YY Group Announces Highlights of the Company’s Preliminary First Half 2025 Results

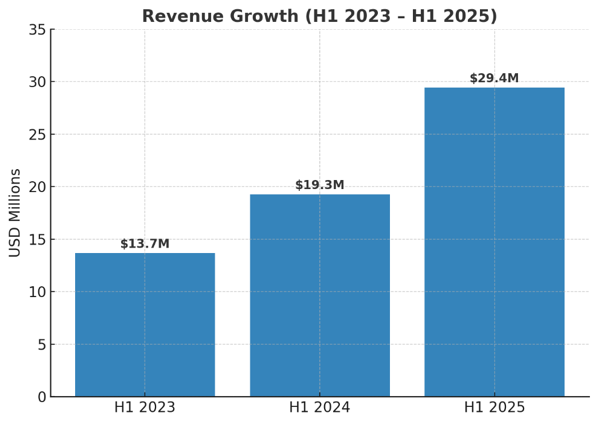

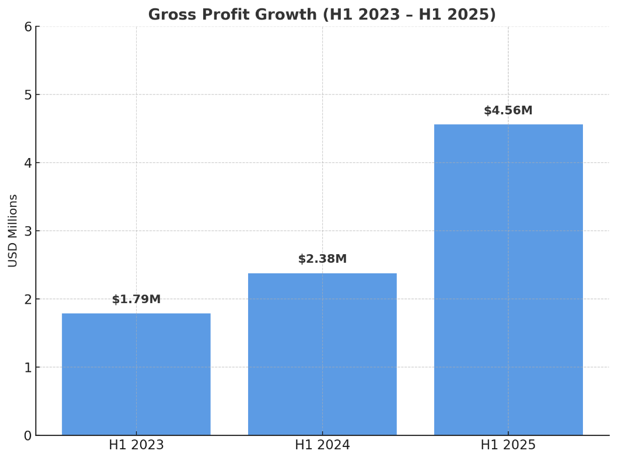

YY Group (NASDAQ:YYGH), a Singapore-based provider of integrated facility management and on-demand staffing solutions, has announced strong preliminary first-half 2025 results. The company reported revenue of $29.4 million, up 53% year-over-year, and gross profit of $4.6 million, nearly doubling from the previous year.

The company's gross margin improved to 15.5% from 12.3% year-over-year. YY Group's growth was driven by expansion in hospitality, F&B, logistics, and condominium management sectors. The company projects full-year 2025 revenue to exceed $60 million. Recent acquisitions, including Property Facility Service (PFS), have enhanced their condominium management capabilities and cross-selling opportunities.

YY Group (NASDAQ:YYGH), società con sede a Singapore che offre servizi integrati di gestione degli immobili e soluzioni di personale on-demand, ha comunicato risultati preliminari positivi per la prima metà del 2025. L'azienda ha registrato ricavi per 29,4 milioni di dollari, in crescita del 53% su base annua, e un utile lordo di 4,6 milioni di dollari, quasi raddoppiato rispetto all'anno precedente.

La marginalità lorda è salita al 15,5% rispetto al 12,3% dell'anno precedente. La crescita di YY Group è stata sostenuta dall'espansione nei settori dell'ospitalità, F&B, logistica e gestione di condomini. La società prevede che i ricavi per l'intero 2025 supereranno i 60 milioni di dollari. Acquisizioni recenti, tra cui Property Facility Service (PFS), hanno rafforzato le capacità nella gestione condominiale e le opportunità di cross-selling.

YY Group (NASDAQ:YYGH), con sede en Singapur y proveedor de servicios integrados de facility management y personal bajo demanda, anunció sólidos resultados preliminares del primer semestre de 2025. La compañía informó ingresos de 29,4 millones de dólares, un alza del 53% interanual, y un beneficio bruto de 4,6 millones de dólares, casi el doble respecto al año anterior.

El margen bruto mejoró hasta el 15,5% desde el 12,3% interanual. El crecimiento de YY Group fue impulsado por la expansión en hospitalidad, F&B, logística y gestión de condominios. La empresa proyecta que los ingresos totales de 2025 superarán los 60 millones de dólares. Adquisiciones recientes, incluida Property Facility Service (PFS), han reforzado sus capacidades en gestión de condominios y las oportunidades de venta cruzada.

YY Group (NASDAQ:YYGH)�� 싱가포르�� 본사�� �� 통합 시설 관�� �� 온디맨드 인력 솔루�� 제공업체��, 2025�� 상반�� 예비 실적�� 양호하다�� 발표했습니다. 회사�� 매출 2,940�� 달러�� 기록�� 전년 동기 대�� 53% 증가했으��, 매출총이�� 460�� 달러�� 전년 대�� 거의 �� 배로 늘었습니��.

매출총이익률은 전년 대�� 12.3%에서 15.5%�� 개선되었습니��. YY Group�� 성장은 호스피탈리티, 식음��(F&B), 물류 �� 콘도 관�� 분야�� 확장�� 힘입었습니다. 회사�� 2025�� 연간 매출�� 6,000�� 달러�� 초과�� ��으로 전망합니��. Property Facility Service(PFS)�� 포함�� 최근 인수�� 콘도 관�� 역량�� 크로스셀 기회�� 강화했습니다.

YY Group (NASDAQ:YYGH), prestataire basé à Singapour de services intégrés de facility management et de personnel à la demande, a annoncé de solides résultats provisoires pour le premier semestre 2025. La société a déclaré un chiffre d'affaires de 29,4 millions de dollars, en hausse de 53% sur un an, et une marge brute de 4,6 millions de dollars, presque doublée par rapport à l'année précédente.

La marge brute s'est améliorée à 15,5% contre 12,3% en glissement annuel. La croissance de YY Group a été portée par l'expansion dans l'hôtellerie, la restauration (F&B), la logistique et la gestion de copropriétés. La société prévoit que le chiffre d'affaires 2025 dépassera les 60 millions de dollars. Des acquisitions récentes, dont Property Facility Service (PFS), ont renforcé leurs capacités en gestion de copropriétés et les opportunités de vente croisée.

YY Group (NASDAQ:YYGH), ein in Singapur ansässiger Anbieter integrierter Facility-Management- und On-Demand-Personallösungen, hat starke vorläufige Ergebnisse für das erste Halbjahr 2025 veröffentlicht. Das Unternehmen meldete Umsatz in Höhe von 29,4 Mio. USD, ein Anstieg von 53% gegenüber dem Vorjahr, und einen Bruttogewinn von 4,6 Mio. USD, fast eine Verdoppelung zum Vorjahr.

Die Bruttomarge verbesserte sich von 12,3% auf 15,5% im Jahresvergleich. Das Wachstum von YY Group wurde durch Expansion in den Bereichen Gastgewerbe, F&B, Logistik und Wohnungsverwaltung getrieben. Das Unternehmen erwartet, dass der Gesamtumsatz für 2025 60 Mio. USD übersteigen wird. Jüngste Akquisitionen, darunter Property Facility Service (PFS), haben die Fähigkeiten im Wohnungsmanagement und Cross-Selling-Möglichkeiten gestärkt.

- Revenue increased by 53% year-over-year to $29.4 million

- Gross profit nearly doubled with 100% year-over-year growth

- Gross margin improved significantly from 12.3% to 15.5%

- Strategic acquisition of Property Facility Service (PFS) expanding capabilities

- Projected full-year 2025 revenue to exceed $60 million

- Financial results are preliminary and subject to final review

- Operating in competitive Singapore IFM market with potential asset value fluctuations

Insights

YY Group's strong H1 2025 results show exceptional growth with 53% revenue increase, doubled gross profit, and improved margins indicating operational efficiency.

YY Group's preliminary H1 2025 results demonstrate impressive financial momentum across key metrics. Revenue reached

This margin enhancement signals two important developments: first, the company is achieving meaningful scale benefits across its operations; second, management is maintaining strong cost discipline while driving growth. The simultaneous achievement of high revenue growth and margin expansion is relatively uncommon, as rapid expansion typically involves higher costs that pressure margins.

The company's diversification strategy appears to be bearing fruit. Their on-demand staffing platform (YY Circle) is expanding beyond traditional hospitality and F&B sectors into logistics, while their Integrated Facility Management business is successfully bundling services to increase revenue density. The acquisition of Property Facility Service has strategically enhanced their condominium management capabilities, creating cross-selling opportunities that should improve customer retention and lifetime value.

With the company projecting full-year 2025 revenue to exceed

The Company’s preliminary data shows an increase in gross profit by nearly

Singapore , Sept. 08, 2025 (GLOBE NEWSWIRE) -- YY Group Holding Limited (Nasdaq: YYGH) (“YY Group�� or the “Company��), a Singapore-headquartered provider of integrated facility management and on-demand staffing solutions, today announced preliminary and unaudited financial results for the first half ended June 30, 2025. The Company expects to report revenue of

“Our notable first-half performance reflects the continued strength of our business model and disciplined execution,�� said Mike Fu, Chief Executive Officer of YY Group Holding Limited. “We are expanding across hospitality and F&B while building new momentum in logistics and condominium management. With these results, we are well-positioned to deliver sustained growth in the second half of the year.��

“We nearly doubled gross profit while expanding margins by more than 300 basis points, a testament to both scale and cost discipline,�� said Jason Phua, Chief Financial Officer of YY Group. “Looking ahead, we expect to exceed

Business momentum in the first half is expected to be supported by both of YY Group’s core businesses. The on-demand staffing platform, YY Circle, continued to expand in the hospitality and F&B sectors while gaining traction in logistics and other service industries. The Integrated Facility Management (IFM) business delivered steady performance through new project wins, client renewals, and the introduction of bundled services across cleaning, pest control, security, and landscaping.

Recent acquisitions further enhanced the IFM platform. The addition of Property Facility Service (PFS) expanded YY Group’s condominium management capabilities, creating opportunities to cross-sell complementary services and increase revenue per site. The Company’s digital marketing subsidiary, MediaPlus, also contributed to client growth by generating qualified leads across multiple sectors.

YY Group expects to release its full Unaudited Financial Statements for the six months ended June 30, 2025, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, by the end of September.

Safe Harbor Statement

Certain statements made in this press release are “forward-looking statements�� within the meaning of the “safe harbor�� provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate��, “believe��, “expect��, “estimate��, “plan��, “outlook��, and “project�� and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements reflect the current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, actual results may differ materially from the Company’s expectations or projections. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: (i) the failure to meet projected development and related targets; (ii) changes in applicable laws or regulations; (iii) fluctuations in Singapore’s IFM market and its impact on asset values; and (iv) other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in other reports and other public filings with the Securities and Exchange Commission (the “SEC��) by the Company. Additional information concerning these and other factors that may impact the Company’s expectations and projections can be found in its filings with the SEC, including its annual report on Form 20-F filed on April 8, 2025. The Company’s SEC filings are available publicly on the SEC’s website at www.sec.gov. Any forward-looking statement made by us in this press release is based only on information currently available to YY Group Holding Ltd. and speaks only as of the date on which it is made. YY Group Holding Ltd. undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise, except as required by law.

About YY Group Holding Limited:

YY Group Holding Limited (Nasdaq: YYGH) is a Singapore-headquartered, technology-enabled platform providing flexible, scalable workforce solutions and integrated facility management (IFM) services across Asia and beyond. The Group operates through two core verticals: on-demand staffing and IFM, delivering agile, reliable support to industries such as hospitality, logistics, retail, and healthcare.

Leveraging proprietary digital platforms and IoT-driven systems, YY Group enables clients to meet fluctuating labor demands and maintain high-performance environments. In addition to its core operations in Singapore and Malaysia, the Group maintains a growing presence across Asia, Europe, the Middle East, and other international markets, including the UK, Germany, and Australia.

Listed on the Nasdaq Capital Market, YY Group Holding Limited is committed to service excellence, operational innovation, and long-term value creation for clients and shareholders.

For more information on the Company, please visit .

Investor Contacts

Jason Phua, Chief Financial Officer

YY Group

Mark Niu, Chief Strategy Officer,

YY Group