Art's Way Improves Profitability Despite Ongoing AG Market Headwinds

Art's Way Manufacturing (NASDAQ:ARTW) reported its Q2 2025 financial results, demonstrating improved profitability despite challenging agricultural market conditions. The company posted Q2 2025 sales of $6.34M, a 5.8% decline from Q1 2024, while achieving net income of $1.43M for the first six months of 2025, including a $1.15M Employee Retention Credit refund.

The Agricultural Products segment saw sales decline 11.6% to $4.03M in Q2 2025, while the Modular Buildings segment grew 6.3% to $2.31M. The company successfully reduced operating expenses by 15.3% in the first half of 2025 and improved six-month gross profit by 3.8% compared to 2024. Earnings per share reached $0.28 for the first six months of 2025, compared to a loss of $0.09 in 2024.

[ "Net income improved by $1.86M to $1.43M for first six months of 2025", "Operating expenses reduced by 15.3% in first half of 2025", "Modular Buildings segment sales increased 23% in first six months of 2025", "Gross profit improved 3.8% in first half of 2025", "Strong performance in grinder mixer sales due to record high livestock prices" ]Art's Way Manufacturing (NASDAQ:ARTW) ha comunicato i risultati finanziari del secondo trimestre 2025, mostrando una redditività migliorata nonostante le difficili condizioni del mercato agricolo. L'azienda ha registrato vendite nel Q2 2025 pari a 6,34 milioni di dollari, con un calo del 5,8% rispetto al primo trimestre 2024, raggiungendo un utile netto di 1,43 milioni di dollari nei primi sei mesi del 2025, comprensivo di un rimborso di 1,15 milioni di dollari per il Credito di Ritenzione dei Dipendenti.

Il segmento Prodotti Agricoli ha subito un calo delle vendite dell'11,6% a 4,03 milioni di dollari nel Q2 2025, mentre il segmento Edifici Modulari è cresciuto del 6,3% raggiungendo 2,31 milioni di dollari. L'azienda ha ridotto con successo le spese operative del 15,3% nella prima metà del 2025 e ha migliorato il margine lordo semestrale del 3,8% rispetto al 2024. L'utile per azione ha raggiunto 0,28 dollari nei primi sei mesi del 2025, rispetto a una perdita di 0,09 dollari nel 2024.

- Utile netto aumentato di 1,86 milioni di dollari, raggiungendo 1,43 milioni nei primi sei mesi del 2025

- Spese operative ridotte del 15,3% nella prima metà del 2025

- Vendite del segmento Edifici Modulari cresciute del 23% nei primi sei mesi del 2025

- Margine lordo migliorato del 3,8% nella prima metà del 2025

- Ottime performance nelle vendite di miscelatori per mangimi grazie ai prezzi record del bestiame

Art's Way Manufacturing (NASDAQ:ARTW) informó sus resultados financieros del segundo trimestre de 2025, mostrando una rentabilidad mejorada a pesar de las difÃciles condiciones del mercado agrÃcola. La compañÃa reportó ventas en el Q2 2025 de 6,34 millones de dólares, una disminución del 5,8% respecto al primer trimestre de 2024, mientras que alcanzó un ingreso neto de 1,43 millones de dólares en los primeros seis meses de 2025, incluyendo un reembolso de 1,15 millones por Crédito de Retención de Empleados.

El segmento de Productos AgrÃcolas experimentó una caÃda en ventas del 11,6% hasta 4,03 millones de dólares en el Q2 2025, mientras que el segmento de Edificios Modulares creció un 6,3% hasta 2,31 millones de dólares. La empresa redujo con éxito los gastos operativos en un 15,3% en la primera mitad de 2025 y mejoró el beneficio bruto semestral en un 3,8% respecto a 2024. Las ganancias por acción alcanzaron 0,28 dólares en los primeros seis meses de 2025, frente a una pérdida de 0,09 dólares en 2024.

- El ingreso neto mejoró en 1,86 millones de dólares, alcanzando 1,43 millones en los primeros seis meses de 2025

- Gastos operativos reducidos en un 15,3% en la primera mitad de 2025

- Ventas del segmento de Edificios Modulares aumentaron un 23% en los primeros seis meses de 2025

- El beneficio bruto mejoró un 3,8% en la primera mitad de 2025

- Fuerte desempeño en ventas de mezcladoras debido a precios récord en ganado

Art's Way Manufacturing (NASDAQ:ARTW)ë� 2025ë � 2ë¶ê¸° ì¬ë¬´ ì¤ì ì� ë°ííë©° ì´ë ¤ì� ëì ìì¥ íê²½ ìììë ììµì±ì´ ê°ì ëììì ë³´ì¬ì£¼ììµëë�. íì¬ë� 2025ë � 2ë¶ê¸° ë§¤ì¶ 634ë§� ë¬ë¬ë¥� 기ë¡íì¼ë©�, ì´ë 2024ë � 1ë¶ê¸° ëë¹� 5.8% ê°ìí� ìì¹ì ëë�. ëí 2025ë � ìë°ê¸� ìì´ìµì 143ë§� ë¬ë¬ë¡�, ì¬ê¸°ìë 115ë§� ë¬ë¬ì� ì§ì ì ì§ í¬ë ë� íê¸ê¸ì´ í¬í¨ëì´ ììµëë¤.

ëì ì í ë¶ë¬¸ì 2025ë � 2ë¶ê¸° 매ì¶ì� 11.6% ê°ìí� 403ë§� ë¬ë¬ë¥� 기ë¡íì¼ë�, 모ëë� ë¹ë© ë¶ë¬¸ì 6.3% ì¦ê°í� 231ë§� ë¬ë¬ë¥� ë¬ì±íìµëë¤. íì¬ë� 2025ë � ìë°ê¸� ì´ìë¹ì©ì� 15.3% ì¤ìì¼ë©°, 6ê°ìê°� ì´ì´ìµì 2024ë � ëë¹� 3.8% ê°ì ëììµëë�. ì£¼ë¹ ìì´ìµì 2025ë � ìë°ê¸� 0.28ë¬ë¬ë¡�, 2024ë � ìë°ê¸°ì 0.09ë¬ë¬ ìì¤ìì íìë¡� ì íëììµëë�.

- 2025ë � ìë°ê¸� ìì´ìµì´ 186ë§� ë¬ë¬ ì¦ê°íì¬ 143ë§� ë¬ë¬ 기ë¡

- 2025ë � ìë°ê¸� ì´ìë¹ì© 15.3% ê°ì

- 모ëë� ë¹ë© ë¶ë¬� ë§¤ì¶ 2025ë � ìë°ê¸� 23% ì¦ê°

- 2025ë � ìë°ê¸� ì´ì´ì� 3.8% ê°ì

- ê°ì¶� ê°ê²� ì¬ì ìµê³ ì¹ë¡ ì¸í ê·¸ë¼ì¸ë 믹ì í매 ê°ì¸

Art's Way Manufacturing (NASDAQ:ARTW) a publié ses résultats financiers du deuxième trimestre 2025, montrant une rentabilité améliorée malgré un contexte difficile sur le marché agricole. La société a enregistré des ventes de 6,34 millions de dollars au T2 2025, soit une baisse de 5,8 % par rapport au premier trimestre 2024, tout en réalisant un bénéfice net de 1,43 million de dollars au cours des six premiers mois de 2025, incluant un remboursement de crédit de rétention des employés de 1,15 million de dollars.

Le segment Produits Agricoles a vu ses ventes diminuer de 11,6 % à 4,03 millions de dollars au T2 2025, tandis que le segment Bâtiments Modulaires a progressé de 6,3 % à 2,31 millions de dollars. La société a réussi à réduire ses frais d'exploitation de 15,3 % au premier semestre 2025 et a amélioré sa marge brute semestrielle de 3,8 % par rapport à 2024. Le bénéfice par action a atteint 0,28 dollar pour les six premiers mois de 2025, contre une perte de 0,09 dollar en 2024.

- Le bénéfice net sâest amélioré de 1,86 million de dollars pour atteindre 1,43 million au premier semestre 2025

- Les frais dâexploitation ont été réduits de 15,3 % au premier semestre 2025

- Les ventes du segment Bâtiments Modulaires ont augmenté de 23 % au premier semestre 2025

- La marge brute a progressé de 3,8 % au premier semestre 2025

- Excellentes performances dans les ventes de mélangeurs grâce aux prix record du bétail

Art's Way Manufacturing (NASDAQ:ARTW) veröffentlichte seine Finanzergebnisse für das zweite Quartal 2025 und zeigte trotz herausfordernder Bedingungen im Agrarsektor eine verbesserte Rentabilität. Das Unternehmen verzeichnete Umsätze von 6,34 Mio. USD im Q2 2025, was einem Rückgang von 5,8 % gegenüber dem ersten Quartal 2024 entspricht, und erzielte einen Nettoertrag von 1,43 Mio. USD für die ersten sechs Monate 2025, einschlieÃlich einer Rückerstattung von 1,15 Mio. USD aus dem Employee Retention Credit.

Der Bereich Landwirtschaftliche Produkte verzeichnete im Q2 2025 einen Umsatzrückgang von 11,6 % auf 4,03 Mio. USD, während der Bereich Modulare Gebäude um 6,3 % auf 2,31 Mio. USD wuchs. Das Unternehmen konnte die Betriebskosten im ersten Halbjahr 2025 um 15,3 % senken und den Bruttogewinn im Sechsmonatsvergleich um 3,8 % gegenüber 2024 verbessern. Der Gewinn je Aktie erreichte im ersten Halbjahr 2025 0,28 USD im Vergleich zu einem Verlust von 0,09 USD im Jahr 2024.

- Nettoertrag verbesserte sich um 1,86 Mio. USD auf 1,43 Mio. USD in den ersten sechs Monaten 2025

- Betriebskosten im ersten Halbjahr 2025 um 15,3 % reduziert

- Umsatz im Bereich Modulare Gebäude in den ersten sechs Monaten 2025 um 23 % gestiegen

- Bruttogewinn im ersten Halbjahr 2025 um 3,8 % verbessert

- Starke Verkaufszahlen bei Futtermischern aufgrund rekordhoher Viehpreise

- None.

- Overall sales declined 5.8% to $6.34M in Q2 2025

- Agricultural Products segment sales dropped 20.7% in first six months of 2025

- Rising steel prices and tariff uncertainty affecting supply chain costs

- Dealers reluctant to restock inventory due to high interest rates

- Net income improvement largely dependent on one-time Employee Retention Credit refund of $1.15M

Insights

Art's Way reports net income of $1.4M despite sales decline; employee tax credit boosted results as company navigates agricultural market challenges.

Art's Way shows a mixed performance in Q2 2025, navigating the cyclical agricultural equipment market with some strategic success. The company posted

This profitability boost comes with an important asterisk -

The Agricultural Products segment, their largest division, faced headwinds with sales declining

Management's cost-cutting initiatives have yielded meaningful results, with operating expenses down

Looking ahead, the company expects market improvement in 12-18 months, suggesting they believe they're at the bottom of the agricultural cycle. Their Q3 inventory build strategy indicates confidence in potential retail opportunities later in 2025. However, rising steel prices and tariff concerns could pressure margins, creating some uncertainty despite the company's cautious optimism.

ARMSTRONG, IA / / July 10, 2025 / Art's Way Manufacturing Co., Inc. (NASDAQ:ARTW) (the "Company"), a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the second quarter of fiscal 2025.

President, CEO and Chairman Marc McConnell reports, "We are pleased to show operational progress and improved profitability during our second quarter despite challenging market conditions in the ag equipment space. During the quarter, we benefited greatly from sustained performance from our Modular Buildings segment while our Agricultural Products segment continued to see modest demand. We remain focused on enhancing our products and customer experience while also further improving our balance sheet and cashflow positions. We are pleased with our progress on these fronts and believe we are on firm footing to work through the uncertainty of the current environment with cautious optimism."

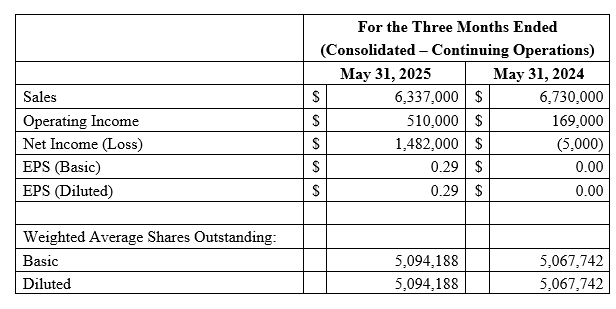

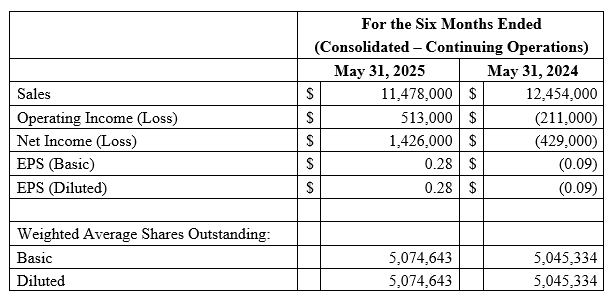

Consolidated - continuing operations

Sales of

$6,337,000 for Q2 2025,5.8% decline from Q1 2024. Six-month sales of$11,478,000 ,7.8% decline from the first six months of fiscal 2024.Six-month gross profit improvement of

3.8% compared to the first six months of fiscal 2024.Operating expenses reduced by

15.3% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.Net income of

$1,426,000 for the six months ending May 31, 2025,$1,855,000 improvement from same period in fiscal 2024. We received an Employee Retention Credit refund during the six months ending May 31, 2025 that positively impacted net income by$1,154,000.

Agricultural Products

Sales of

$4,025,000 for Q2 2025, a11.6% decline from Q2 2024. Six-month sales of$6,973,000 ,20.7% decline from the first six months of fiscal 2024.Six-month gross profit declined

1.0% compared to the first six months of fiscal 2024.Operating expenses reduced by

24.2% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.Net income of

$527,000 for the six months ending May 31, 2025, improvement of$1,236,000 from same period in fiscal 2024. We received an Employee Retention Credit refund during the six months ending May 31, 2025 that positively impacted net income by$976,000 in this segment.

Weakened row crop prices and high interest rates continued to make for a difficult agricultural market through the first six months of fiscal 2025. Livestock prices, predominately cattle, are at all time highs in fiscal 2025 and have driven strong grinder mixer sales activity thus far in fiscal 2025. While we have seen quite a bit of destocking from heightened levels in fiscal 2024, many dealers are not eager to replace their stock at current interest rate levels. The agriculture market is highly cyclical, and we still believe we are at the bottom of the cycle. We anticipate that conditions will improve in the next 12 to 18 months in our market. Our efforts in fiscal 2024 to right-size our production and administrative staff has reduced our operating expenses, which is aiding in our efforts to weather the bottom of the cycle. In Q3 of fiscal 2025, we expect to be building stock inventory in order to react to retail opportunities in the second half of fiscal 2025. We will continue to release product specific programs in the second half of fiscal 2025 to turn inventory and unlock cash from product lines where our inventory levels are higher, which has been successful so far in fiscal 2025. We are seeing steel prices rise as tariff uncertainty impacts domestic demand. We expect U.S.-based steel manufacturers to be able to increase production to meet ongoing demand and note the presence of a major U.S. investment by Nippon Steel for a new US Steel mill. The United States currently imports approximately

Modular Buildings

Sales of

$2,312,000 for Q2 2025, up6.3% from Q2 2025. Six-month sales of$4,505,000 ,23.0% increase from the first six months of fiscal 2024.Six-month gross profit improvement of

12.2% compared to the first six months of fiscal 2024.Operating expenses increased by

35.0% for the six months ending May 31, 2025 compared to the same period in fiscal 2024.Net income of

$899,000 for the six months ending May 31, 2025, improvement of$619,000 from the same period in fiscal 2024. We received an Employee Retention Credit refund in six months ending May 31, 2025 that positively impacted net income by$179,000 in this segment.

Demand for our modular buildings continues to be strong in fiscal 2025. Our expertise and execution in the custom research and laboratory market has established us as an industry leader. There continues to be a copious amount of quoting activity and custom build inquiries in fiscal 2025, despite some concerns about governmental grants and funding. In Q1 of fiscal 2025, we brought on a Director of Business Development and Sales who is transitioning to replace our retiring President and Director of Sales. The overlap in these positions in fiscal 2025 is providing additional sales capacity for us in fiscal 2025. We also expect to utilize our outgoing President and Director of Sales as a consultant moving forward to improve sales and maintain customer relationships. We are utilizing the transition period to explore new markets where our custom building can offer competitiveness to the marketplace.

Income (Loss) per Share: Income per basic and diluted share for the first six months of fiscal 2025 was

Art's-Way Manufacturing Co., Inc.

Art's Way Manufacturing is a small, publicly traded company that specializes in equipment manufacturing. For over 65 years, it has been committed to designing and building high-quality machinery for all operations. It has approximately 100 employees across two branch locations: Art's Way Manufacturing in Armstrong, Iowa and Art's Way Scientific in Monona, Iowa. Art's Way , , , , , , and are designed to optimize production, increase efficiency and meet the growing demands of customers. Art's Way Manufacturing has two reporting segments: and .

For more information, contact: Marc McConnell, President, Chief Executive Officer and Chairman

712-208-8467

[email protected]

Or visit the Company's website at

Caution Regarding Forward-Looking Statements

This release includes "forward-looking statements" within the meaning of the federal securities laws. In some cases you can identify forward-looking statements by the use of words such as "may," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," "foresee," or the negative of these terms or other similar expressions. Statements made in this release that are not strictly statements of historical facts, including the Company's expectations regarding: (i) the Company's business position; (ii) demand and potential growth within the Company's business segments; (iii) future results, including but not limited to, revenue and margin expectations, expectations with respect to the impact of price increases, and expectations with respect to backlog and product mix; (iv) the Company's ability to increase production with capital investments and other activities, (v) future agricultural sales and plans to enter into building contracts; (vi) cash flows and plans to fund strategic initiatives and pay down debt; and (vii) the benefits of the Company's business model and strategy, are forward-looking statements. Statements of anticipated future results are based on current expectations and are subject to a number of risks and uncertainties, including, but not limited to: customer demand for the Company's products; credit-worthiness of the Company's customers; the Company's ability to operate at lower expense levels; the Company's ability to complete projects in a timely and efficient manner in accordance with customer specifications; the Company's ability to renew or obtain financing on reasonable terms; the Company's ability to repay current debt, continue to meet debt obligations and comply with financial covenants; inflation and tariffs and their effect on the Company's supply chain and demand for its products; domestic and international economic conditions; the Company's ability to attract and maintain an adequate workforce in a competitive labor market; factors affecting the strength of the agricultural sector; the cost of raw materials; unexpected changes to performance by any of the Company's operating segments; and other factors detailed from time to time in the Company's Securities and Exchange Commission filings. Actual results may differ markedly from management's expectations. Readers are cautioned not to place undue reliance upon any such forward-looking statements. The Company does not intend to update forward-looking statements other than as required by law.

SOURCE: Art's-Way Manufacturing Co.

View the original on ACCESS Newswire