National Capital Bancorp, Inc. Reports Second Quarter Earnings and Quarterly Cash Dividend

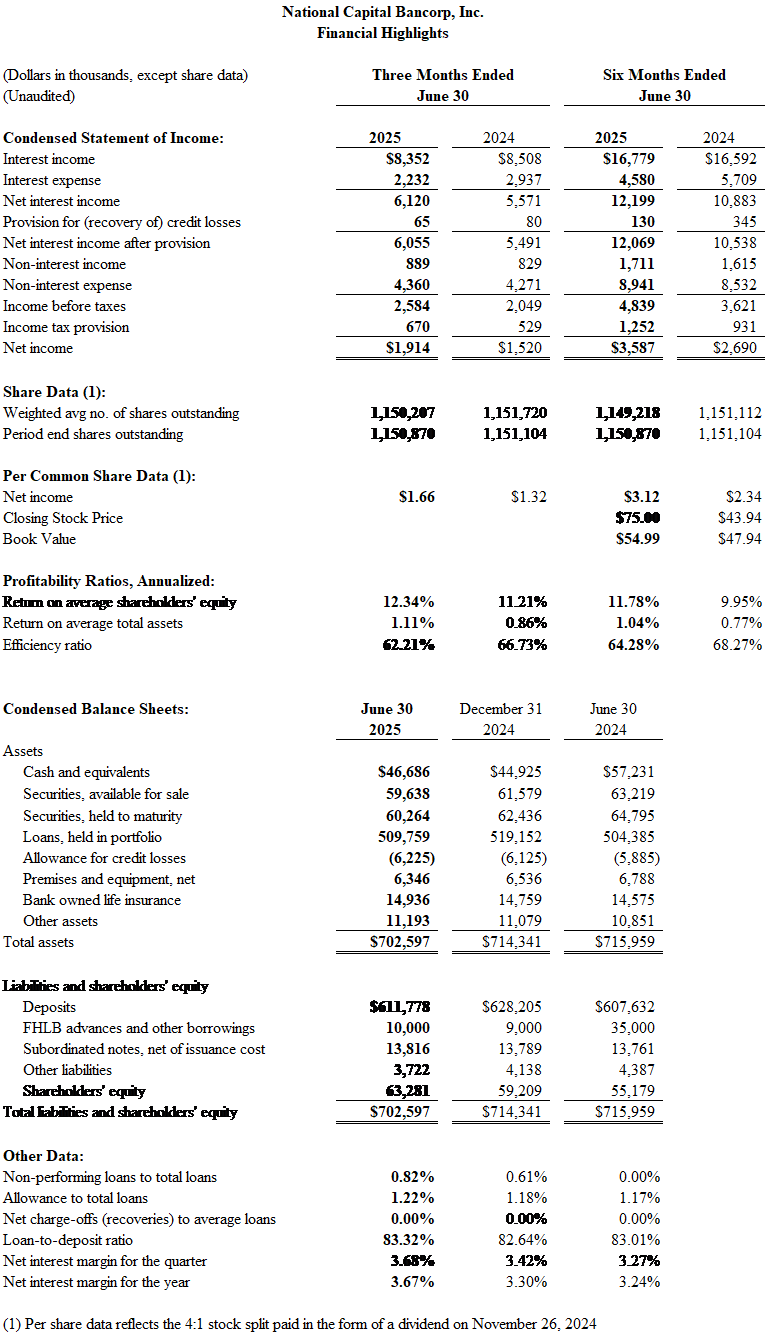

National Capital Bancorp (OTCID:NACB) reported strong Q2 2025 financial results with net income of $1.914 million ($1.66 per share), up from $1.52 million ($1.32 per share) in Q2 2024. The company's performance was driven by higher net interest income and margin expansion to 3.68%.

Total assets stood at $702.6 million, with loans at $509.8 million and deposits at $611.8 million. The bank declared a quarterly cash dividend of $0.21 per share, payable August 29, 2025. Additionally, a new share repurchase program of up to $600,000 was approved in February 2025, though no shares were repurchased during Q2.

The company's return on average assets and equity for H1 2025 were 1.04% and 11.78% respectively, while total shareholders' equity increased to $63.3 million from $55.2 million year-over-year.

National Capital Bancorp (OTCID:NACB) ha riportato solidi risultati finanziari nel secondo trimestre del 2025, con un utile netto di 1,914 milioni di dollari (1,66 dollari per azione), in aumento rispetto a 1,52 milioni di dollari (1,32 dollari per azione) registrati nel secondo trimestre del 2024. La performance dell'azienda è stata trainata da un incremento del reddito netto da interessi e da un ampliamento del margine al 3,68%.

Il totale delle attività ammontava a 702,6 milioni di dollari, con prestiti per 509,8 milioni di dollari e depositi per 611,8 milioni di dollari. La banca ha dichiarato un dividendo trimestrale in contanti di 0,21 dollari per azione, pagabile il 29 agosto 2025. Inoltre, a febbraio 2025 è stato approvato un nuovo programma di riacquisto azionario fino a 600.000 dollari, anche se nel secondo trimestre non sono state riacquistate azioni.

Il rendimento medio delle attività e del capitale proprio per la prima metà del 2025 è stato rispettivamente del 1,04% e dell'11,78%, mentre il patrimonio netto totale degli azionisti è aumentato a 63,3 milioni di dollari dai 55,2 milioni dell'anno precedente.

National Capital Bancorp (OTCID:NACB) reportó sólidos resultados financieros en el segundo trimestre de 2025, con un ingreso neto de 1.914 millones de dólares (1,66 dólares por acción), superior a los 1,52 millones de dólares (1,32 dólares por acción) del segundo trimestre de 2024. El desempeño de la compañía fue impulsado por un mayor ingreso neto por intereses y una expansión del margen al 3,68%.

Los activos totales fueron de 702,6 millones de dólares, con préstamos por 509,8 millones y depósitos por 611,8 millones de dólares. El banco declaró un dividendo trimestral en efectivo de 0,21 dólares por acción, pagadero el 29 de agosto de 2025. Además, en febrero de 2025 se aprobó un nuevo programa de recompra de acciones por hasta 600.000 dólares, aunque no se recompraron acciones durante el segundo trimestre.

El retorno sobre activos promedio y sobre patrimonio para el primer semestre de 2025 fue de 1,04% y 11,78%, respectivamente, mientras que el patrimonio total de los accionistas aumentó a 63,3 millones de dólares desde 55,2 millones año tras año.

National Capital Bancorp (OTCID:NACB)�� 2025�� 2분기�� 순이�� 191�� 4�� 달러 (주당 1.66달러)�� 기록하며 2024�� 2분기�� 152�� 달러(주당 1.32달러) 대�� 상승�� 강력�� 재무 성과�� 발표했습니다. 회사�� 성과�� 순이자수�� 증가왶� 3.68%로의 이자마진 확대�� 힘입은 것입니다.

�� 자산은 7�� 2,060�� 달러였으며, 대출금은 5�� 980�� 달러, 예금은 6�� 1,180�� 달러�� 기록했습니다. 은행은 주당 0.21달러�� 분기 현금 배당금을 선언했으��, 배당금은 2025�� 8�� 29�� 지급될 예정입니��. 또한 2025�� 2월에 최대 60�� 달러 규모�� 자사�� 매입 프로그램�� 승인되었으나, 2분기 동안에는 자사�� 매입�� 이루어지지 않았습니��.

2025�� 상반�� 평균자산수익률과 자기자본수익률은 각각 1.04%왶� 11.78%였으며, �� 주주지분은 전년 동기 대�� 5,520�� 달러에서 6,330�� 달러�� 증가했습니다.

National Capital Bancorp (OTCID:NACB) a publié de solides résultats financiers pour le deuxième trimestre 2025, avec un bénéfice net de 1,914 million de dollars (1,66 dollar par action), en hausse par rapport à 1,52 million de dollars (1,32 dollar par action) au deuxième trimestre 2024. La performance de la société a été portée par une augmentation du revenu net d’intérêts et une expansion de la marge à 3,68%.

Le total des actifs s’élevait à 702,6 millions de dollars, avec des prêts à 509,8 millions et des dépôts à 611,8 millions de dollars. La banque a déclaré un dividende trimestriel en espèces de 0,21 dollar par action, payable le 29 août 2025. De plus, un nouveau programme de rachat d’actions d’un montant maximal de 600 000 dollars a été approuvé en février 2025, bien qu’aucune action n’ait été rachetée au cours du deuxième trimestre.

Le rendement moyen des actifs et des capitaux propres pour le premier semestre 2025 était respectivement de 1,04% et 11,78%, tandis que les capitaux propres totaux des actionnaires ont augmenté à 63,3 millions de dollars contre 55,2 millions d’une année sur l’autre.

National Capital Bancorp (OTCID:NACB) meldete starke Finanzergebnisse für das zweite Quartal 2025 mit einem Nettogewinn von 1,914 Millionen US-Dollar (1,66 US-Dollar pro Aktie), gegenüber 1,52 Millionen US-Dollar (1,32 US-Dollar pro Aktie) im zweiten Quartal 2024. Die Leistung des Unternehmens wurde durch höhere Nettozinserträge und eine Margenausweitung auf 3,68% angetrieben.

Die Gesamtaktiva beliefen sich auf 702,6 Millionen US-Dollar, mit Krediten in Höhe von 509,8 Millionen US-Dollar und Einlagen von 611,8 Millionen US-Dollar. Die Bank erklärte eine vierteljährliche Bardividende von 0,21 US-Dollar pro Aktie, zahlbar am 29. August 2025. Zudem wurde im Februar 2025 ein neues Aktienrückkaufprogramm von bis zu 600.000 US-Dollar genehmigt, wobei im zweiten Quartal keine Aktien zurückgekauft wurden.

Die Eigenkapitalrendite und die durchschnittliche Gesamtkapitalrendite für das erste Halbjahr 2025 lagen bei 1,04% bzw. 11,78%, während das gesamte Eigenkapital der Aktionäre im Jahresvergleich von 55,2 Millionen auf 63,3 Millionen US-Dollar anstieg.

- None.

- Total assets declined slightly to $702.6M from $716M YoY

- Loan balances decreased by $11.3M during Q2 2025

- Deposits decreased $7.8M during Q2 2025

- Noted slowdown in loan growth YoY

WASHINGTON, DC / / July 30, 2025 / National Capital Bancorp, Inc. (the "Company") (OTCID:NACB), the holding company for The National Capital Bank of Washington ("NCB" or the "Bank") reported net income of

Total assets were down slightly year-over-year at

The Company's net interest margin of

Total shareholders' equity increased to

"We are encouraged by the Bank's performance through the first half of 2025, highlighted by continued improvement in our net interest margin and meaningful progress in our efficiency ratio," said Jimmy Olevson, President and Chief Executive Officer of the Bank. "While we recognize a year-over-year slowdown in loan growth, we remain optimistic given the strength of our current loan pipeline. We remain cautious given the broader economic conditions and ongoing uncertainty in the DC market and are proactively monitoring credit quality across our loan portfolio. Our focus remains on driving long-term shareholder value, which is supported by the dedication of our exceptional team."

The Company also announced today that its Board of Directors has declared a cash dividend of

In February 2025, the Board of Directors approved a share repurchase program of up to

National Capital Bancorp, Inc. is the holding company for The National Capital Bank of Washington, which was founded in 1889 and is Washington's Oldest Bank. NCB is headquartered on Capitol Hill with offices in the Friendship Heights community in Northwest D.C., the Courthouse/Clarendon community in Arlington, Virginia and the Fox Hill senior living community of Bethesda, Maryland. NCB also operates residential mortgage and commercial lending offices and a wealth management services division. NCB product and service offerings include personal and business deposit accounts, robust online and mobile banking services and sophisticated treasury management solutions - all delivered with top-rated personal service. NCB is well positioned to serve all the banking needs of those in our communities. For more information about NCB, visit .

Forward-Looking Statements

This news release may contain certain forward-looking statements, such as statements of the Company's plans, objectives, expectations, estimates and intentions. Forward-looking statements may be identified using words such as "expects," "subject," "will," "intends," "will be" or "would," These statements are subject to change based on various important factors (some of which are beyond the Company's control) and actual results may differ materially. Accordingly, readers should not place undue reliance on any forward-looking statements (which reflect management's analysis of factors only as of the date of which they are given). These factors include general economic conditions, trends in interest rates, the ability of the Company to effectively manage its growth and results of regulatory examinations, among other factors. The foregoing list of important factors is not exclusive.

Contact: Randal J. Rabe, EVP, Chief Financial Officer

Phone: 202-546-8000

Email: [email protected]

SOURCE: NATIONAL CAPITAL BANCORP, INC.

View the original on ACCESS Newswire