-offs (recoveries) as a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

percentage of average loans |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

Provision for loan losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

as a percentage of average loans |

|

| 0.11 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 0.00 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Quarter Ending |

| ||||||||||||||||||

| Dec. 31, |

|

| Sept. 30, |

|

| June 30, |

|

| March 31, |

|

| Dec. 31 |

| ||||||

SELECTED RATIOS |

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2024 |

|

| 2023 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Return on average assets (annualized) |

|

| 1.64 | % |

|

| 1.73 | % |

|

| 1.80 | % |

|

| 1.65 | % |

|

| 1.77 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average equity (annualized) |

|

| 15.85 | % |

|

| 15.91 | % |

|

| 17.42 | % |

|

| 16.03 | % |

|

| 19.87 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Return on average equity (excluding unrealized gain on investments) |

|

| 14.92 | % |

|

| 14.77 | % |

|

| 15.68 | % |

|

| 15.04 | % |

|

| 16.34 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Average shareholders' equity to average assets |

|

| 11.02 | % |

|

| 11.72 | % |

|

| 11.50 | % |

|

| 11.00 | % |

|

| 10.84 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Yield on earning assets (tax equivalent) |

|

| 5.92 | % |

|

| 6.20 | % |

|

| 6.28 | % |

|

| 5.97 | % |

|

| 5.81 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Effective Cost of Funds |

|

| 2.06 | % |

|

| 2.31 | % |

|

| 2.31 | % |

|

| 2.34 | % |

|

| 2.16 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net interest margin (tax equivalent) |

|

| 3.86 | % |

|

| 3.89 | % |

|

| 3.97 | % |

|

| 3.63 | % |

|

| 3.65 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Efficiency ratio (tax equivalent) |

|

| 39.0 | % |

|

| 43.7 | % |

|

| 43.2 | % |

|

| 43.1 | % |

|

| 42.4 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period book value per common share |

| $ | 50.21 |

|

| $ | 51.79 |

|

| $ | 47.23 |

|

| $ | 47.17 |

|

| $ | 46.73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period book value (excluding unrealized gain/loss on investments) |

| $ | 55.08 |

|

| $ | 53.78 |

|

| $ | 51.82 |

|

| $ | 50.77 |

|

| $ | 49.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

End of period common shares outstanding (in 000's) |

|

| 1,085 |

|

|

| 1,078 |

|

|

| 1,079 |

|

|

| 1,079 |

|

|

| 1,086 |

|

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Twelve Months Ending |

| |||||||||||||||||||||||||

| December 31, 2024 |

|

| December 31, 2023 |

| ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

| Tax |

|

|

|

|

|

|

|

| Tax |

| ||||||||

| Average |

|

|

|

|

|

|

| Equivalent |

|

| Average |

|

|

|

|

| Equivalent |

| ||||||||

YIELD ANALYSIS |

| Balance |

|

| Interest |

| Yield |

|

| Yield |

|

| Balance |

| Interest |

| Yield |

| Yield |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Interest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Short term investment |

| $ | 46,595 |

|

| $ | 2,417 |

|

| 5.19 | % |

|

| 5.19 | % |

| $ | 26,075 |

| 1,379 |

|

| 5.29 | % |

| 5.29 | % |

FRB Stock |

|

| 436 |

|

|

| 26 |

|

| 6.00 | % |

|

| 6.00 | % |

|

| 429 |

| 26 |

|

| 6.00 | % |

| 6.00 | % |

Taxable securities |

|

| 0 |

|

|

| 0 |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 1,383 |

| 73 |

|

| 5.28 | % |

| 5.28 | % |

Tax Free securities |

|

| 139,161 |

|

|

| 4,486 |

|

| 3.22 | % |

|

| 3.44 | % |

|

| 132,399 |

| 3,438 |

|

| 2.60 | % |

| 3.29 | % |

Loans |

|

| 301,718 |

|

|

| 21,651 |

|

| 7.18 | % |

|

| 7.18 | % |

|

| 287,127 |

| 19,144 |

|

| 6.67 | % |

| 6.67 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Interest Earning Assets |

|

| 487,910 |

|

|

| 28,580 |

|

| 5.86 | % |

|

| 5.92 | % |

|

| 447,413 |

| 24,060 |

|

| 5.38 | % |

| 5.58 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

| 5,712 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5,856 |

|

|

|

|

|

|

|

|

|

Other assets |

|

| 7,363 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7,306 |

|

|

|

|

|

|

|

|

|

Allowance for loan losses |

|

| (5,230 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

| (5,057 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Noninterest Earning Assets |

|

| 7,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8,105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Assets |

| $ | 495,755 |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 455,518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction and Money Market accounts |

| $ | 200,832 |

|

| $ | 6,125 |

|

| 3.05 | % |

|

| 3.05 | % |

|

| 179,325 |

| 5,504 |

|

| 3.07 | % |

| 3.07 | % |

Certificates and other time deposits |

|

| 107,041 |

|

|

| 4,846 |

|

| 4.53 | % |

|

| 4.53 | % |

|

| 78,092 |

| 3,034 |

|

| 3.89 | % |

| 3.89 | % |

Other borrowings |

|

| 0 |

|

|

| 0 |

|

| 0.00 | % |

|

| 0.00 | % |

|

| 10,327 |

| 73 |

|

| 0.0071 |

|

| 0.71 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Interest Bearing Liabilities |

|

| 307,873 |

|

|

| 10,971 |

|

| 3.56 | % |

|

| 3.56 | % |

|

| 267,744 |

| 8,611 |

|

| 3.22 | % |

| 3.22 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Noninterest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

| 132,835 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 140,835 |

|

|

|

|

|

|

|

|

|

Other liabilities |

|

| 3,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2,573 |

|

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

| 51,974 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 44,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total Liabilities and Shareholders Equity |

| $ | 495,755 |

|

|

|

|

|

|

|

|

|

|

|

|

| $ | 455,518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Interest Income and Spread |

| $ | 180,037 |

|

| $ | 17,609 |

|

| 2.29 | % |

|

| 2.35 | % |

|

| 179,669 |

| 15,449 |

|

| 2.16 | % |

| 2.37 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Interest Margin |

|

|

|

|

|

|

|

|

| 3.61 | % |

|

| 3.67 | % |

|

|

|

|

|

|

| 3.45 | % |

| 3.66 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| December 31 |

|

|

|

|

|

| December 31 |

|

|

|

| ||||

| 2024 |

|

| % |

|

|

| 2023 |

|

| % |

| ||||

LOAN PORTFOLIO |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Commercial and industrial |

| $ | 168,145 |

|

|

| 54.97 | % |

| $ | 162,907 |

|

|

| 54.77 | % |

AG���˹ٷ� estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial |

|

| 96,441 |

|

|

| 31.53 | % |

|

| 86,215 |

|

|

| 28.99 | % |

Residential |

|

| 11,209 |

|

|

| 3.66 | % |

|

| 17,271 |

|

|

| 5.81 | % |

Construction and development |

|

| 29,933 |

|

|

| 9.79 | % |

|

| 30,724 |

|

|

| 10.33 | % |

Consumer |

|

| 136 |

|

|

| 0.04 | % |

|

| 306 |

|

|

| 0.10 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total loans |

| $ | 305,864 |

|

|

| 100.00 | % |

|

| 297,423 |

|

|

| 100.00 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| December 31 |

|

|

|

| December 31 |

|

|

|

| ||||||

|

| 2024 |

|

|

|

|

|

|

| 2023 |

|

|

|

|

| |

REGULATORY CAPITAL DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 Capital |

| $ | 59,758 |

|

|

|

|

|

| $ | 53,464 |

|

|

|

|

|

Total Capital (Tier 1 + Tier 2) |

| $ | 64,147 |

|

|

|

|

|

| $ | 57,695 |

|

|

|

|

|

Total Risk-Adjusted Assets |

| $ | 349,667 |

|

|

|

|

|

| $ | 337,534 |

|

|

|

|

|

Tier 1 Risk-Based Capital Ratio |

|

| 17.09 | % |

|

|

|

|

|

| 15.84 | % |

|

|

|

|

Total Risk-Based Capital Ratio |

|

| 18.34 | % |

|

|

|

|

|

| 17.10 | % |

|

|

|

|

Tier 1 Leverage Ratio |

|

| 11.28 | % |

|

|

|

|

|

| 11.09 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Time Equivalent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employees (FTE's) |

|

| 28 |

|

|

|

|

|

|

| 28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Stock Price Range |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(For the Three Months Ended): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High |

| $ | 91.00 |

|

|

|

|

|

| $ | 90.00 |

|

|

|

|

|

Low |

| $ | 80.00 |

|

|

|

|

|

| $ | 79.25 |

|

|

|

|

|

Close |

| $ | 91.00 |

|

|

|

|

|

| $ | 90.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Trinity Bank, N.A. is a commercial bank that began operations May 28, 2003. For a full financial statement, visit Trinity Bank's website: Regulatory reporting format is also available at

###

For information contact:

Richard Burt

Executive Vice President

Trinity Bank

817-763-9966

This Press Release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future financial conditions, results of operations and the Bank's business operations. Such forward-looking statements involve risks, uncertainties and assumptions, including, but not limited to, monetary policy and general economic conditions in Texas and the greater Dallas-Fort Worth metropolitan area, the risks of changes in interest rates on the level and composition of deposits, loan demand and the values of loan collateral, securities and interest rate protection agreements, the actions of competitors and customers, the success of the Bank in implementing its strategic plan, the failure of the assumptions underlying the reserves for loan losses and the estimations of values of collateral and various financial assets and liabilities, that the costs of technological changes are more difficult or expensive than anticipated, the effects of regulatory restrictions imposed on banks generally, any changes in fiscal, monetary or regulatory policies and other uncertainties as discussed in the Bank's Registration Statement on Form SB��1 filed with the Office of the Comptroller of the Currency. Should one or more of these risks or uncertainties materialize, or should these underlying assumptions prove incorrect, actual outcomes may vary materially from outcomes expected or anticipated by the Bank. A forward-looking statement may include a statement of the assumptions or bases underlying the forward‑looking statement. The Bank believes it has chosen these assumptions or bases in good faith and that they are reasonable. However, the Bank cautions you that assumptions or bases almost always vary from actual results, and the differences between assumptions or bases and actual results can be material. The Bank undertakes no obligation to publicly update or otherwise revise any forward‑looking statements, whether as a result of new information, future events or otherwise, unless the securities laws require the Bank to do so.

SOURCE: Trinity Bank, NA (Fort Worth, Texas)

View the original on ACCESS Newswire