CORRECTION - Osisko Development Announces Positive Bulk Tonnage Ore Sorting Results for the Cariboo Gold Project

Osisko Development (NYSE: ODV) announced positive bulk tonnage ore sorting test results for its Cariboo Gold Project in British Columbia. The testing program, conducted on an 80-tonne sample, demonstrated significant improvements in gold recovery and waste rejection using X-ray transmission (XRT) technology.

Key achievements include 42-55% waste rejection with 84-89% gold recovery for mid-size and oversize material, and notably, a 92% gold recovery with 59% waste rejection for the previously untested 6-10mm size fraction. The upgrade ratio of 2.0-2.1 exceeded the 2025 Feasibility Study assumption of 1.95. The test represented a substantially larger dataset compared to previous ~5-tonne tests.

An important finding showed that 76% of the contained gold reported to the fines fraction, higher than the previous 45% assumption, suggesting potential for improved overall recoveries.

Osisko Development (NYSE: ODV) ha annunciato risultati positivi nei test di selezione del minerale a tonnellaggio elevato per il suo progetto Cariboo Gold in British Columbia. Il programma di test, condotto su un campione da 80 tonnellate, ha mostrato miglioramenti significativi nel recupero dell'oro e nel rifiuto dei materiali di scarto grazie alla tecnologia di trasmissione a raggi X (XRT).

Tra i risultati principali si evidenziano un rifiuto di scarti del 42-55% con un recupero dell'oro dell'84-89% per materiali di dimensioni medie e superiori, e in particolare un recupero dell'oro del 92% con un rifiuto di scarti del 59% per la frazione di dimensione 6-10 mm, precedentemente non testata. Il rapporto di miglioramento di 2,0-2,1 ha superato l'assunzione di 1,95 dello studio di fattibilità del 2025. Il test ha coinvolto un set di dati molto più ampio rispetto ai precedenti test di circa 5 tonnellate.

Un risultato importante ha mostrato che il 76% dell'oro contenuto si è concentrato nella frazione fine, superiore al precedente valore stimato del 45%, suggerendo un potenziale miglioramento nel recupero complessivo.

Osisko Development (NYSE: ODV) anunció resultados positivos en pruebas de clasificación de mineral a gran escala para su Proyecto Cariboo Gold en Columbia Británica. El programa de pruebas, realizado sobre una muestra de 80 toneladas, demostró mejoras significativas en la recuperación de oro y el rechazo de residuos utilizando tecnologÃa de transmisión por rayos X (XRT).

Los logros clave incluyen un rechazo de residuos del 42-55% con una recuperación de oro del 84-89% para materiales de tamaño medio y grande, y notablemente, una recuperación de oro del 92% con un rechazo de residuos del 59% para la fracción de tamaño 6-10 mm, previamente no probada. La proporción de mejora de 2.0-2.1 superó la suposición del Estudio de Factibilidad 2025 de 1.95. La prueba representó un conjunto de datos considerablemente mayor en comparación con pruebas anteriores de aproximadamente 5 toneladas.

Un hallazgo importante mostró que el 76% del oro contenido se reportó en la fracción fina, superior al supuesto previo del 45%, lo que sugiere un potencial para mejorar las recuperaciones generales.

Osisko Development (NYSE: ODV)ë� ë¸ë¦¬í°ì컬ë¼ë¹ìì� ìì¹í� Cariboo Gold íë¡ì í¸ì� ëí� ëë� ê´ì ì ë³ ìíìì ê¸ì ì ì¸ ê²°ê³¼ë¥� ë°ííìµëë¤. 80í� ìíì� ëìì¼ë¡� ì¤ìë� ìí íë¡ê·¸ë¨ì Xì� í¬ê³¼(XRT) 기ì ì� íì©íì¬ ê¸� íìì¨ê³¼ í기ë¬� ë°°ì¶ë¥ ìì� ìë¹í� ê°ì ì� ë³´ììµëë�.

주ì ì±ê³¼ë¡ë ì¤ê° í¬ê¸° ë°� ê³¼ë í¬ê¸° 물ì§ì� ëí� 42-55% í기ë¬� ë°°ì¶ê³� 84-89% ê¸� íìì�, 그리ê³� ì´ì ì� ìííì§ ììë� 6-10mm í¬ê¸° ë¶íìì 92% ê¸� íìì¨ê³¼ 59% í기ë¬� ë°°ì¶ì� í¬í¨ë©ëë�. ì ê·¸ë ì´ë� ë¹ì¨ 2.0-2.1ì 2025ë � íë¹ì± ì¡°ì¬ ê°ì ì¹ì� 1.95ë¥� ì´ê³¼íìµëë¤. ì´ë² ìíì ì´ì ì� 5í� ìíì� ë¹í´ í¨ì¬ í� ë°ì´í� ì¸í¸ë¥� ëíí©ëë¤.

ì¤ìí� ë°ê²¬ì¼ë¡ë� ê¸� í¨ì ëì 76%ê° ë¯¸ì¸ ë¶íì� í¬í¨ëì´ ì´ì 45% ê°ì ë³´ë� ëì ì ì²´ íìì� í¥ìì� ê°ë¥ì±ì� ìì¬í©ëë�.

Osisko Development (NYSE: ODV) a annoncé des résultats positifs aux tests de tri du minerai en vrac pour son projet Cariboo Gold en Colombie-Britannique. Le programme de test, réalisé sur un échantillon de 80 tonnes, a démontré des améliorations significatives dans la récupération de l'or et le rejet des déchets grâce à la technologie de transmission aux rayons X (XRT).

Les principales réussites incluent un rejet des déchets de 42-55% avec une récupération de l'or de 84-89% pour les matériaux de taille moyenne et surdimensionnée, et notamment une récupération de l'or de 92% avec un rejet des déchets de 59% pour la fraction de taille 6-10 mm, auparavant non testée. Le ratio d'amélioration de 2,0-2,1 a dépassé l'hypothèse de 1,95 de l'étude de faisabilité de 2025. Le test représentait un ensemble de données nettement plus important comparé aux tests précédents d'environ 5 tonnes.

Une découverte importante a montré que 76% de l'or contenu se retrouvait dans la fraction fine, supérieur à l'hypothèse précédente de 45%, suggérant un potentiel d'amélioration des récupérations globales.

Osisko Development (NYSE: ODV) gab positive Ergebnisse bei GroÃmengen-Probenahmetests für sein Cariboo Gold Projekt in British Columbia bekannt. Das Testprogramm, durchgeführt an einer 80-Tonnen-Probe, zeigte deutliche Verbesserungen bei der Goldrückgewinnung und der Abfallablehnung durch den Einsatz von Röntgendurchstrahlungs-Technologie (XRT).

Zu den wichtigsten Ergebnissen zählen 42-55% Abfallablehnung bei 84-89% Goldrückgewinnung für mittelgroÃes und übergroÃes Material sowie bemerkenswerterweise eine 92% Goldrückgewinnung bei 59% Abfallablehnung für die zuvor nicht getestete KorngröÃe 6-10 mm. Das Aufbereitungsverhältnis von 2,0-2,1 übertraf die Annahme der Machbarkeitsstudie 2025 von 1,95. Der Test umfasste einen deutlich gröÃeren Datensatz im Vergleich zu früheren Tests mit etwa 5 Tonnen.

Eine wichtige Erkenntnis zeigte, dass 76% des enthaltenen Goldes in der Feinkornfraktion zu finden war, was über der bisherigen Annahme von 45% liegt und auf ein Potenzial für verbesserte Gesamtrückgewinnungen hinweist.

- Achieved 84-89% gold recovery with 42-55% waste rejection for mid-size and oversize material

- New 6-10mm fraction showed excellent 92% gold recovery with 59% waste rejection

- Upgrade ratio of 2.0-2.1 exceeded the 2025 FS assumption of 1.95

- 76% of gold reported to fines fraction, suggesting potential for higher overall recoveries

- Low processing cost of approximately C$1-2 per tonne

- Additional variability studies still needed to refine sorting assumptions across the deposit

- Optimization of fragmentation model still required as part of detailed engineering

Insights

Osisko's larger-scale ore sorting tests confirm gold recovery assumptions while identifying new efficiency opportunities in previously untested smaller ore fractions.

The ore sorting test results from Osisko Development's Cariboo Gold Project represent a significant technical validation of the processing assumptions in their 2025 Feasibility Study. Using a production-scale XRT sorter on an ~80 tonne sample (16x larger than previous ~5 tonne tests), they've demonstrated 42-55% waste rejection while maintaining 84-89% gold recovery for the primary ore size fractions. This is critical for project economics as it confirms their ability to efficiently pre-concentrate ore before more expensive processing steps.

The most notable development is the successful testing of the previously unassessed 6-10mm size fraction, which showed impressive 59% waste rejection with 92% gold recovery. This represents a potential optimization opportunity not factored into the current feasibility study. The upgrade ratios of 2.0-2.1 slightly exceed the feasibility study assumption of 1.95, indicating the technology performs better than projected in concentrating gold.

Another interesting finding is that 76% of gold reported to the fines fraction (<10mm) versus the 45% assumed in the feasibility study. This higher-than-expected gold content in fines could positively impact overall recoveries. The pre-concentration circuit, which operates at only

These results substantially de-risk the project's processing assumptions while highlighting opportunities for further optimization. The planned variability study will be important to confirm these results across different areas of the deposit, potentially enhancing the project economics beyond current feasibility parameters.

Ìý(±·³Û³§·¡: ODV, TSXV: ODV), please note that the highlights section and eleventh paragraph have been updated to reflect the correct reference to gold recovery for the 6â�10 mm fraction of "

HIGHLIGHTS

- X-ray transmission (XRT) ore sorter testwork of a ~80 tonne sample taken from the Cariboo underground achieved positive results consistent with 2025 FS parameters

- 42

-55% waste rejection with 84-89% gold recovery achieved by sorting mid-size and oversize sample material including 10â�30 mm and 30â�70 mm size fractions, respectively- Encouraging results from testing the previously unassessed 6â�10 mm size fraction, made possible by recent advancements in AI, demonstrated

59% waste rejection and92% gold recovery, highlighting a potential opportunity for future optimization

- Encouraging results from testing the previously unassessed 6â�10 mm size fraction, made possible by recent advancements in AI, demonstrated

- 2.0-2.1 upgrade ratio consistent with 2025 FS assumption of 1.95

- New testwork represents a significantly larger data set, with previous sorting totalling ~5 tonnes and completed largely on material sourced from drill core

76% of the contained gold in the test sample estimated to report to the fines fraction (<10 mm)- Flowsheet optimization work, including a variability study to refine assumptions across the deposit, is contemplated to be completed as part of detailed engineering

MONTREAL, July 07, 2025 (GLOBE NEWSWIRE) -- Osisko Development Corp. (NYSE: ODV, TSXV: ODV) ("Osisko Development" or the "Company") is pleased to announce positive results from an ore sorting testing program conducted on a bulk tonnage sample of mineralized material extracted from its permitted,

| Table 1: Cariboo Ore Sorting Results Summary vs. 2025 FS Assumptions | |||||||||

| Particle Size | Sample Mass | 2025 Ore Sorter Results | 2025 FS Assumptions | ||||||

| (mm) | (tonnes) | Mass Pull | Gold Recovery | Upgrade Ratio | Mass Pull | Gold Recovery | Upgrade Ratio | ||

| 6â�10 | 8 | 41 | % | 92 | % | 2.23 | â� not tested â� | ||

| 10â�30 | 61 | 45 | % | 89 | % | 1.96 | 14 | 89.1 | 1.95 |

| 30â�70 | 10 | 58 | % | 84 | % | 2.06 | 14 | 89.1 | 1.95 |

1. Mass pull is defined as the percentage of total feed material retained for further processing, with waste rejection being the equivalent inverse measure.

2. Upgrade ratio is defined as the concentrate material grade (post-sorting) divided by the feed material grade (pre-sorting). Meaning if feed grade is x g/t Au an upgrade ratio of 2.0 would equate to 2x g/t Au in post-sorting material.

The program, carried out by the Saskatchewan Research Council ("SRC") with support from TOMRA Sorting ("TOMRA") at SRC's testing facility in Saskatoon, Saskatchewan, Canada, utilized an x-ray transmission sensor ("XRT") to evaluate ~80 tonnes of split material (representative of a ~400 tonne bulk sample) using a production-scale TOMRA COM 1200 Tertiary XRT machine. The ore sorter pre-concentrate circuit in the 2025 FS is designed to utilize an XRT sensor to separate unmineralized sandstone (waste rock) from the gold-associated sulfide material (metal bearing rock) based on atomic density. Since the XRT scanner detects sulfide material as high-density and waste as low-density, it can selectively divert marginal material away from the next processing stage at a low cost of approximately C

Sample material, extracted from the underground Lowhee Zone, was initially crushed, screened and split to produce several particle size fractions for testing: (i) fines (<10 mm); (ii) mid-size (10â�30 mm); and (iii) oversize (30â�70 mm). Additional testing was carried out on a 6â�10 mm particle size, which was previously unassessed and not part of the 2025 FS.

Methodologies and Additional Observations

- Overview. The completed ore sorter testwork represents one of the largest programs of its kind, using mineralized material taken directly from the underground. The objective was to further optimize and validate ore sorting parameters within the processing flowsheet, and inform areas for additional opportunities.

- Previous ore sorter testwork used as the basis for the 2025 FS assumptions primarily relied on laboratory and pilot scale work that in aggregate totalled ~5 tonnes of material largely sourced from drill core samples.

- Methodology. Consistent with the parameters outlined in the 2025 FS and previous testwork, material was tested in separate size-based tranches. Fines particles of 10 mm or smaller bypassed the sorter, while particles between 10â�30 mm and 30â�70 mm underwent sorter testing. The sorter was set up for each size fraction by changing the ejection modules between runs with different particle sizes.

- Each sample tranche was tested in a cascade-style test wherein sorter settings were adjusted between passes to evaluate the relationship between mass pull and recovery.

- The latest software available from TOMRA was used including recent artificial intelligence (AI) developments implemented by TOMRA. This includes Tomra's "Deep Learning" algorithm, an AI function which uses the intensity of the XRT signal to estimate the depth dimension of a particle, improving the prediction in the 3rd dimension.

- The five settings used to develop the cascade style test were: ultra-high (>

50% of area is sulphide), high sulphide (greater than20% area), medium sulphide (between10% and20% area), and low sulphide (between5% and10% area). - The first pass targeted the most x-ray responsive material, yielding the highest gold grade, but with lower overall recovery. Subsequent passes were conducted until a target mass pull of approximately

50% was achieved.

- Opportunities & Next Steps.

- Testing on a subsample of the fines material consisting of 8 tonnes of the 6â�10 mm size fraction, enabled by recent advancements in AI software, showed promising results including

92% gold recovery with a41% mass pull (refer to Table 1). This size fraction was previously untested for ore sorting and may represent a material opportunity for future flowsheet optimization. - An estimated

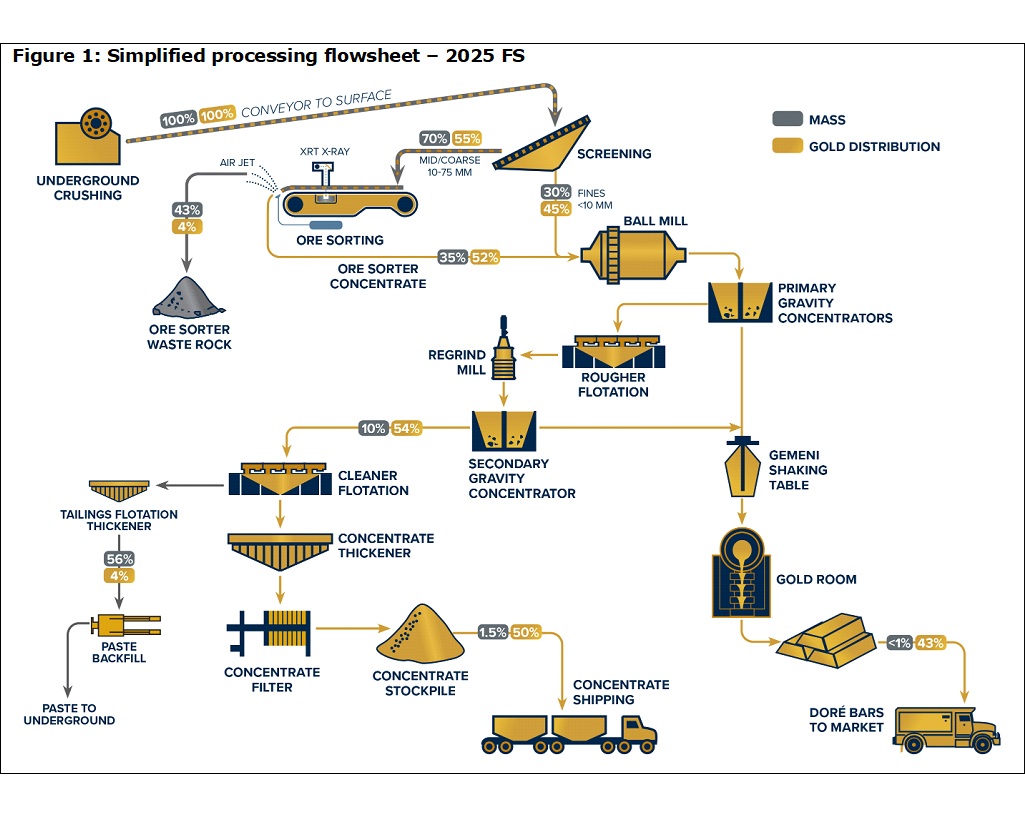

76% of the gold reported to the fines size fraction in the ore sorter testwork sample, which is elevated relative to the 2025 FS assumption of45% (see Figure 1), but would contribute to higher overall recoveries. Optimization of the fragmentation model is underway as part of detailed engineering, to refine the process flow sheet parameters. - A variability study is contemplated as part of detailed engineering to refine sorting assumptions across the deposit. This will include both laboratory scale work and tests on operating sized equipment.

- Testing on a subsample of the fines material consisting of 8 tonnes of the 6â�10 mm size fraction, enabled by recent advancements in AI software, showed promising results including

Quality Assurance (QA) / Quality Control (QC)

The samples were received at SRC and screened into their separate size fractions (6-10 mm, 10-30 mm, and 30-70 mm). Each size fraction was assayed individually to generate a head assay for each of the tranches. During the processing of each tranche through the sorter, sub samples of product and waste were collected using a sample cutter and observed by Osisko Development's integrated owners team metallurgists. The sub-samples were sent to Base Met lab in Kamloops, B.C., Canada for standard 30g fire assay, in duplicate. For any assays with significant difference between the duplicates additional screen metallics fire assay was used.

Screen metallics fire assays are conducted on 1,000 g samples. The material is first screened on a 106 mesh screen and all the coarse material is assayed to extinction. The material passing through the screen is fire assayed in triplicate using 30 g samples and an AA finish.

ABOUT CARIBOO GOLD PROJECT

The Cariboo Gold Project is a permitted,

The Cariboo Gold Project hosts probable mineral reserves of 2.07 million ounces of contained Au (17,815 kt grading 3.62 g/t Au); measured mineral resources of 8,000 ounces of contained Au (47 kt grading 5.06 g/t Au); indicated mineral resources of 1.60 million ounces of contained Au (17,332 kt grading 2.88 g/t Au); and inferred mineral resources of 1.86 million ounces of contained Au (18,774 kt grading 3.09 g/t Au). Mineral resources are reported exclusive of mineral reserves.

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Tad Crowie, P.Eng., Senior Metallurgist of JDS Energy & Mining Inc. and Victor Gauthier, P.Eng., Manager â� Technical Services of Osisko Development, each of whom is considered to be a "qualified person" within the meaning of National Instrument 43-101 â� Standards of Disclosure for Mineral Projects ("NI 43-101").

Technical Reports

Information relating to Cariboo Gold Project and the 2025 feasibility study ("2025 FS") are supported by the technical report, titled "NI 43-101 Technical Report, Feasibility Study for the Cariboo Gold Project, District of Wells, British Columbia, Canada" and dated June 11, 2025 (with an effective date of April 25, 2025) (the "Technical Report").

The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. Reference should be made to the full text of the Technical Report, including all assumptions, qualifications and limitations therein, which is available electronically on SEDAR+ () and on EDGAR () under Osisko Development's issuer profile and on the Company's website at .

³å³å³å³å³å³å³å³å³å³å³å³å³å³å³å³å³å³å³å³å³åÌý

End Notes (excluding tables)

1. In this news release the Company uses certain abbreviations, including: million ("m"); thousand ("k"); metric tonne ("t"); troy ounce ("oz"); grams per tonne ("g/t"); gold ("Au"); grams ("g").

______________________

ABOUT OSISKO DEVELOPMENT CORP.

Osisko Development Corp. is a continental North American gold development company focused on past-producing mining camps located in mining friendly jurisdictions with district scale potential. The Company's objective is to become an intermediate gold producer by advancing its flagship permitted

For further information, visit our website at or contact:

| Sean RoosenÌý | Ìý | Philip Rabenok |

| Chairman and CEO | Ìý | Vice President, Investor Relations |

| Email: [email protected] | Ìý | Email: [email protected] |

| Tel: +1 (514) 940-0685Ìý | Ìý | Tel: +1 (437) 423-3644 |

| Ìý | Ìý | Ìý |

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this news release may be deemed "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (together, "forward-looking statements"). These forward-looking statements, by their nature, require Osisko Development to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Forward-looking statements are not guarantees of performance. Words such as "may", "will", "would", "could", "expect", "believe", "plan", "anticipate", "intend", "estimate", "continue", or the negative or comparable terminology, as well as terms usually used in the future and the conditional, are intended to identify forward-looking statements. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including the assumptions, qualifications and limitations relating to the Cariboo Gold Project being permitted; assumptions, qualifications and parameters underlying the 2025 FS (including, but not limited to, the mineral resources, mineral reserves, production profile, mine design and project economics); the results of the ore sorter testwork as an indicator of quality and consistency with the assumptions underlying the 2025 FS, as well as other considerations that are believed to be appropriate in the circumstances; the ability and timing of the Company to attain future optimizations as a result of the ore sorter testwork (if at all); the significance and impact of ore sorting results on the previously untested 6-10 mm material (if any); the reliability of recent advancements in AI, including to identify potential opportunities for future optimization; the relevance and representativity of the size and quality of the ore sorter testwork; the ability and timing of the Company to complete a variability study and the impact thereof (if any); the ability of the Company to achieve ore sorting as contemplated by the 2025 FS; the ability of ore sorting to achieve operating costs as estimated; the ability of ore sorting to generate a non-potentially acid generating waste product; the potential impact of tariffs and other trade restrictions (if any); management's perceptions of historical trends, current conditions and expected future developments; the utility and significance of historic data, including the significance of the district hosting past producing mines, and any other information herein that is not a historical fact may be "forward looking information". Osisko Development considers its assumptions to be reasonable based on information currently available, but cautions the reader that their assumptions regarding future events, many of which are beyond the control of Osisko Development, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect Osisko Development and its business. Such risks and uncertainties include, among others, risks relating to third-party approvals, including the issuance of permits by governments, capital market conditions and the Company's ability to access capital on terms acceptable to the Company for the contemplated exploration and development at the Company's properties; the ability to continue current operations and exploration; regulatory framework and presence of laws and regulations that may impose restrictions on mining; errors in management's geological modelling; the timing and ability of the Company to obtain and maintain required approvals and permits; the results of exploration activities; risks relating to exploration, development and mining activities; the global economic climate; fluctuations in metal and commodity prices; fluctuations in the currency markets; dilution; environmental risks; and community, non-governmental and governmental actions and the impact of stakeholder actions. Osisko Development is confident a robust consultation process was followed in relation to its received BC Mines Act and Environmental Management Act permits for the Cariboo Gold Project and continues to actively consult and engage with Indigenous nations and stakeholders. While any party may seek to have the decision related to the BC Mines Act and/or Environmental Management Act permits reviewed by the courts, the Company does not expect that such a review would, were it to occur, impact its ability to proceed with the construction and operation of the Cariboo Gold Project in accordance with the approved BC Mines Act and Environmental Management Act permits. Readers are urged to consult the disclosure provided under the heading "Risk Factors" in the Company's annual information form for the year ended December 31, 2024 as well as the financial statements and MD&A for the year ended December 31, 2024 and quarter ended March 31, 2025, which have been filed on SEDAR+ () under Osisko Development's issuer profile and on the SEC's EDGAR website (), for further information regarding the risks and other factors facing the Company, its business and operations. Although the Company's believes the expectations conveyed by the forward-looking statements are reasonable based on information available as of the date hereof, no assurances can be given as to future results, levels of activity and achievements. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. Forward-looking statements are not guarantees of performance and there can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

A photo accompanying this announcement is available at Ìý